The Problem

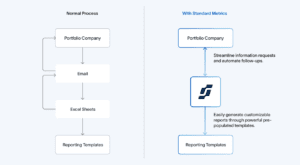

With over 40 portfolio companies, the team at January Capital kept finding themselves manually consolidating financial and operating metrics. This involved receiving metrics via emails, manually sending chasers, having back and forth conversations to reconcile historical metrics (particularly when spreadsheet formats changed), and extracting information into internal and external reporting templates.

Not only was it time inefficient and required many man hours to collect, review and transform the data (on a monthly or quarterly basis); but the data fidelity was also low, with data integrity being a major problem. Of course, these issues do not tend to go away — instead over time, they continue to compound and grow.

The Solution

Two years ago, realizing the unsustainability of this state, the team began a software selection process that would allow for a more automated process with appropriate data integrity and governance. Their “holy grail” was:

1. An interoperable system that could integrate into other systems they used; and

2. Was able to be deployed with minimal customization and with a short implementation period; but

3. Did not reduce the feature set it offered.

After speaking to 20 providers, the team finally came across Standard Metrics.

With Standard Metrics

Since the adoption of Standard Metrics, January Capital has managed to materially streamline and improve its data collection and portfolio monitoring process.

As a venture capital investor with minority ownership, January Capital needed a way to incentivize its portfolio companies to share more data, more often.

Designed for investment firms who do not just have 5–10 portfolio companies but a much greater number, Standard Metrics not only made it easier for portfolio companies to share data through pre-built integrations with accounting, payroll, and banking systems with robust permissioning controls, but also offered a powerful dashboard for portfolio companies to review their own data just as their investors would– rather than simply being a portal portfolio companies log onto to send data to an investor. Moreover, the platform allowed portfolio companies to share their data with not only January Capital, but all of their investors!

The January Capital team instead now focuses their time on interpreting the data and deriving insights. Importantly, Standard Metrics now provides a “single source of truth” that the entire business can access– all team members can see accurate, consistent data.

- 90% reduction in time spent on data collection and consolidation through Standard Metric’s direct integration offering with portfolio company banking, accounting, and payroll systems

- Significant improvement in team collaboration through a central source of truth for all historical data

- An increased ability to produce actionable analytics through comprehensive, consistent data

First a customer, then an investor

After becoming Standard Metrics customers in early 2021, the January Capital team doubled down on their conviction and became investors later within the same year.

Automate your portfolio reporting

Find out how you can:

- Collect a higher volume of accurate data

- Analyze a robust, auditable data set

- Deliver insights that drive fund performance