TLDR from Q3 2025

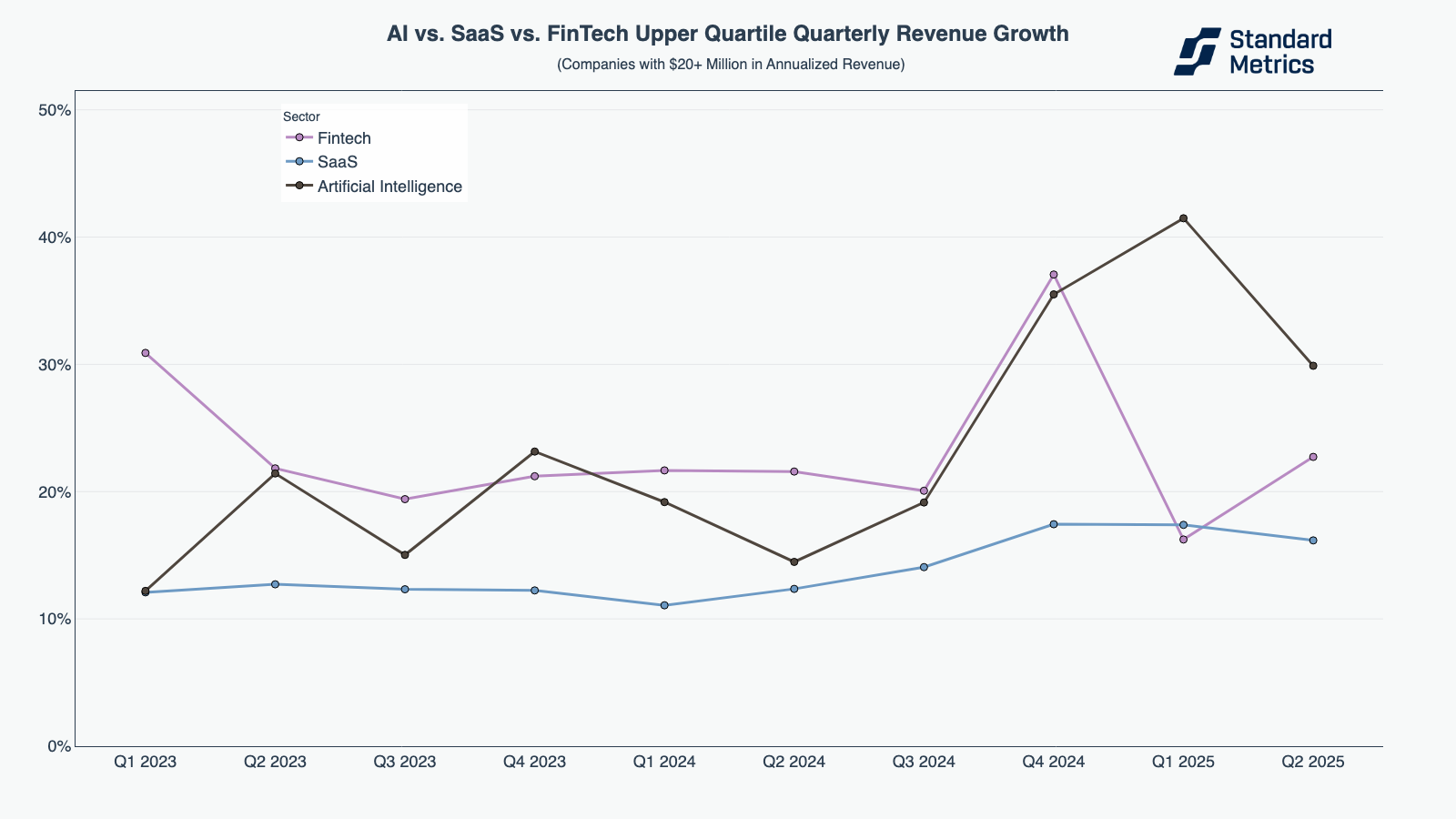

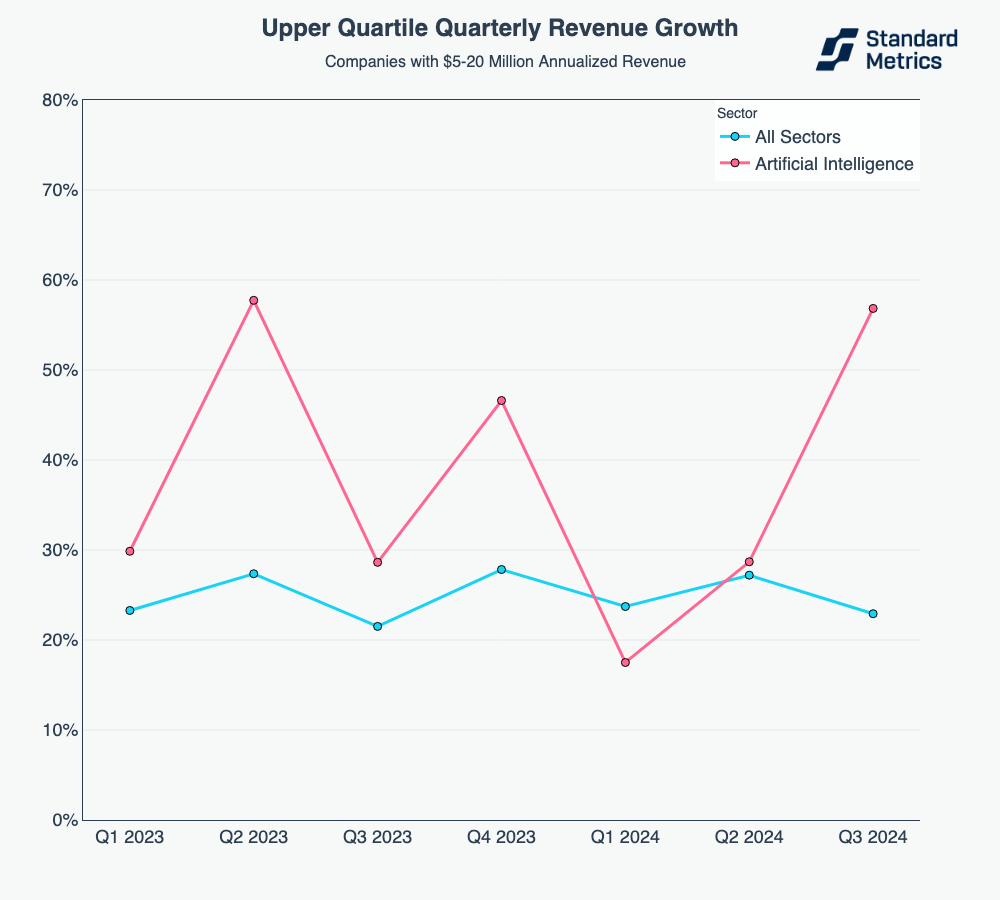

- AI outpaced fintech and SaaS in revenue growth in Q3. However, growth slowed last quarter for later stage AI companies.

