AI‑driven

portfolio reporting

The centralized, auditable metrics you need to nail portfolio reviews, report to LPs faster, and easily spot opportunities for follow on investment.

How it works

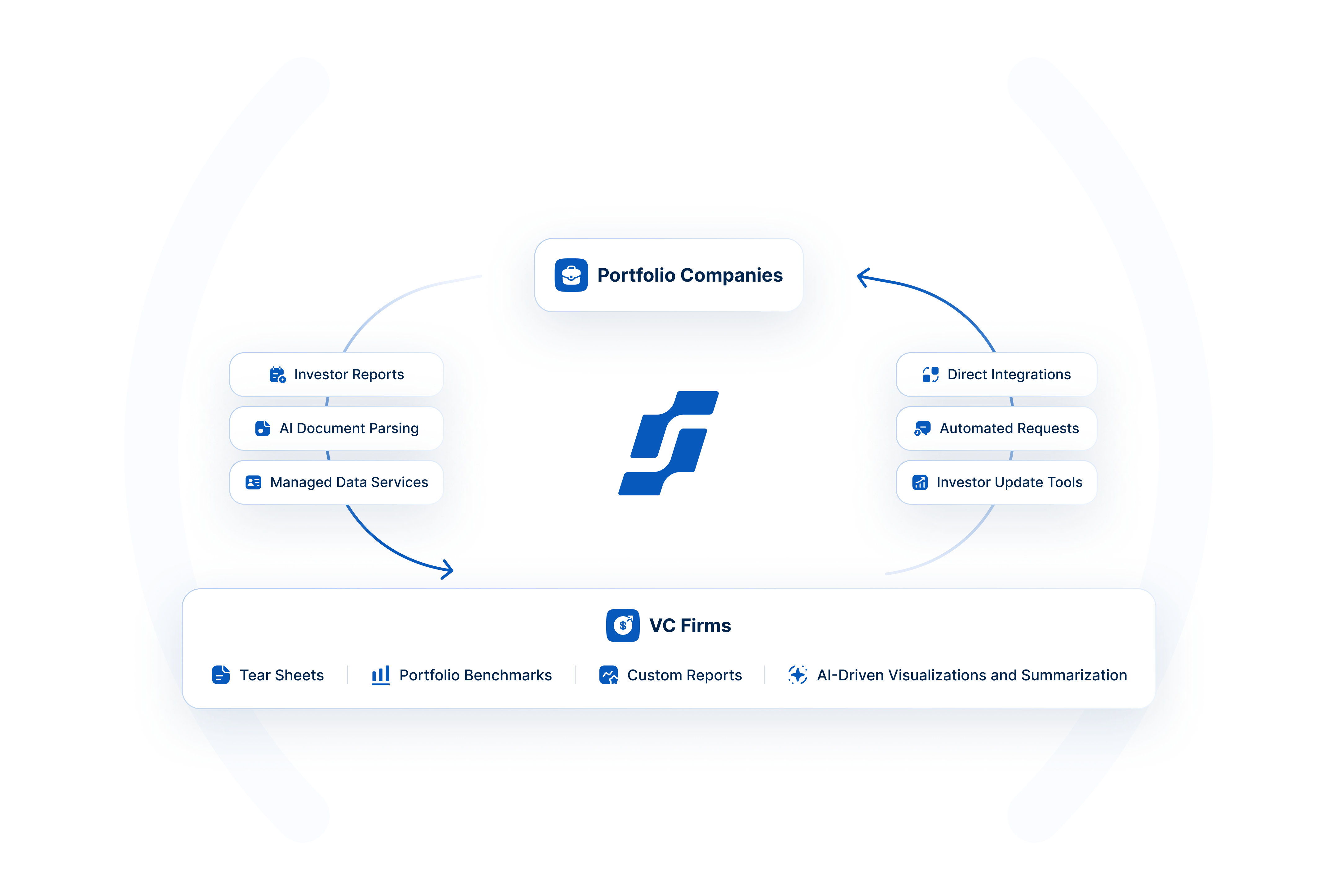

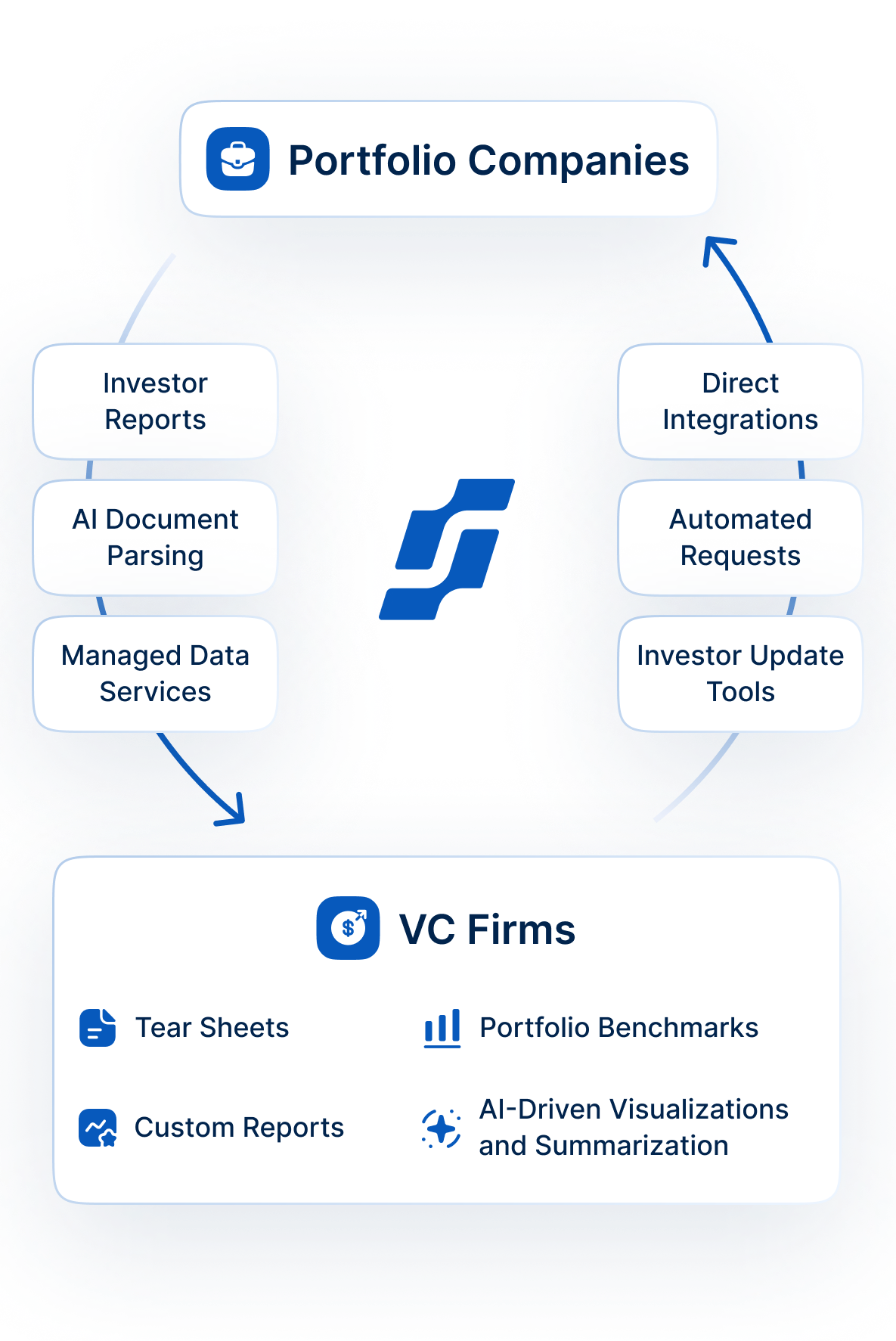

A collaborative platform for VC teams and their portfolio companies

Portfolio Reviews

LP Reporting

Board Meetings

Tools for VC firms and companies