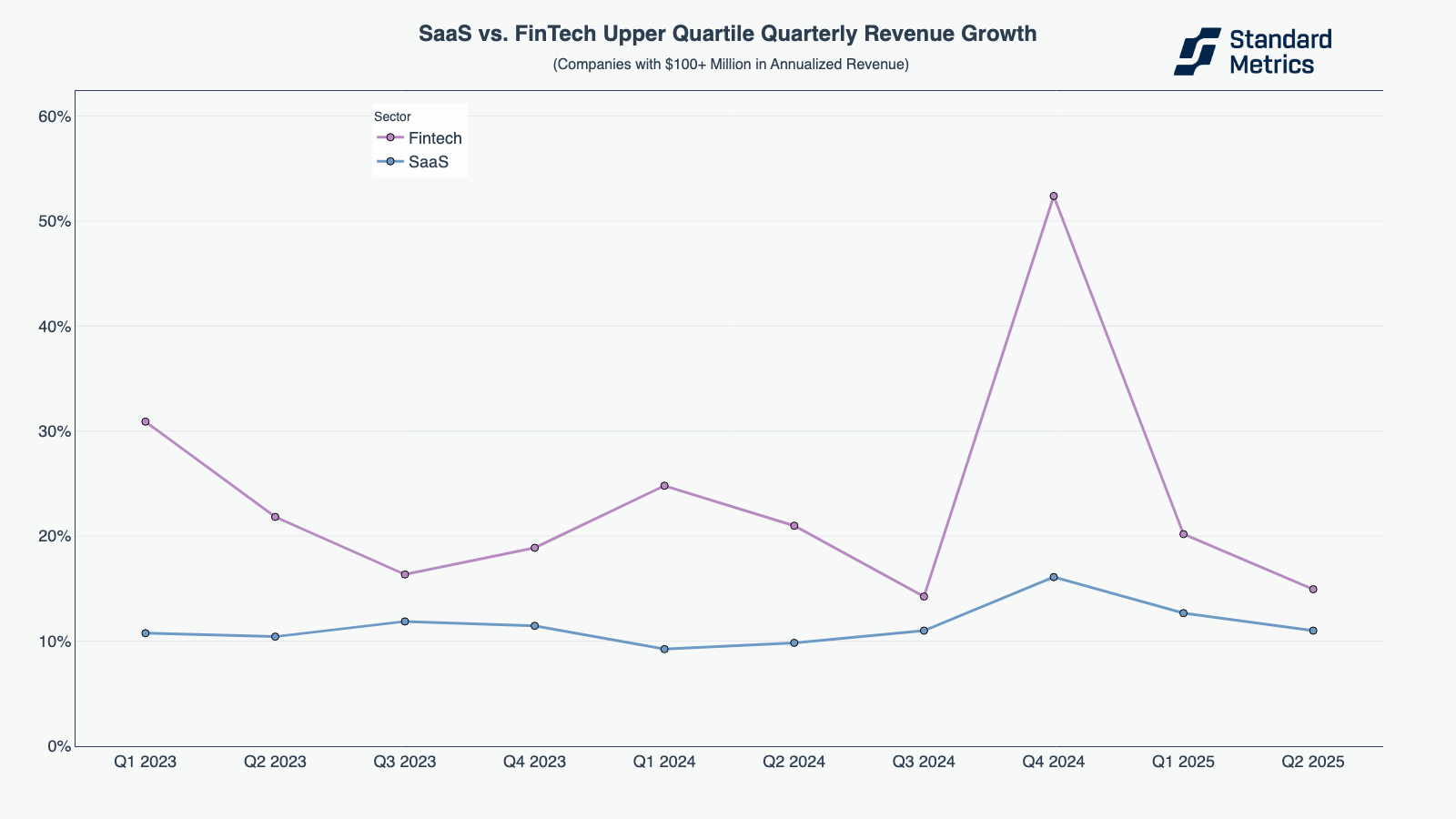

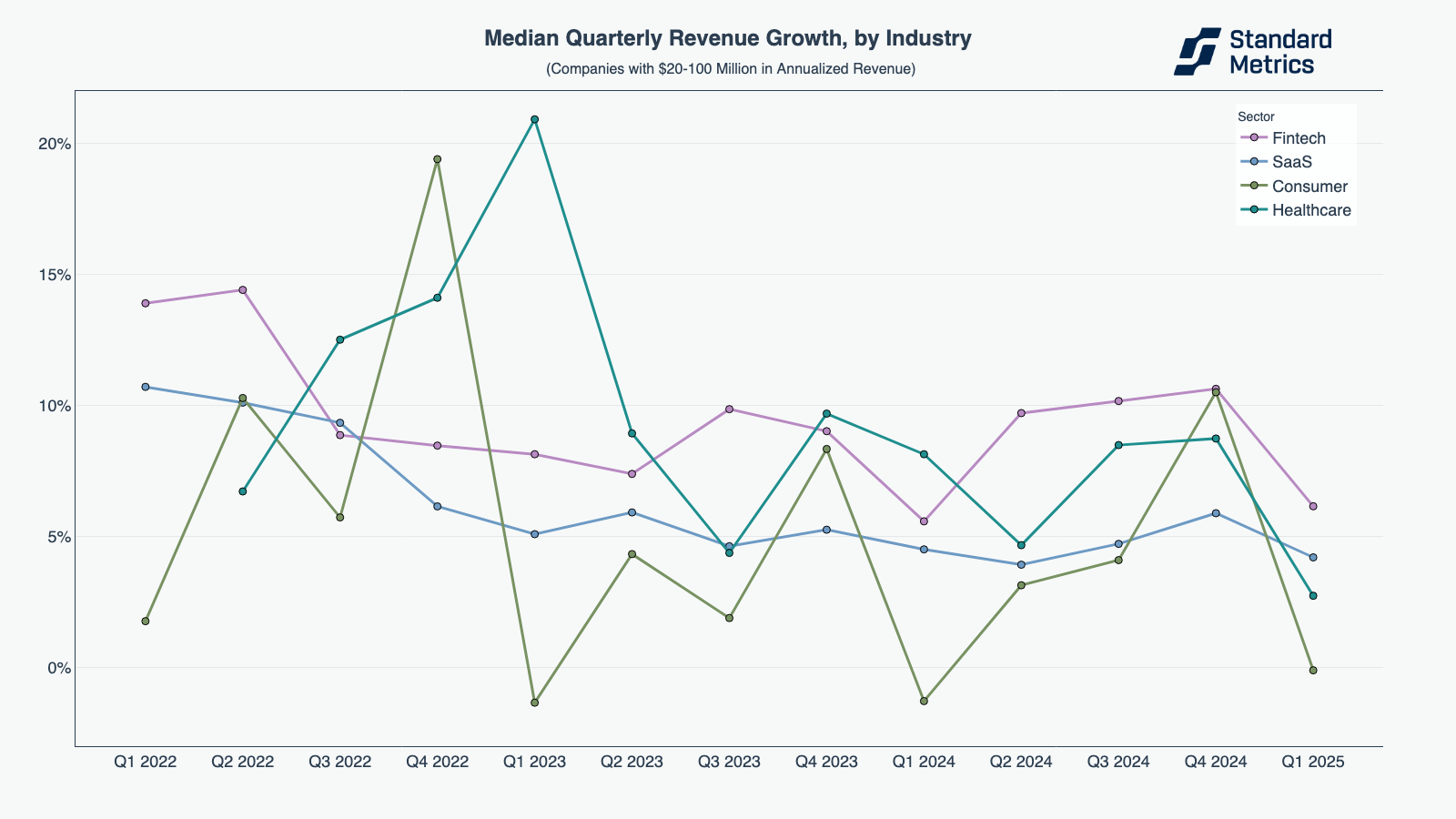

- Fintech continued to outpace SaaS in revenue growth, though the category has yet to return to earlier highs.

Call it a tale of two industries. In our Q3 2025 Startup Benchmarking Report, we dive into the most interesting startup performance trends in fintech and AI. This report is built from our Global Benchmarking data, an anonymized set of financial metrics from over 10,000 venture-backed startups on Standard Metrics.