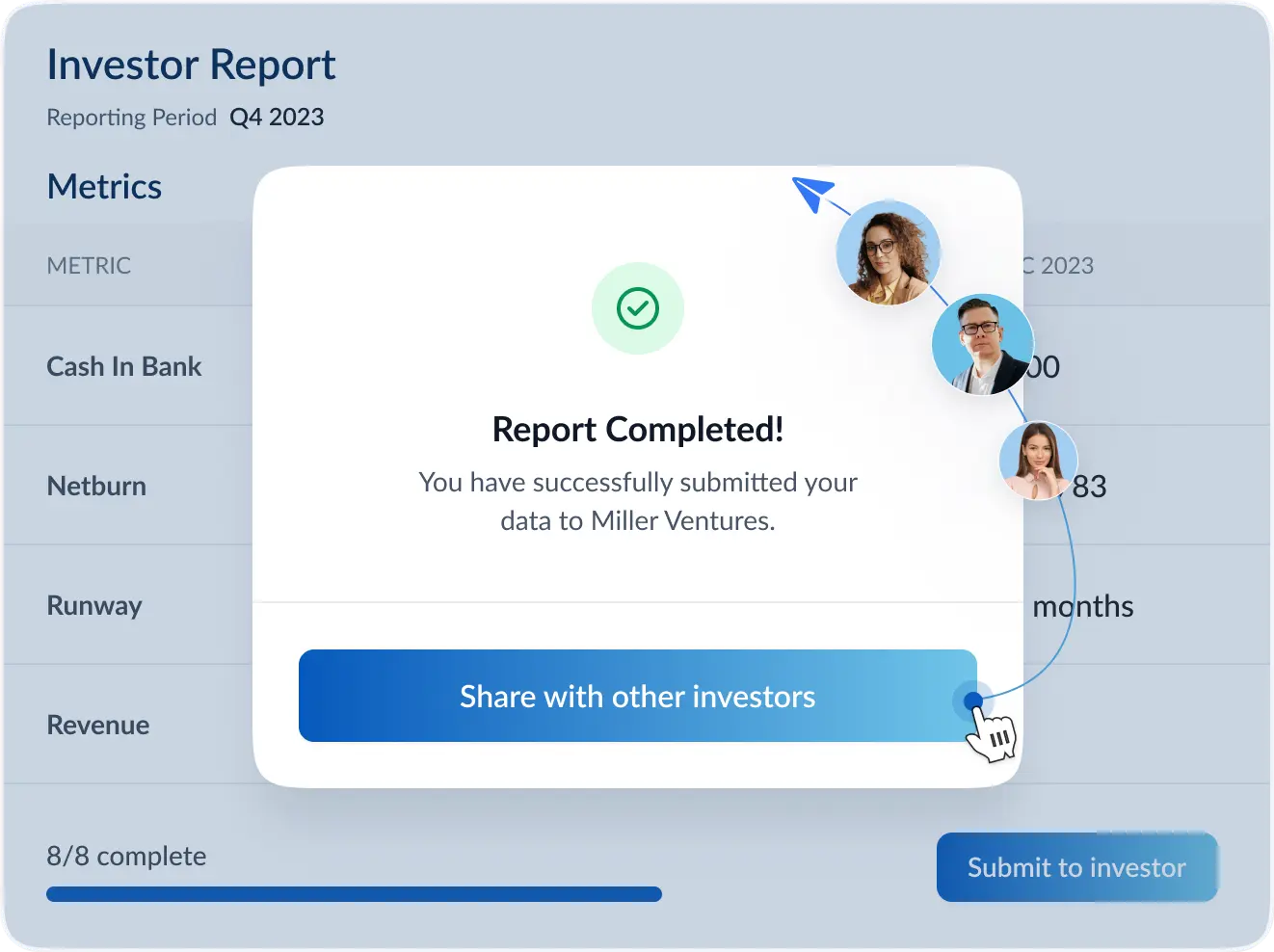

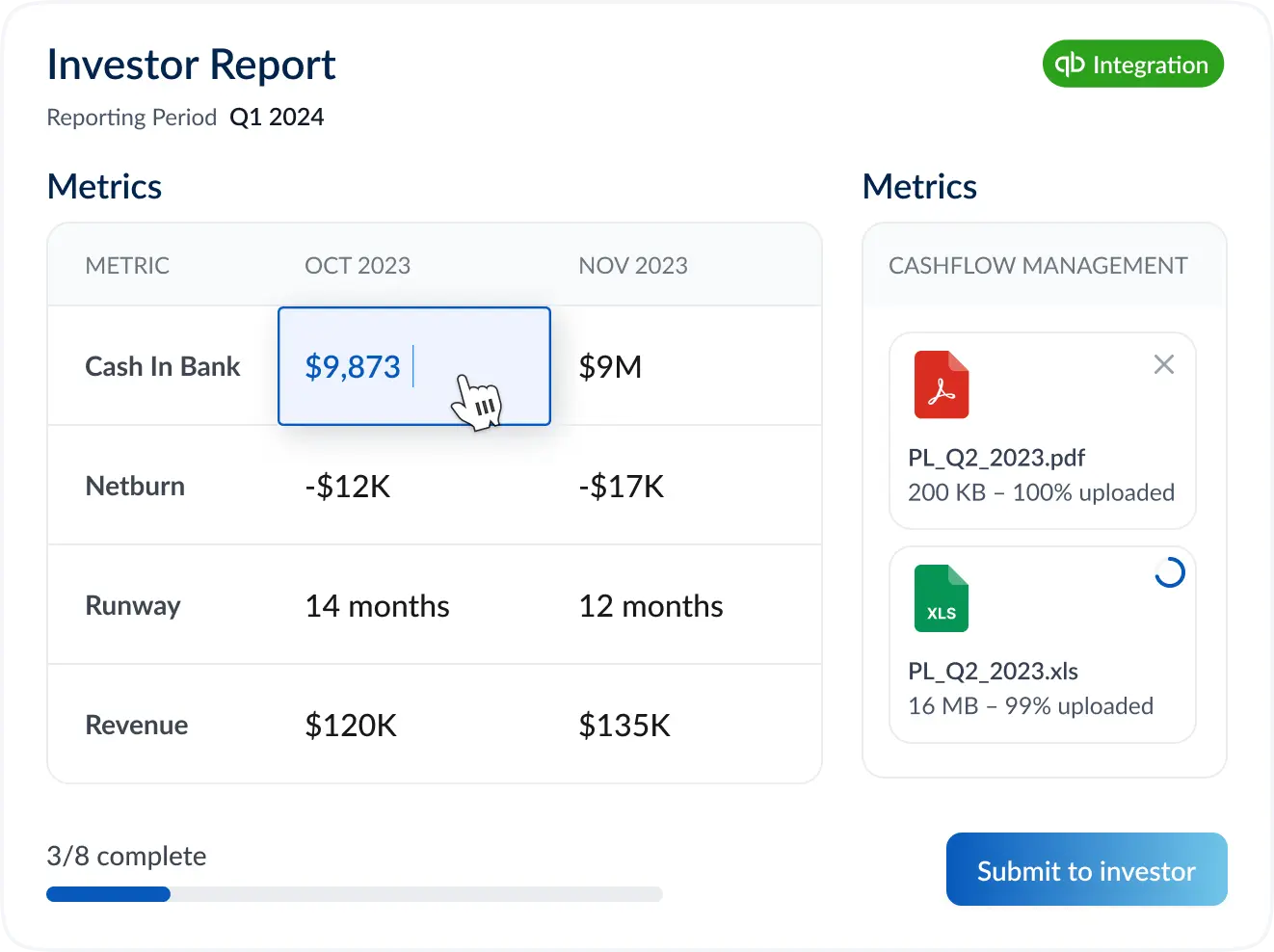

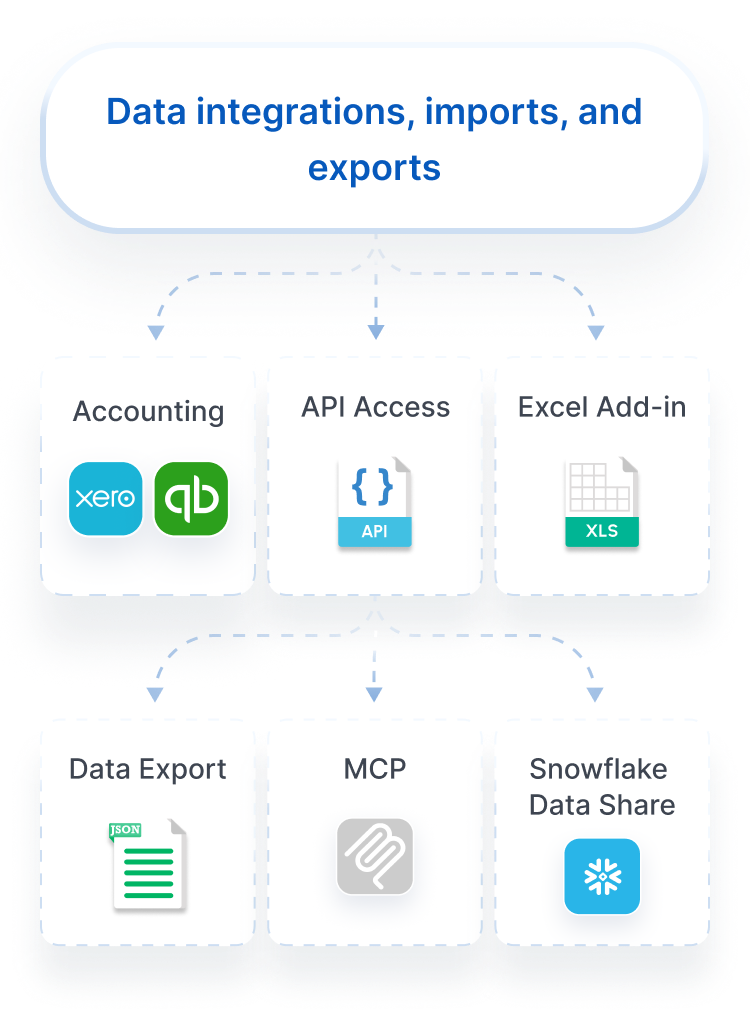

Supercharge data collection. Leverage a deeply configurable collection tool with automated progress tracking. A highly-accurate AI agent in concert with our managed data services team delivers historical data and new metrics directly into the platform. Companies integrate systems of record to save time.