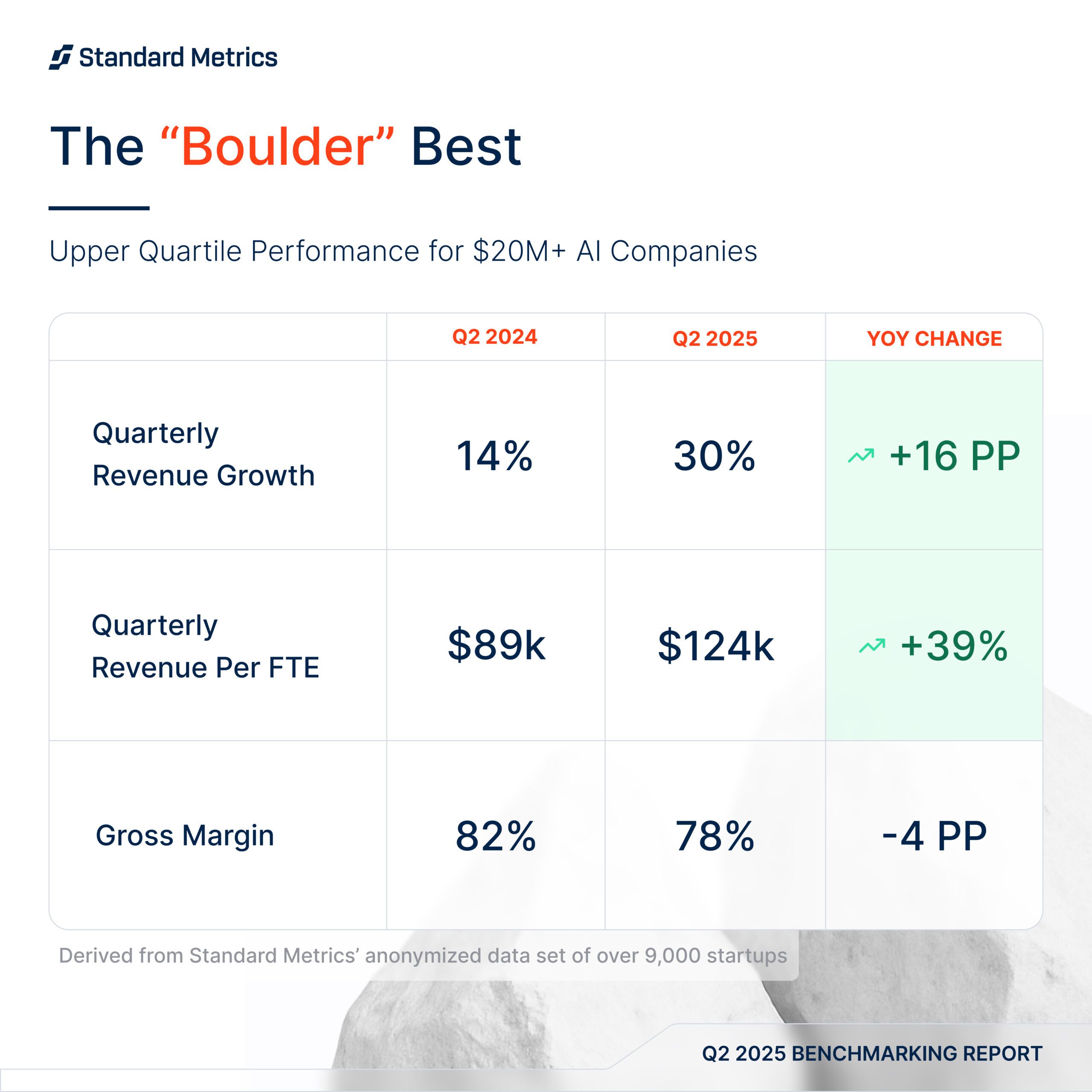

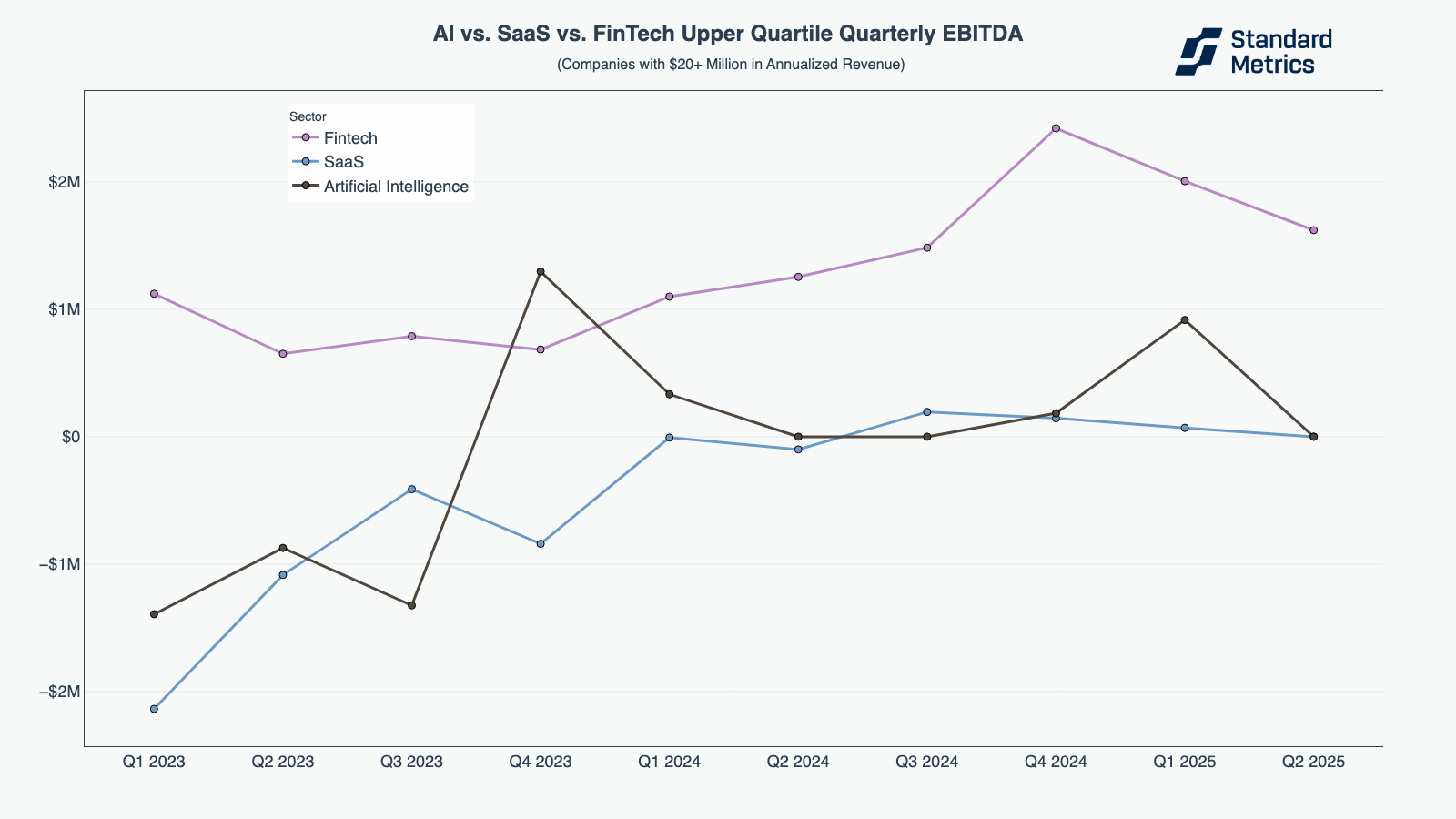

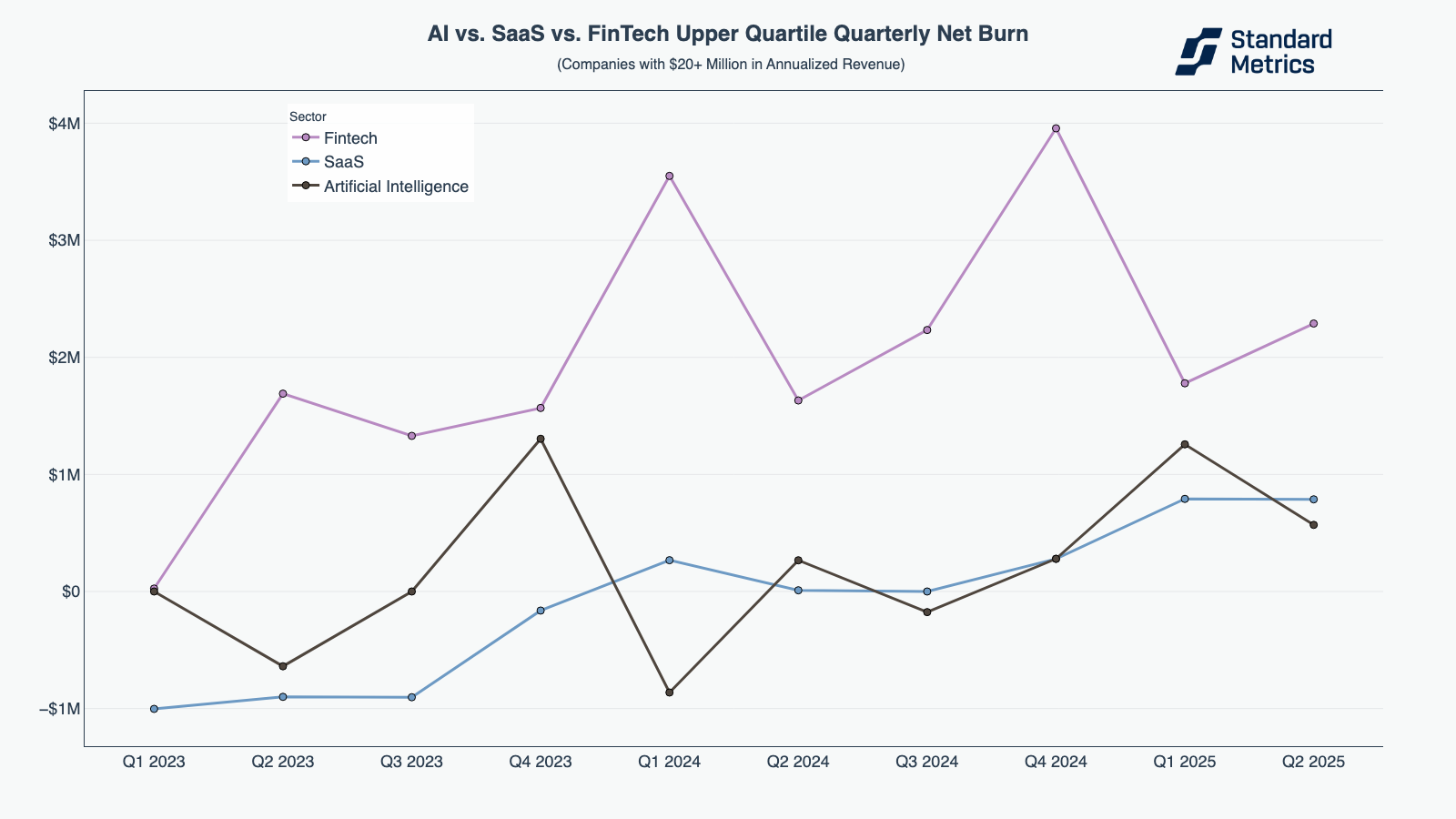

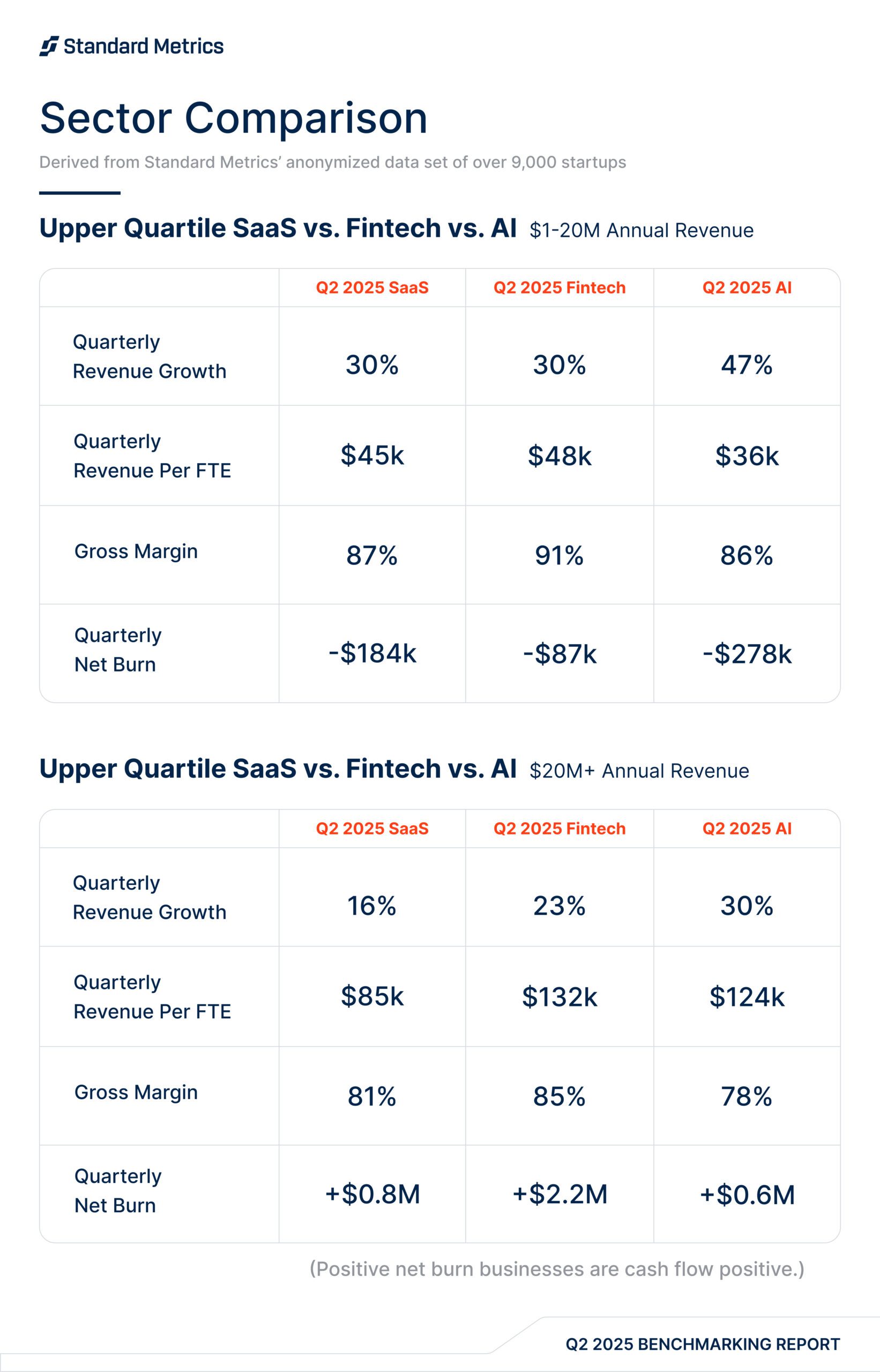

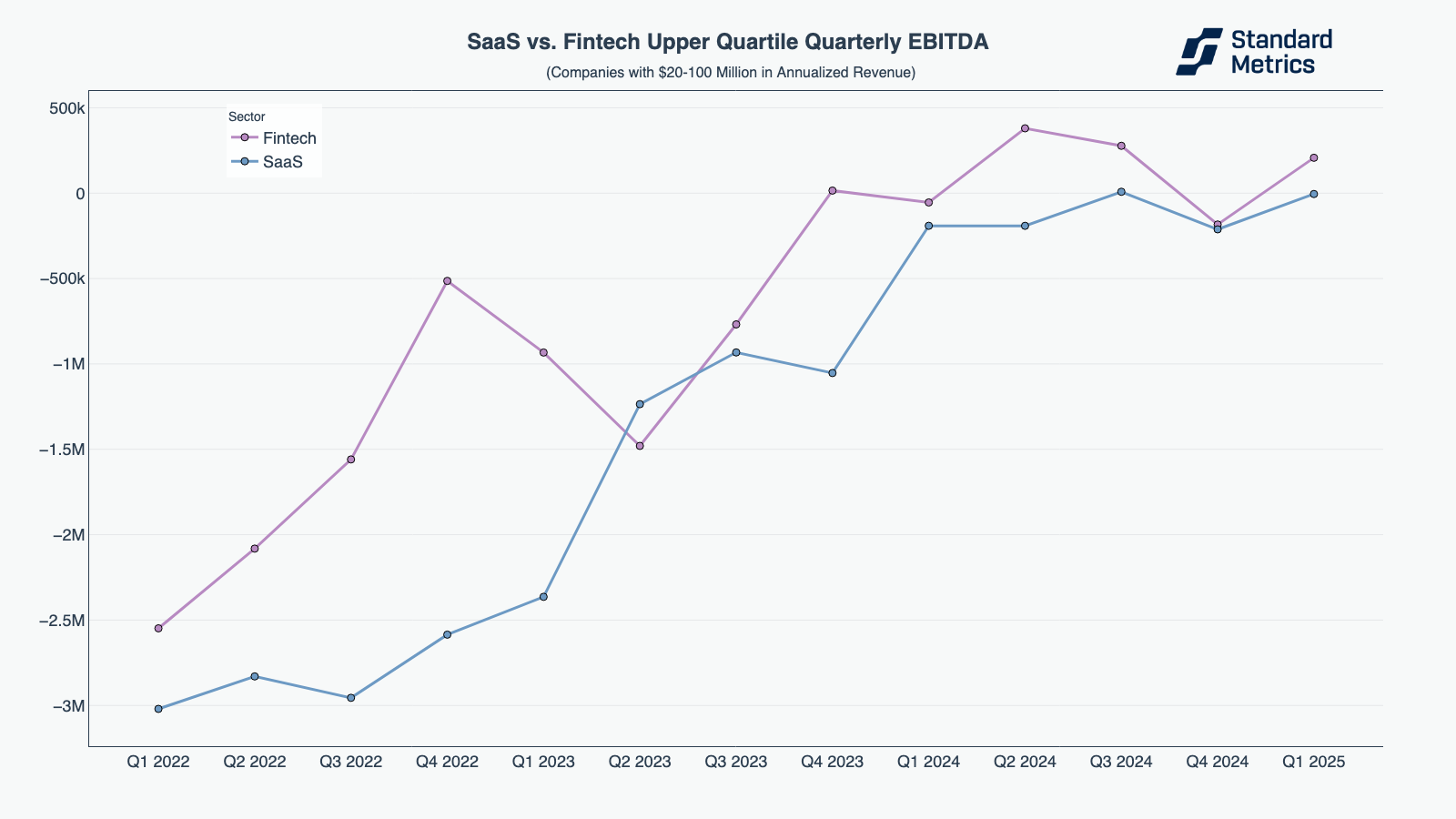

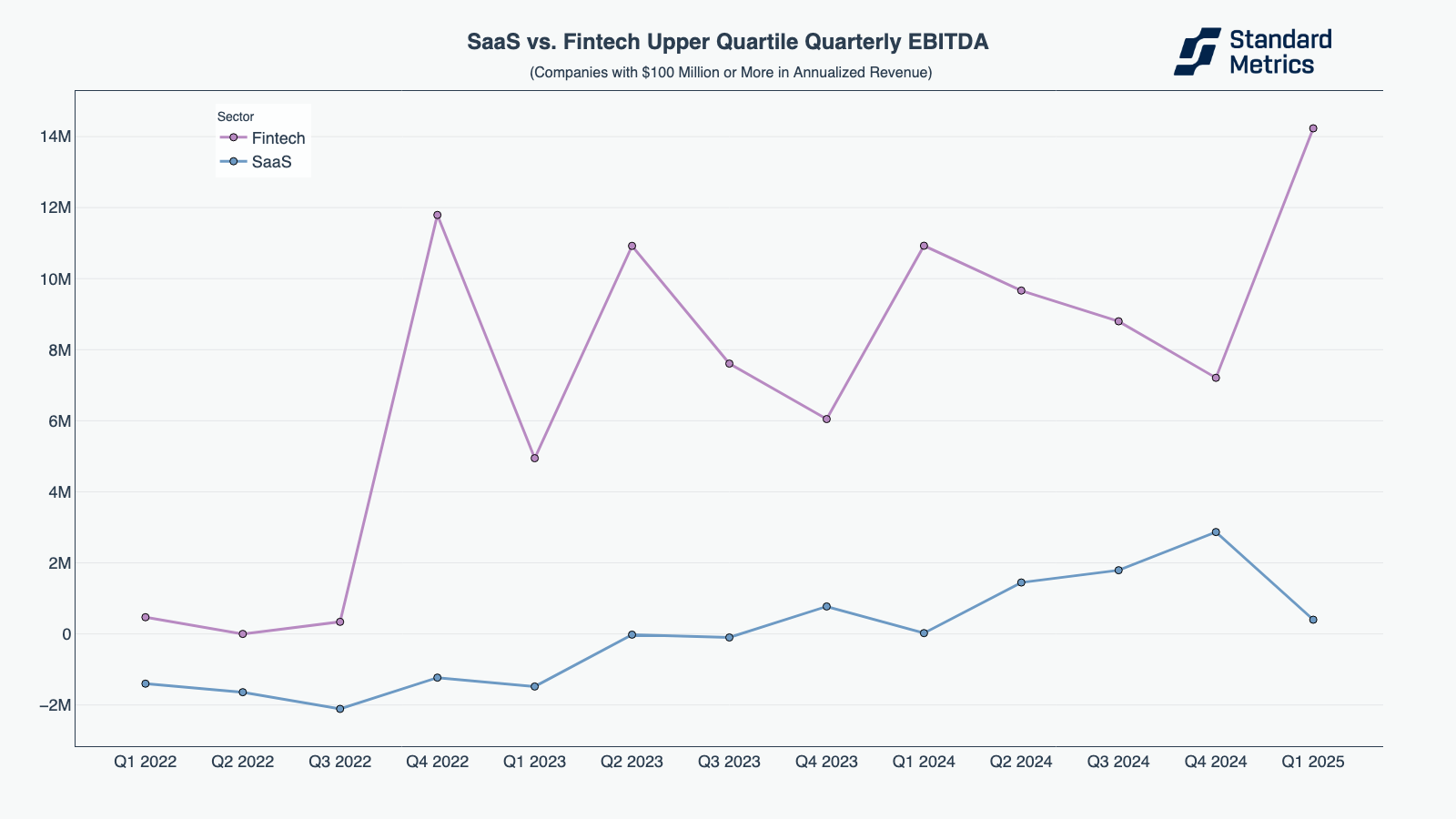

In our Q1 2025 Startup Benchmarking Report we saw evidence that the anecdotal “fintech is back” mantra going around the startup world was true, with mid-sized, upper-quartile companies in the industry surpassing SaaS in revenue growth and EBIDTA. In our Q2 2025 Startup Benchmarking Report, we saw fintech continue to outperform SaaS in revenue growth and even surpass AI in parts of 2024.

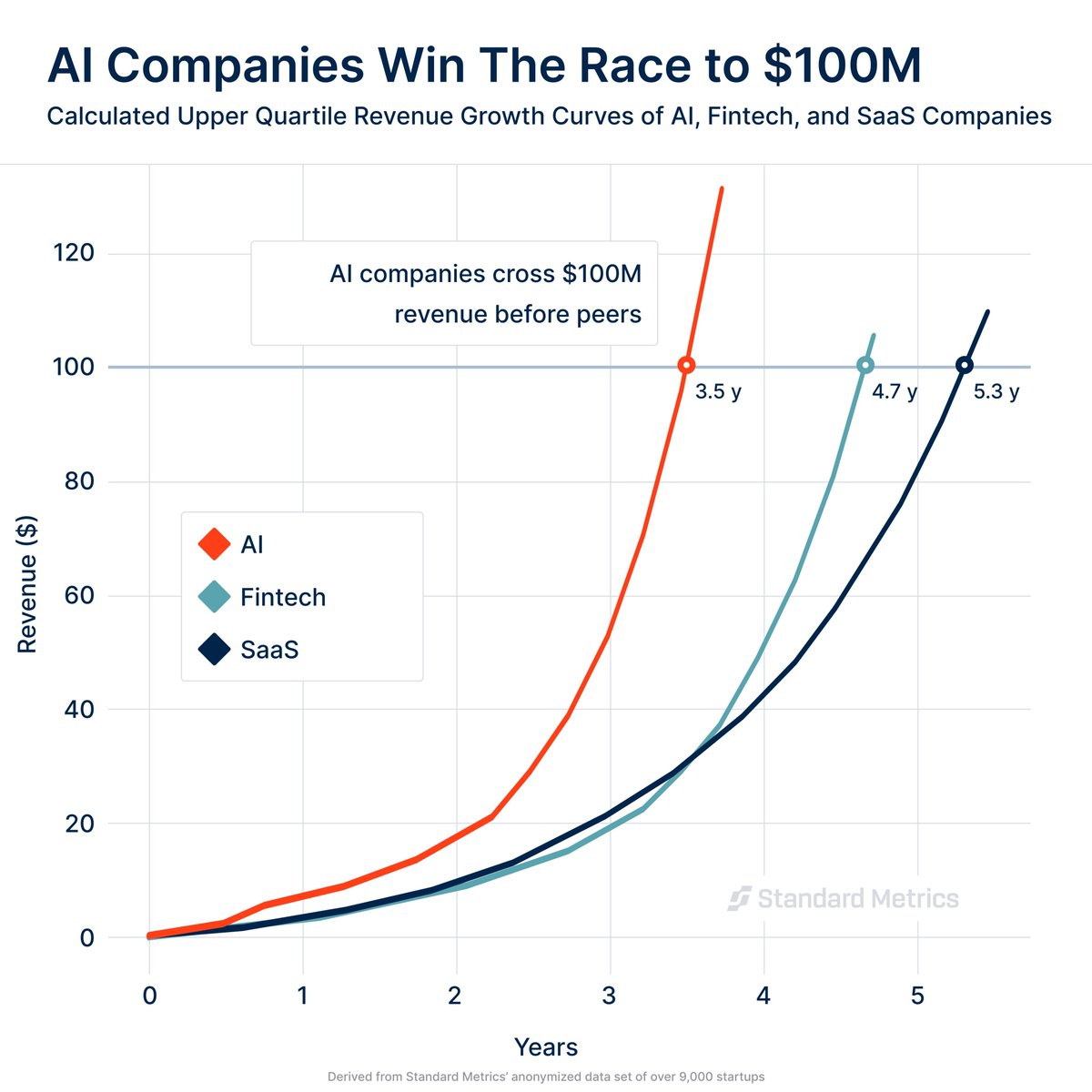

In Q3, fintech continued to improve. While early stage AI (companies between $1-20M in annualized revenue) continued to drive outsized growth, later stage AI (companies with $20M+ in annualized revenue) saw growth slow in Q3 2025. With that said, AI companies are still outperforming SaaS and Fintech, which we demonstrate in a new cohort analysis.

How are the best fintech companies doing?