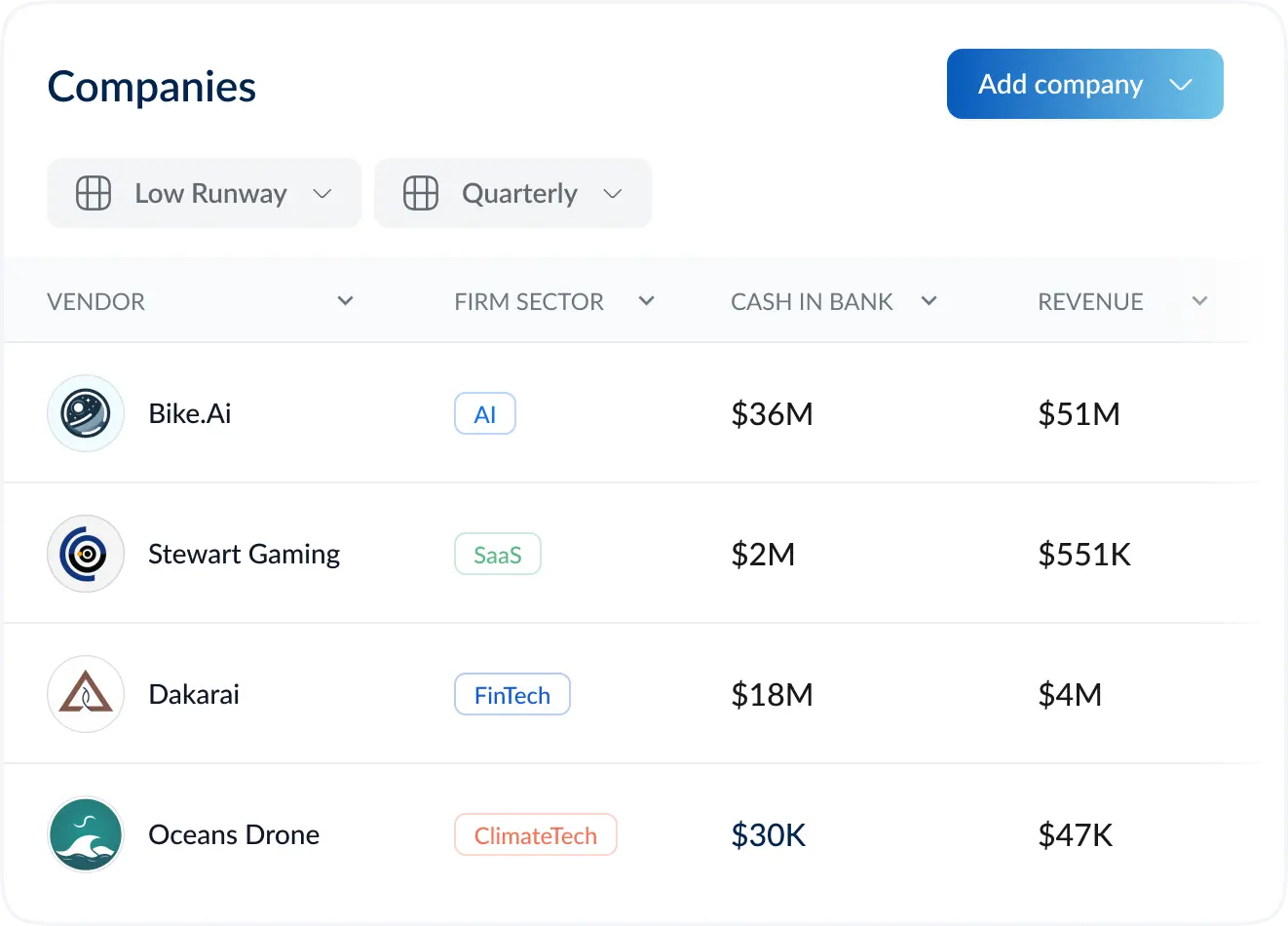

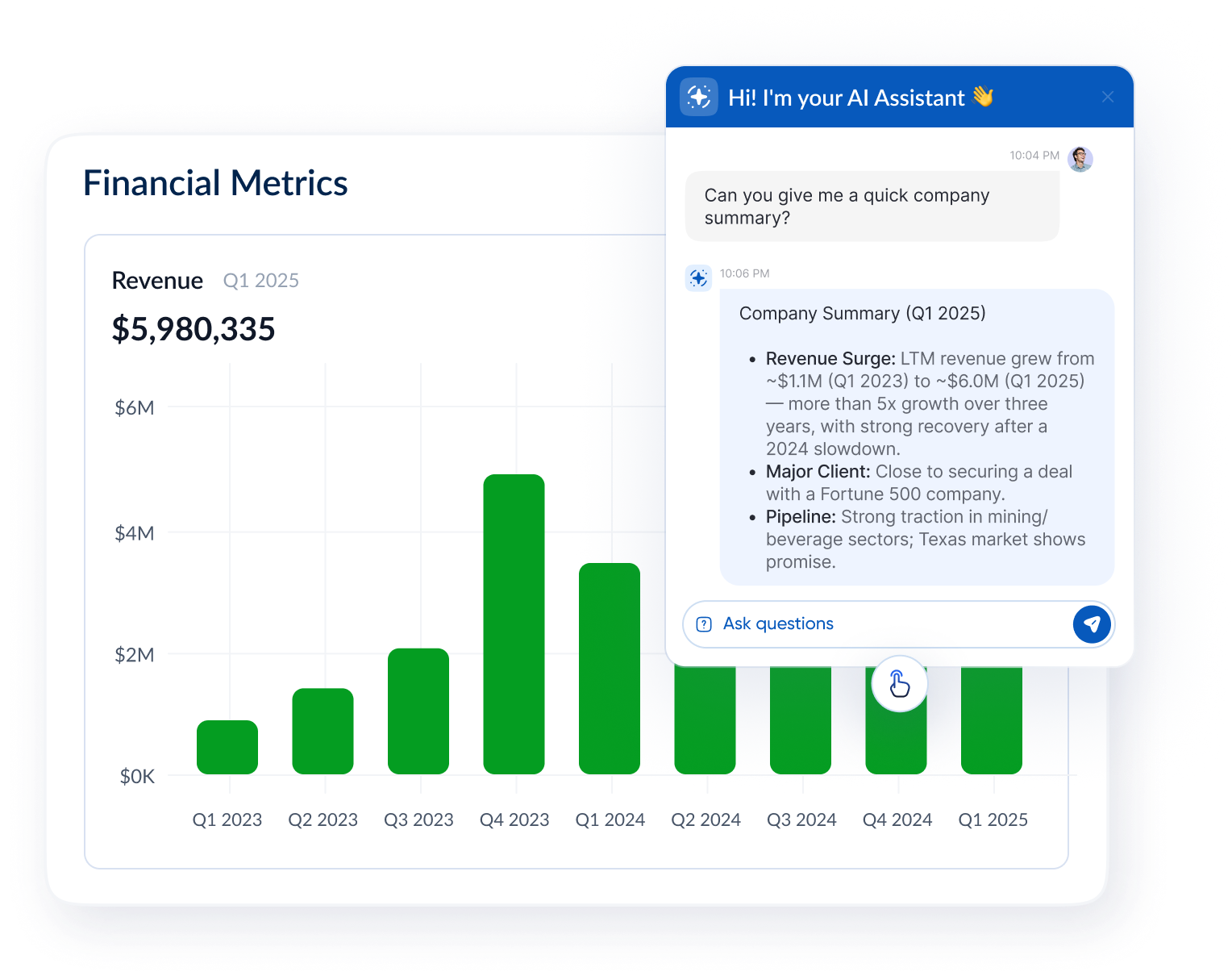

Analyze a robust, auditable data set. Focus on spotting trends, risks and opportunities, rather than managing spreadsheets. Standard, custom, and calculated metrics are structured, traceable to source documents, and can be easily reviewed with our AI portfolio company analyst via natural language queries.

Answer GP and LP questions, faster. Leverage institutional grade tear sheets and reporting templates to give stakeholders a clear line of sight into portfolio health. Sync data into Excel, use our AI-powered embedded BI, or export your dashboard for use in other BI tools.