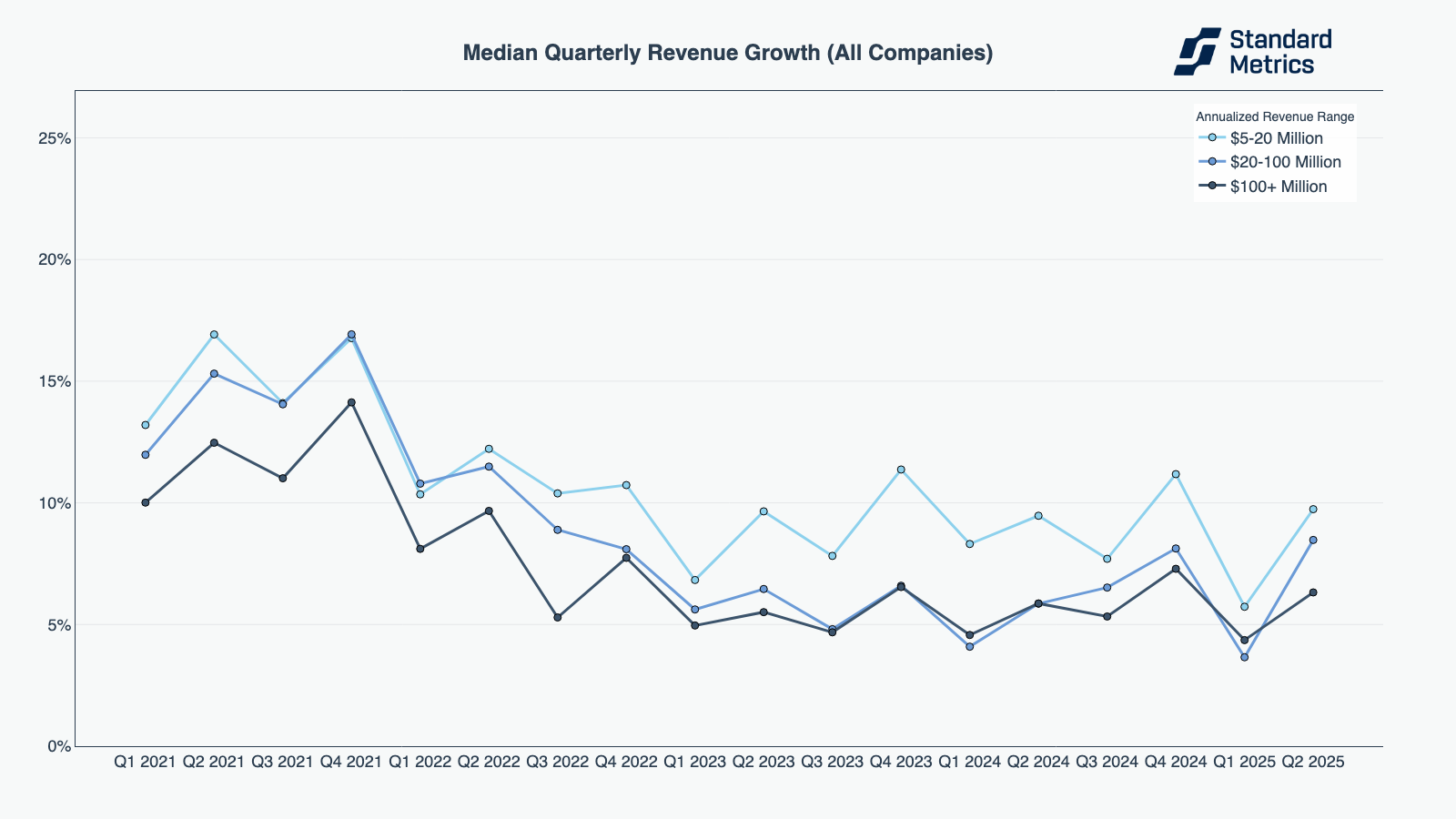

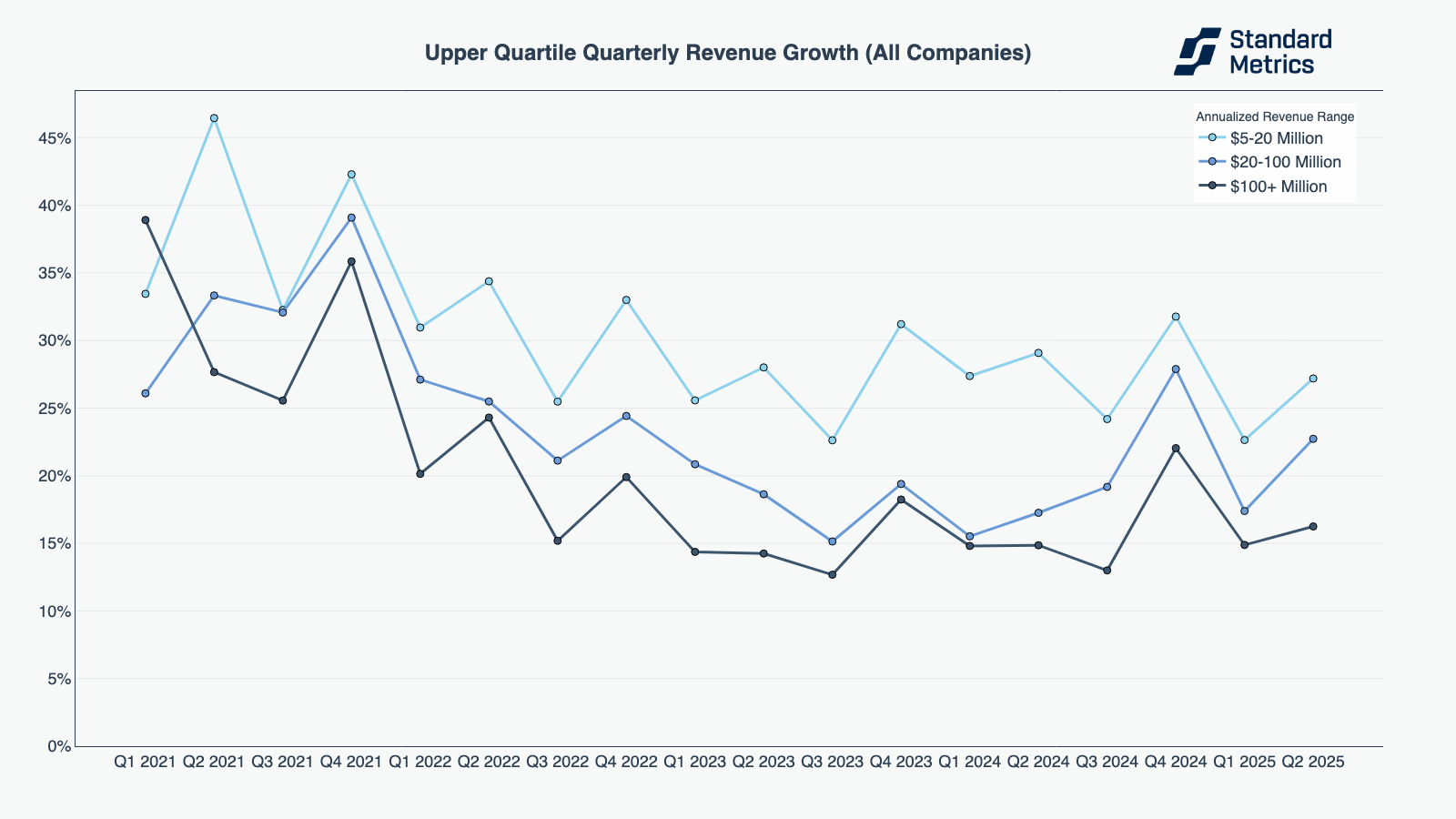

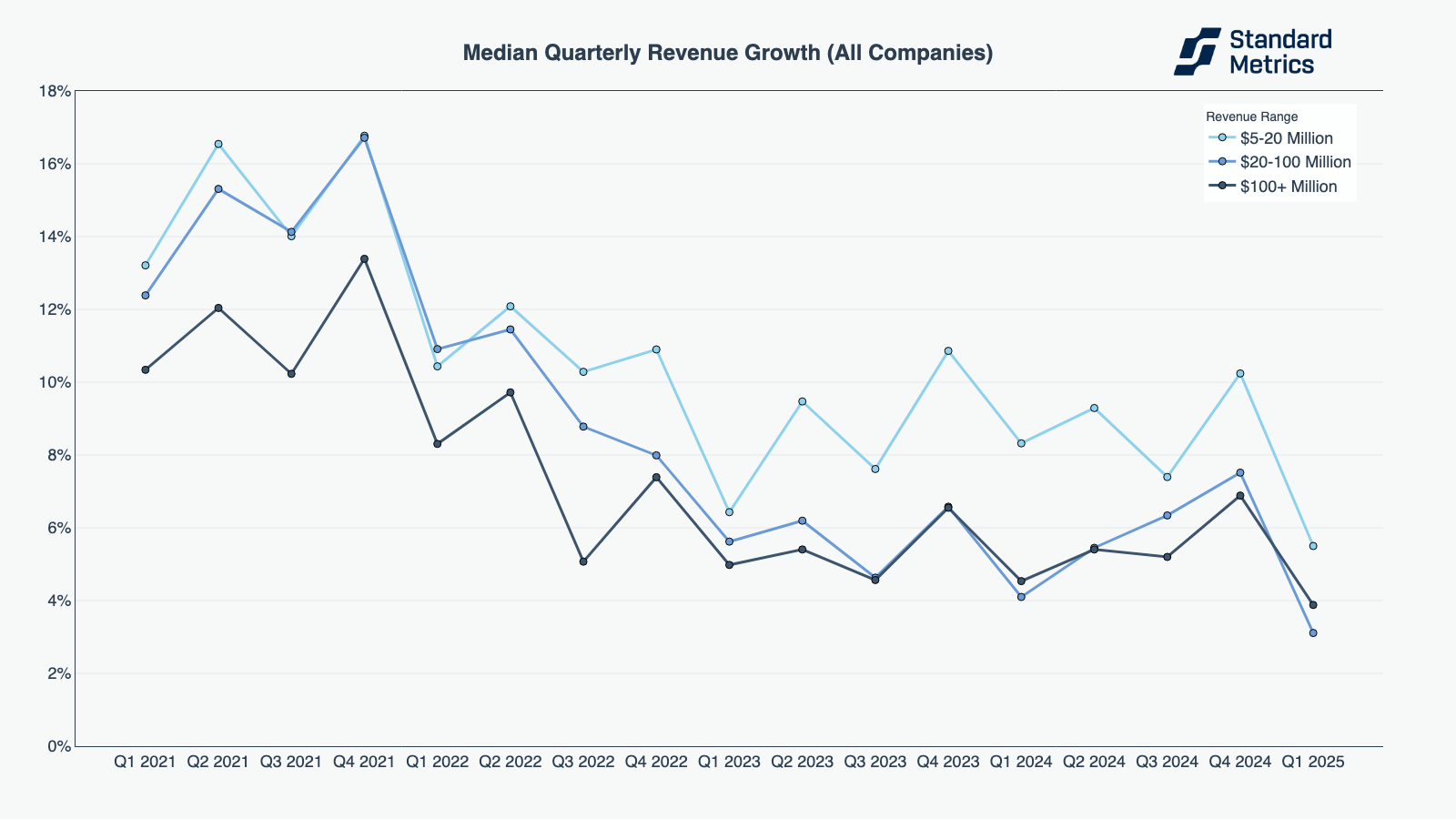

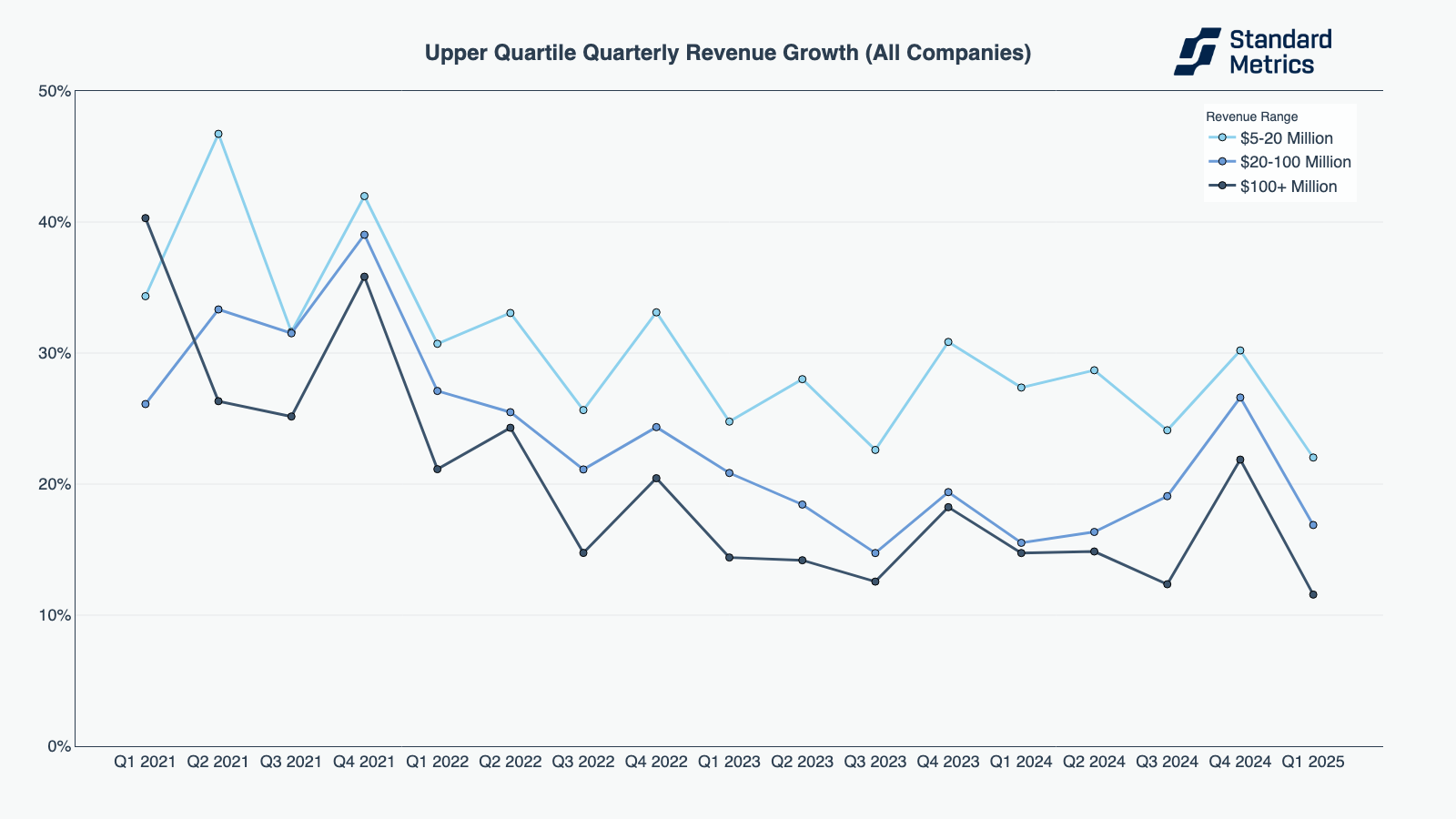

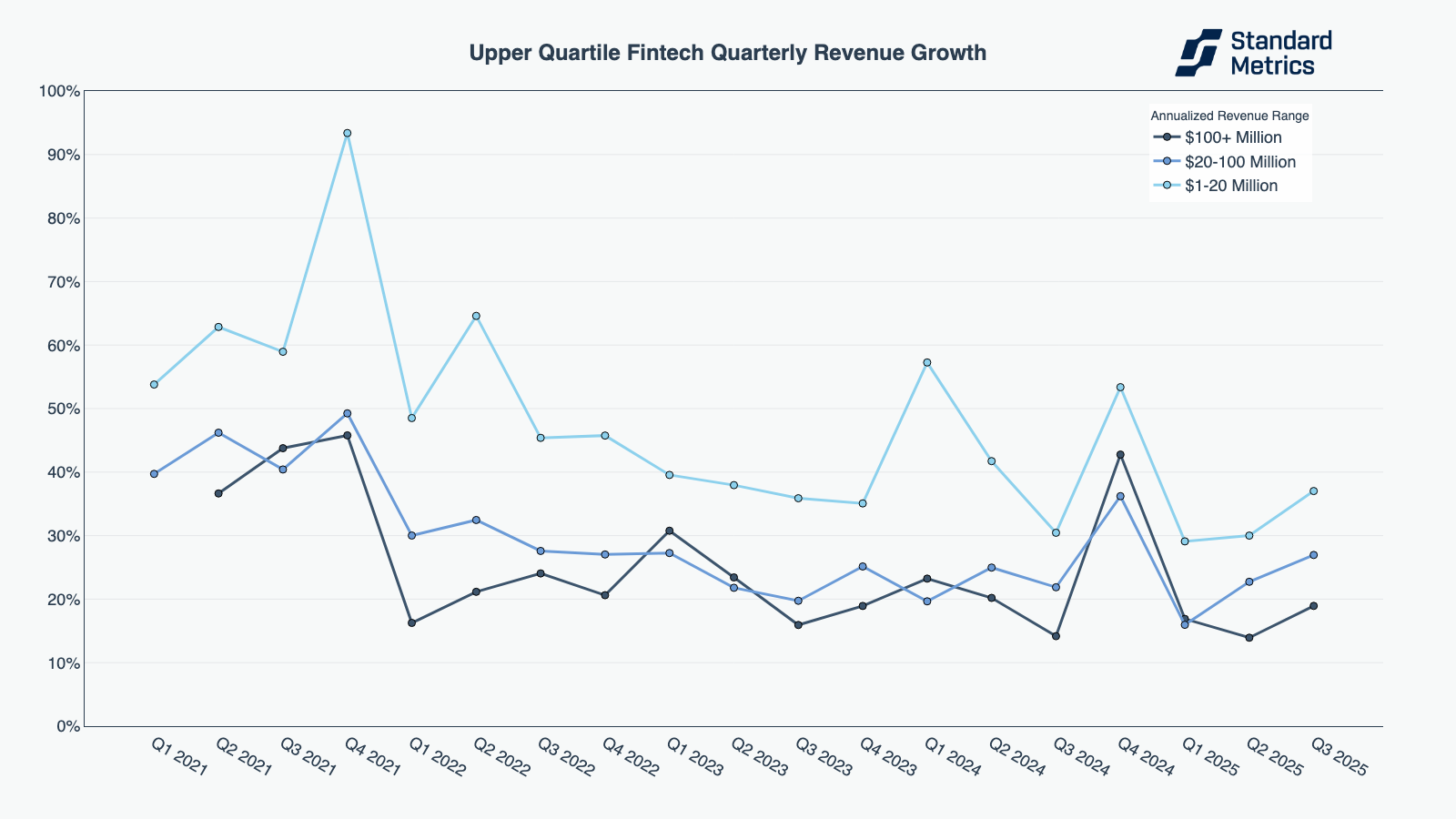

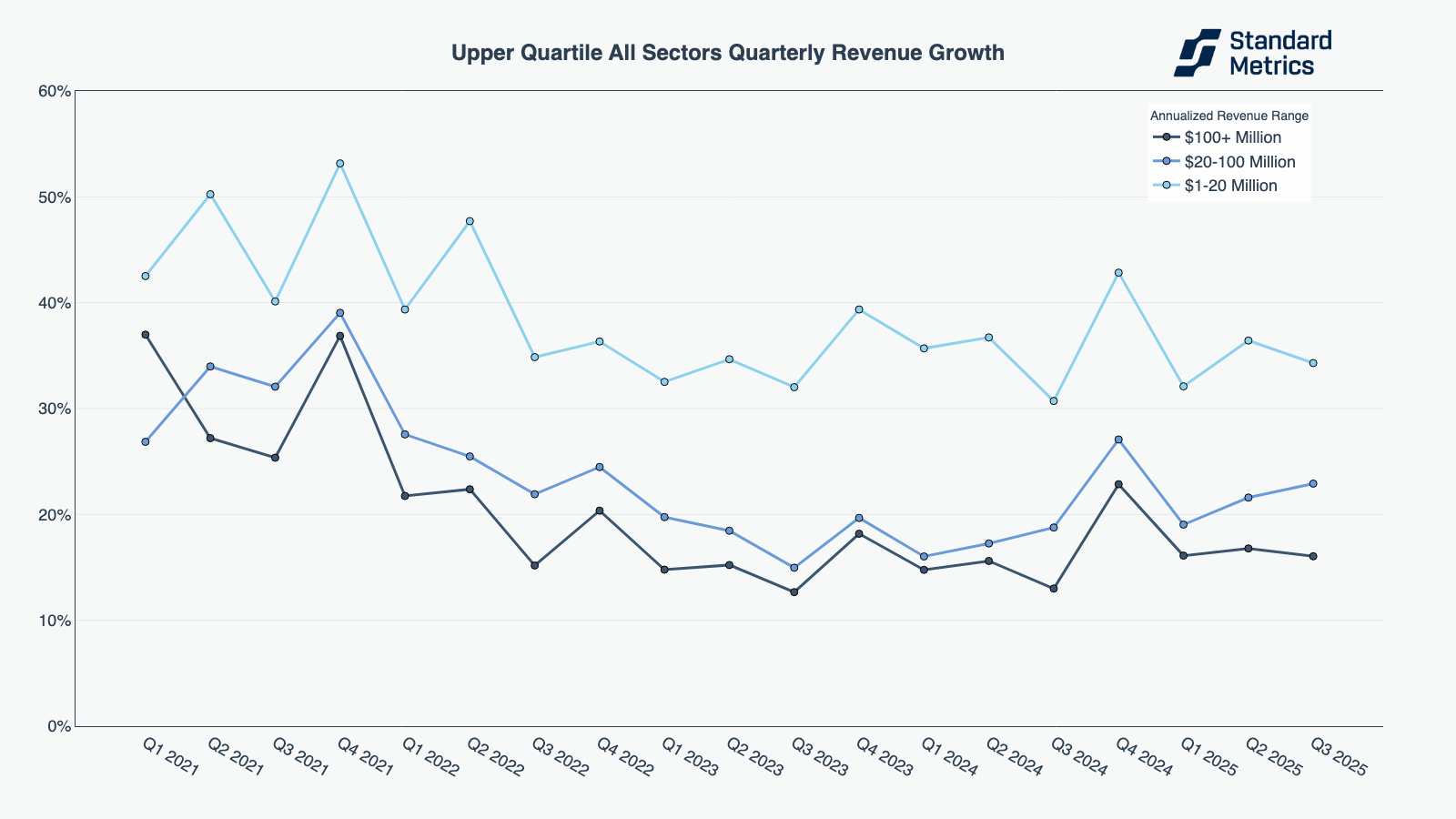

Fintech companies of all sizes improved their quarterly revenue growth in Q3 2025, with early, mid, and late stage fintech companies up 7, 4, and 5 percentage points quarter-over-quarter and 7, 5, and 5 percentage points year-over-year. Fintech companies outpaced the “all sector” benchmark for revenue growth across all revenue bands. However, the category has moderated in growth since 2021 highs.

N=86

N=438

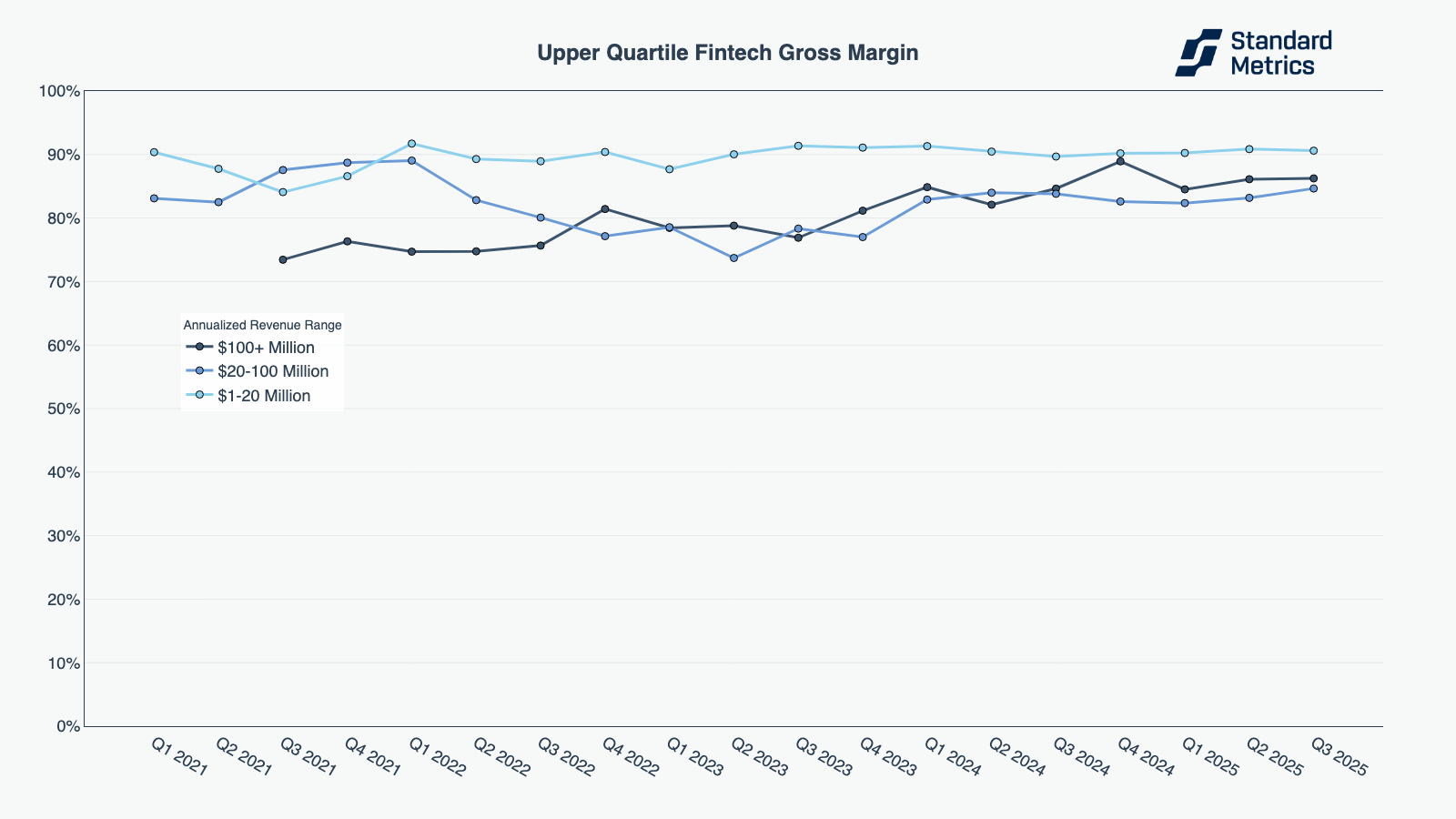

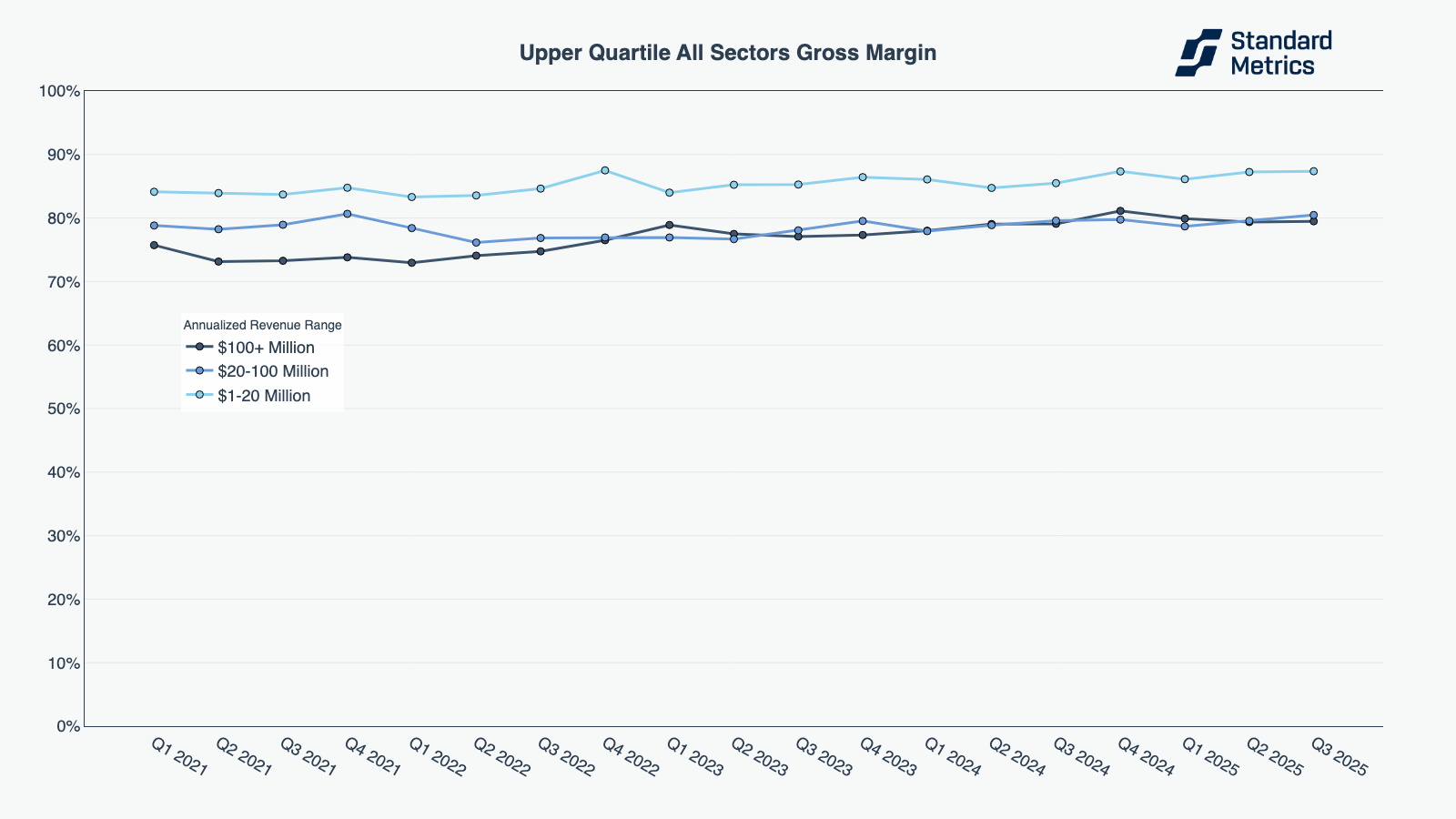

Fintech companies also continued to display strong gross margins. Early-stage fintech reached 91% in Q3 2025. Mid-stage fintech rebounded to 2021 gross margin highs of 85% in Q3 2025. Late-stage fintech has significantly improved gross margins since 2021 and 2022 lows and reached 86% in Q3 2025. Moreover, fintech companies of all stages slightly outpaced their “all sector” peers for gross margin in Q3 2025.