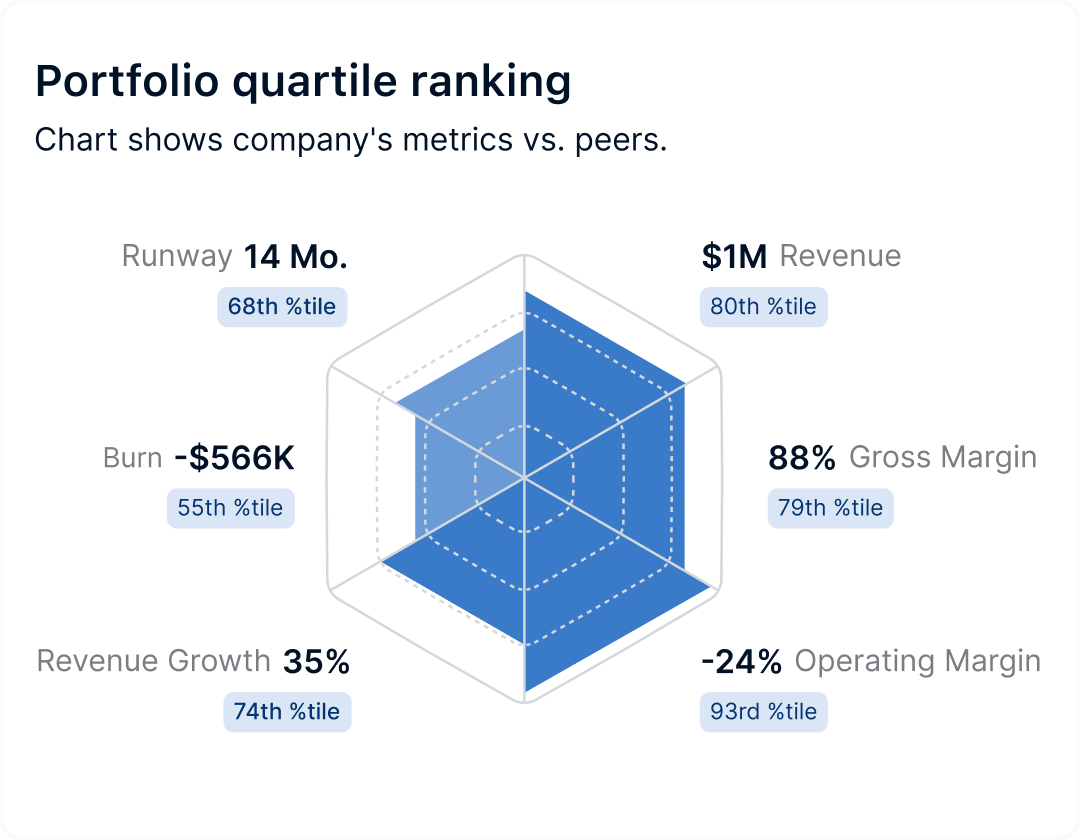

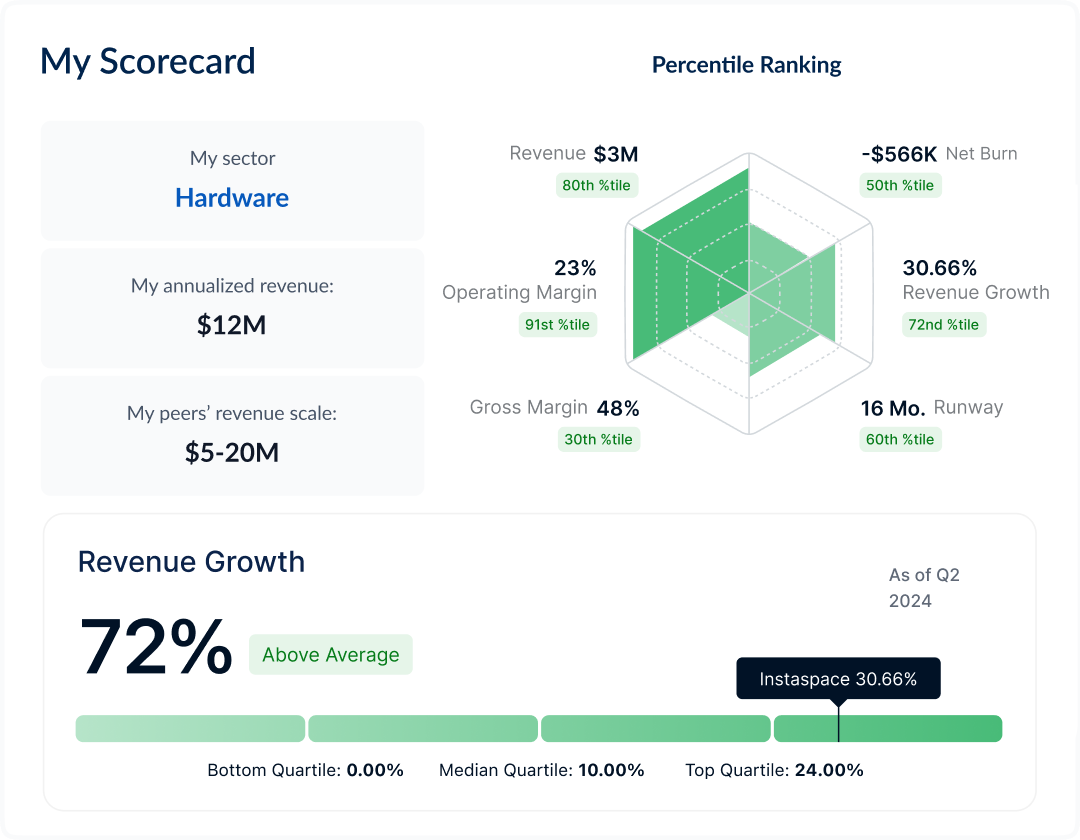

Gain deeper insights and contextualize your data.

Benchmark your entire portfolio against an aggregated and anonymized data set of over 10,000 venture-backed startups.

Why Standard Metrics

January Capital’s portfolio management and finance teams can now focus on analyzing the data and delivering insights — instead of sending emails and collating spreadsheets.

Manual reporting

38 hours per month

Automated reporting

3.5 hours per month

Hear from our customers

By the numbers

$300B+ in AUM across VC clients

10,000+ companies

20M+ company metrics

Data portability

Quickly and easily import, export and sync data from the platform.

Security

We take data protection extremely seriously. We are SOC 2 and GDPR certified, and our security practices are designed to meet the highest industry standards.

Ready to upgrade your portfolio reporting?

Automate it today with Standard Metrics.

Speak with our team