N=73

N=389

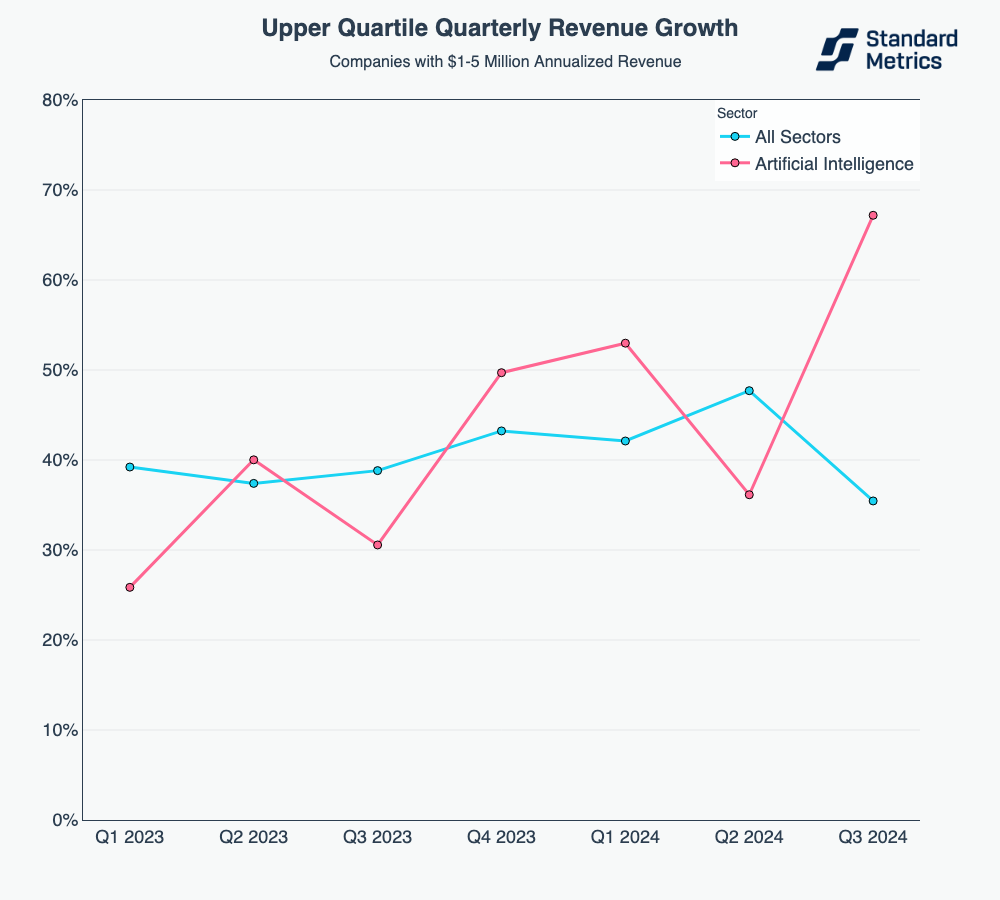

How are the best AI companies doing?

So what does performance look like for AI companies? (Note: We have a more robust set of data for fintech than AI, so we had to create less granular revenue buckets for the AI sector.)

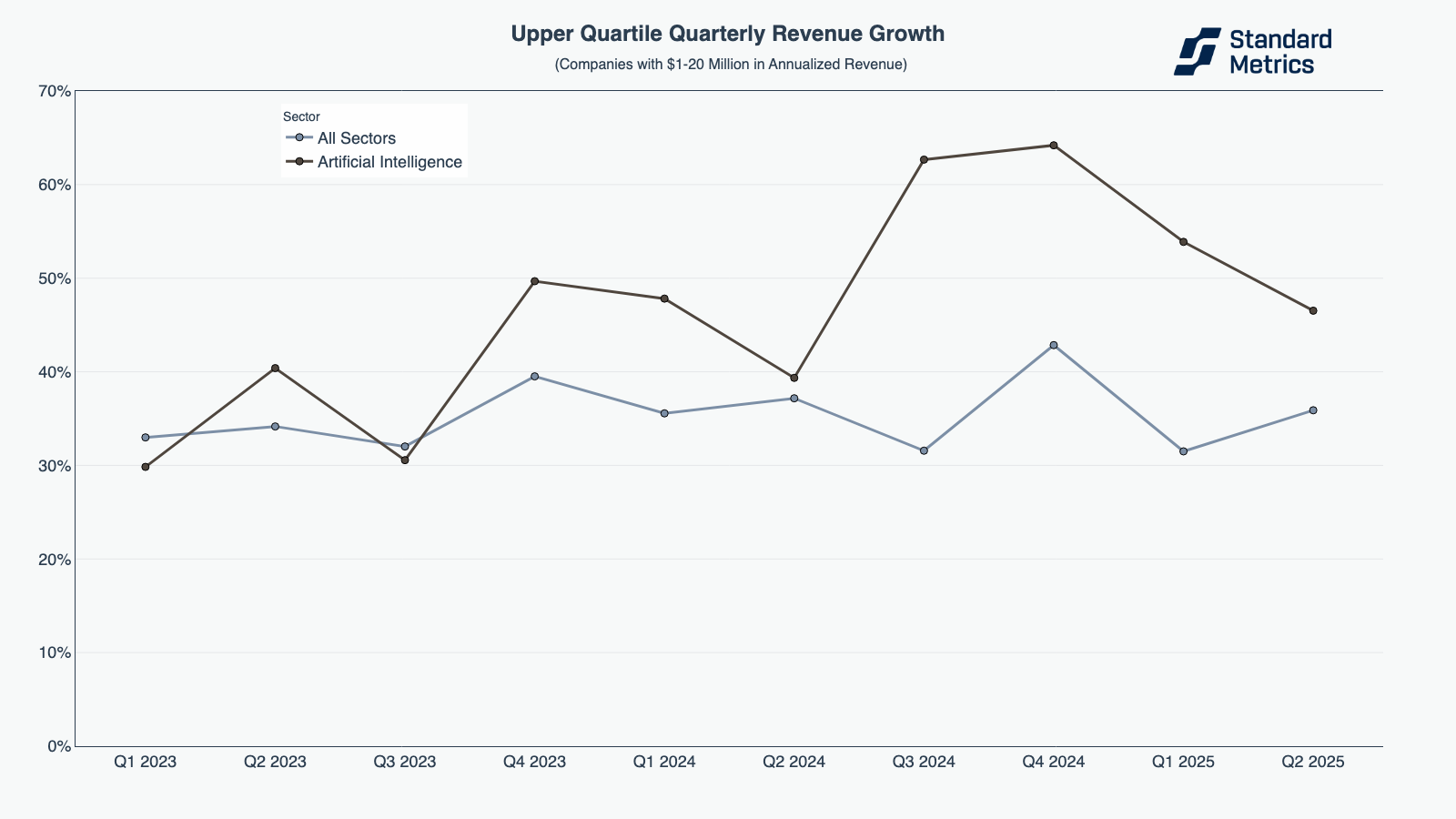

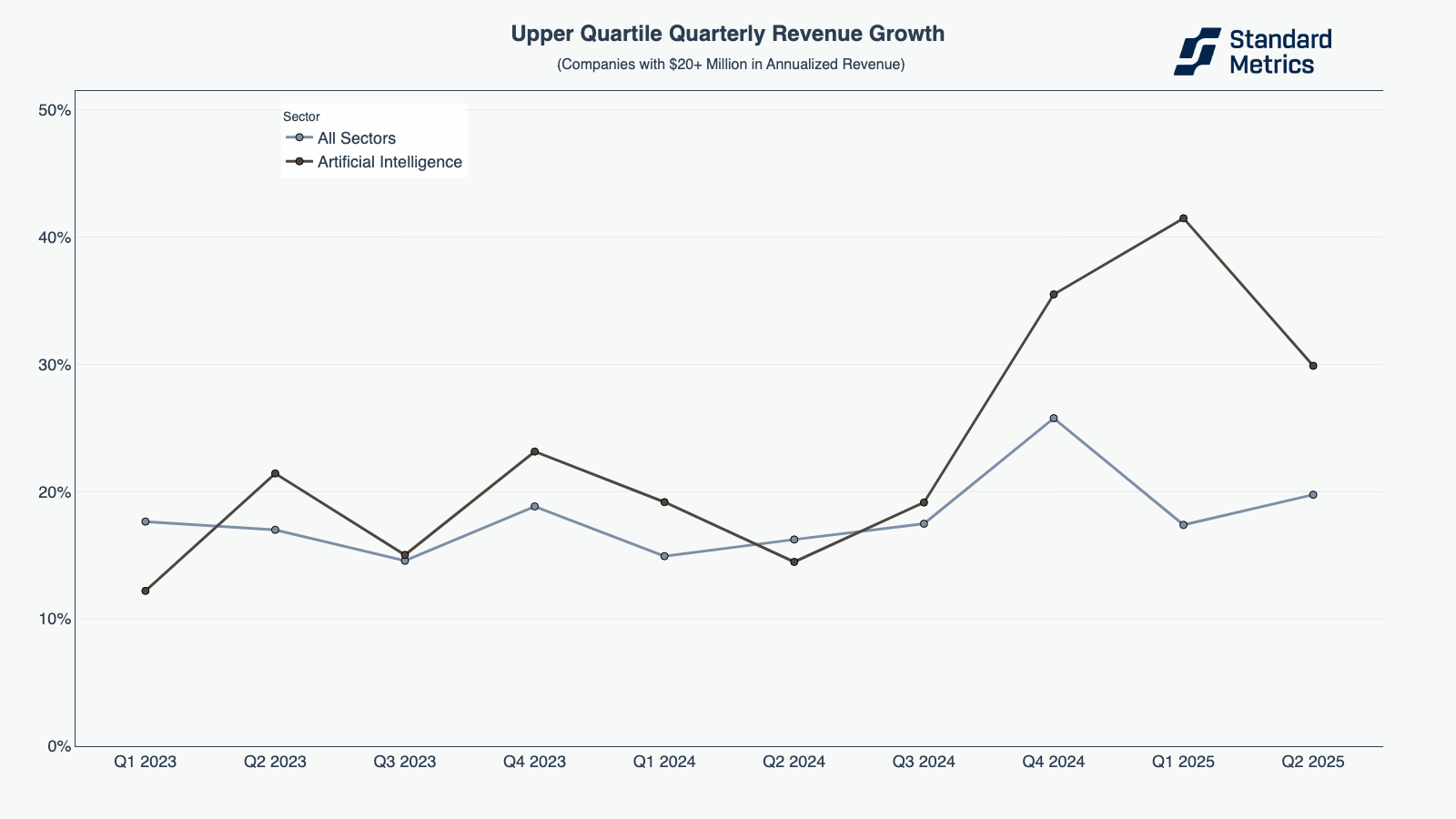

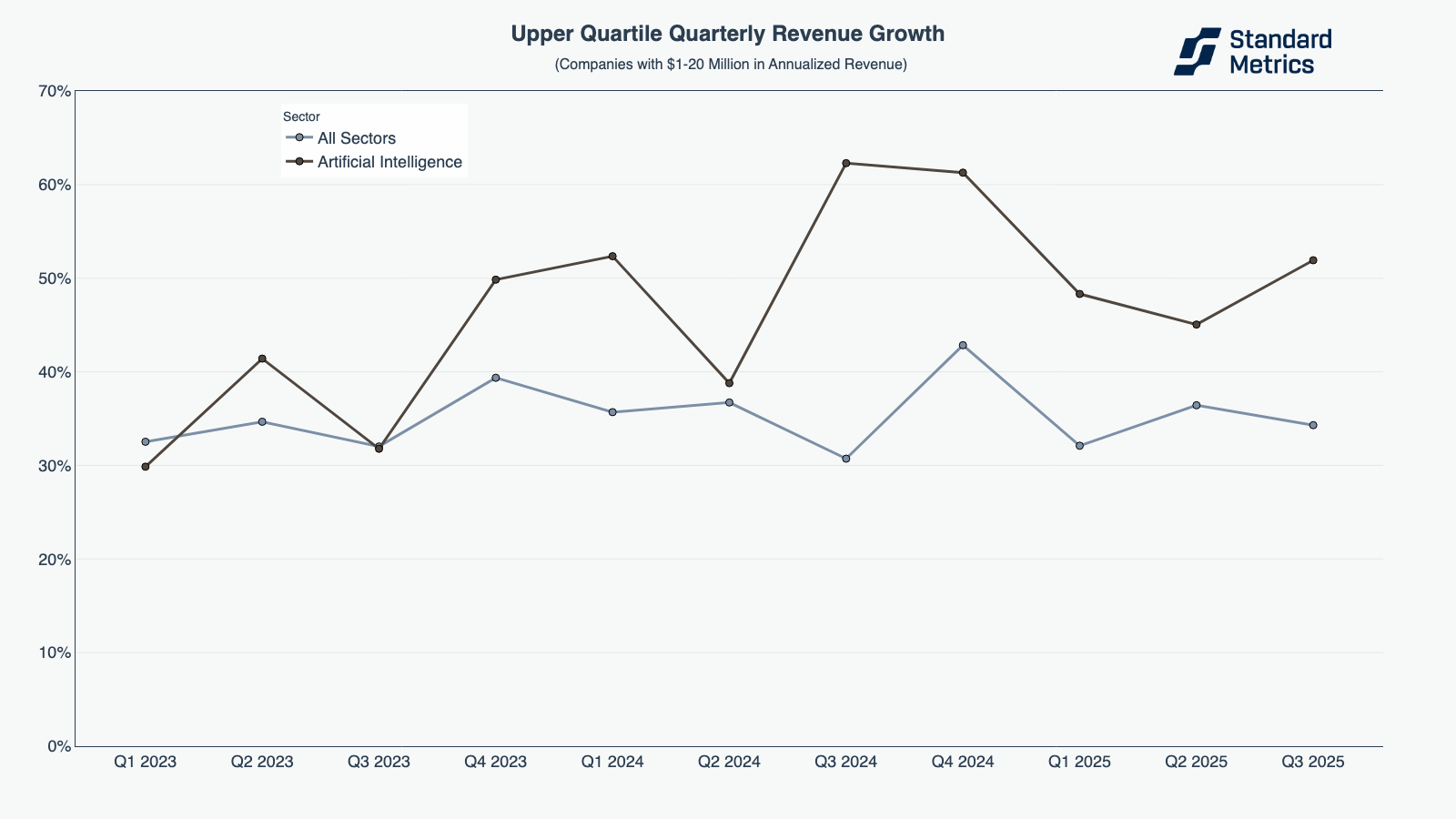

At both the $1-20M and $20M+ revenue ranges, the best AI companies outpaced the “all sector” average. Earlier-stage, upper-quartile AI growers saw improvements in quarterly revenue growth — up 7 percentage points between Q2 and Q3 — and were growing significantly faster than their all-sector peers.

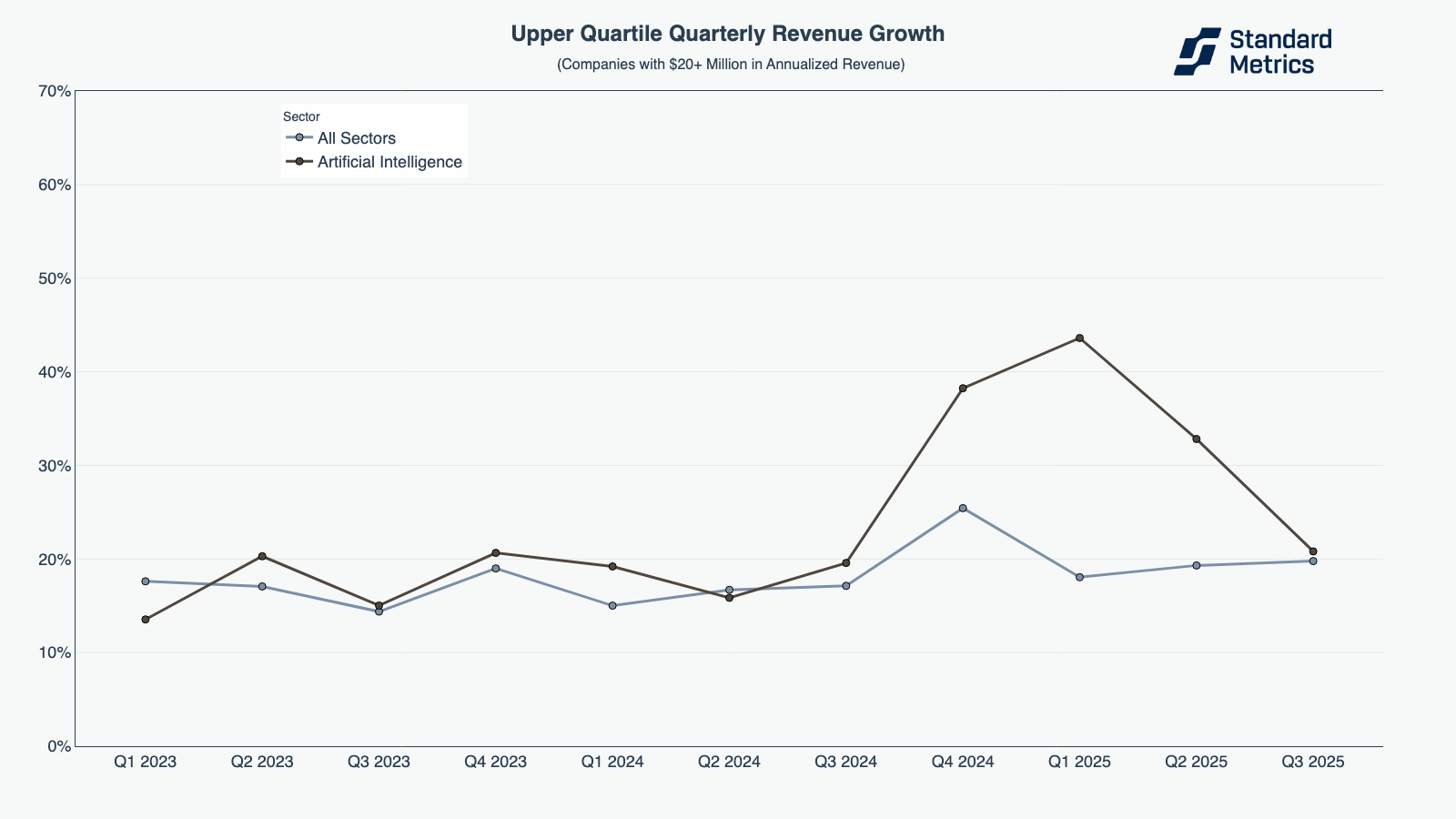

However, late-stage, upper quartile AI companies have declined in quarterly revenue growth since their Q1 2025 high of 44% to 21% in Q3 2025.

N=180

N=89

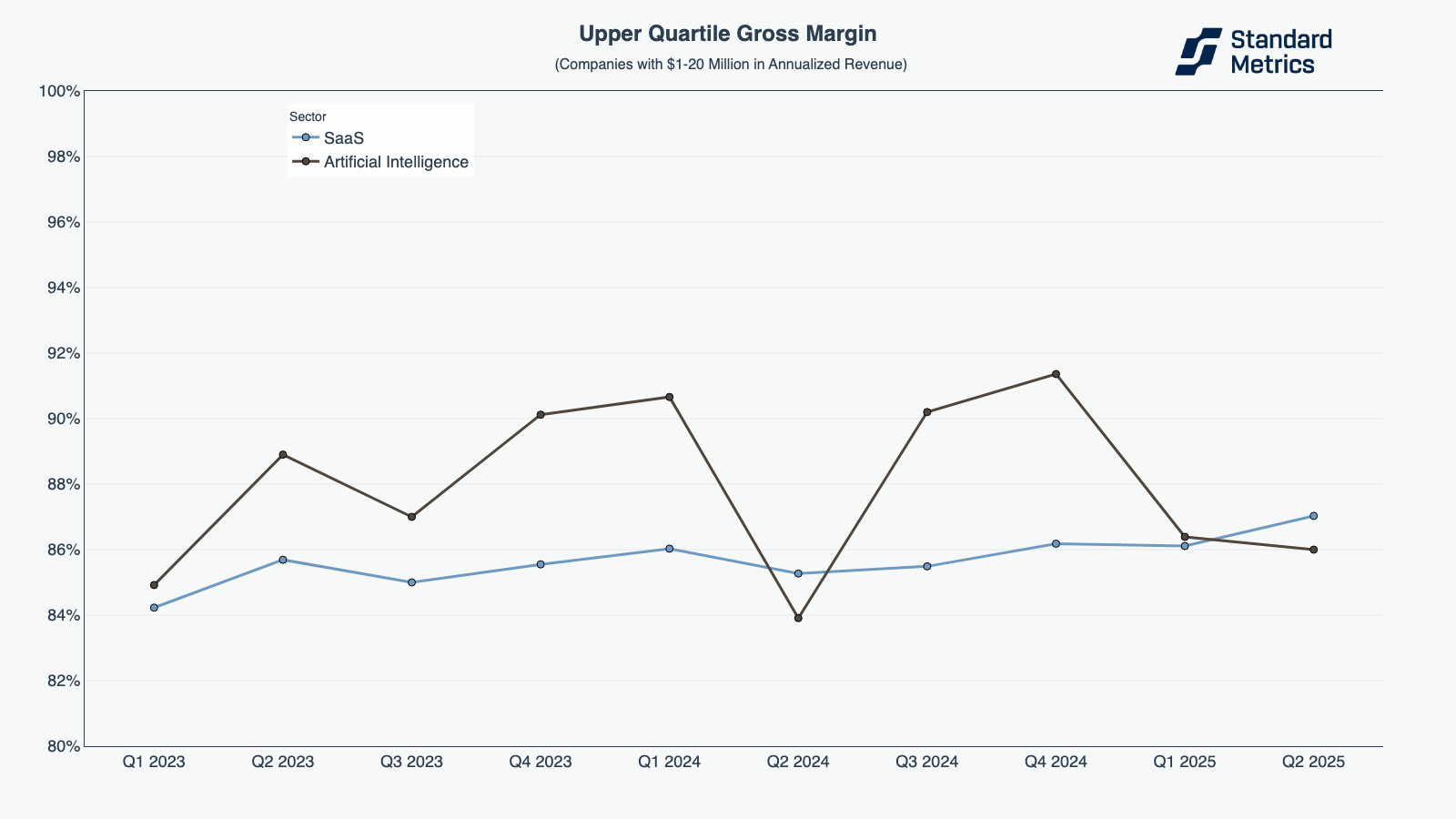

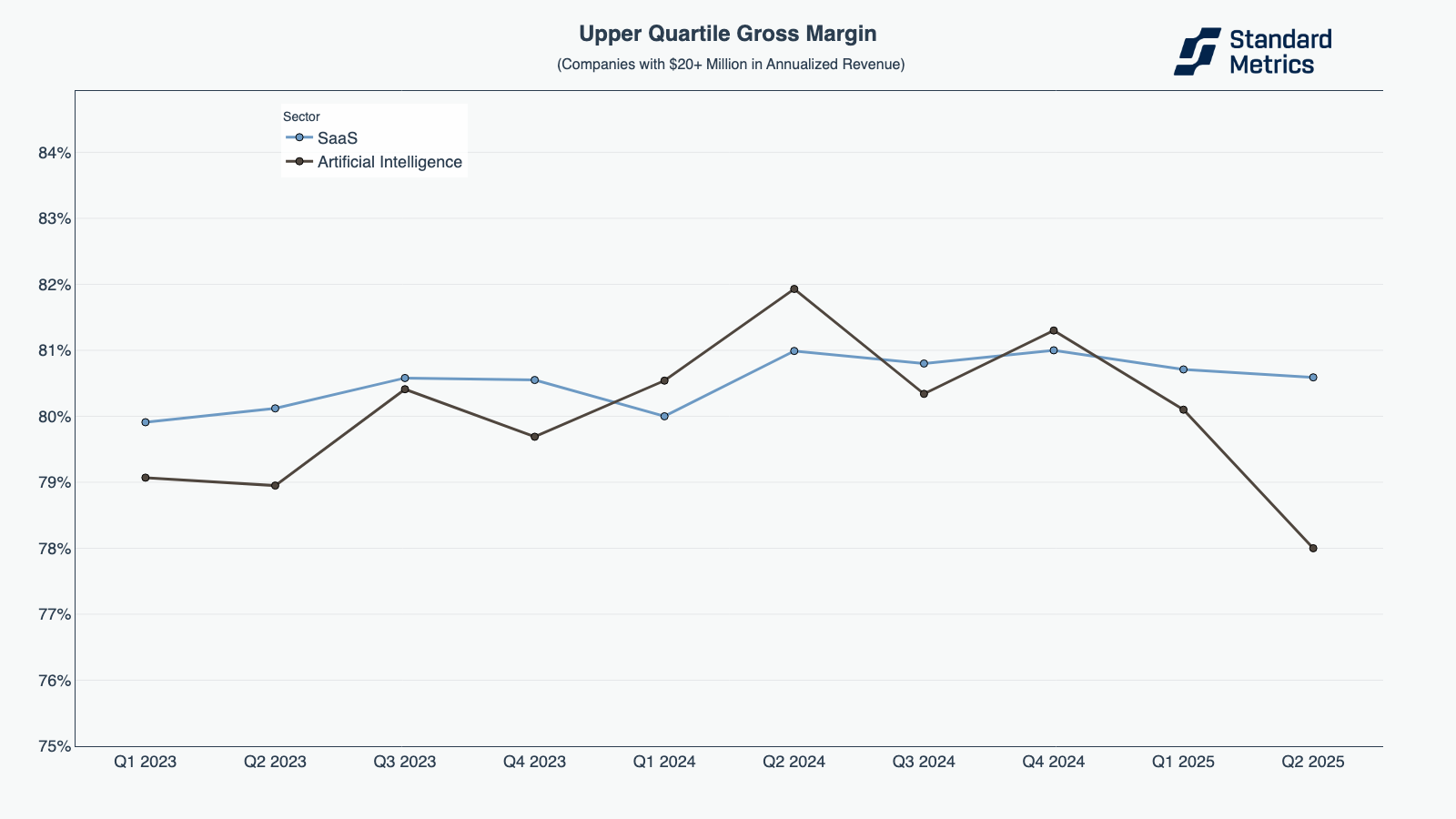

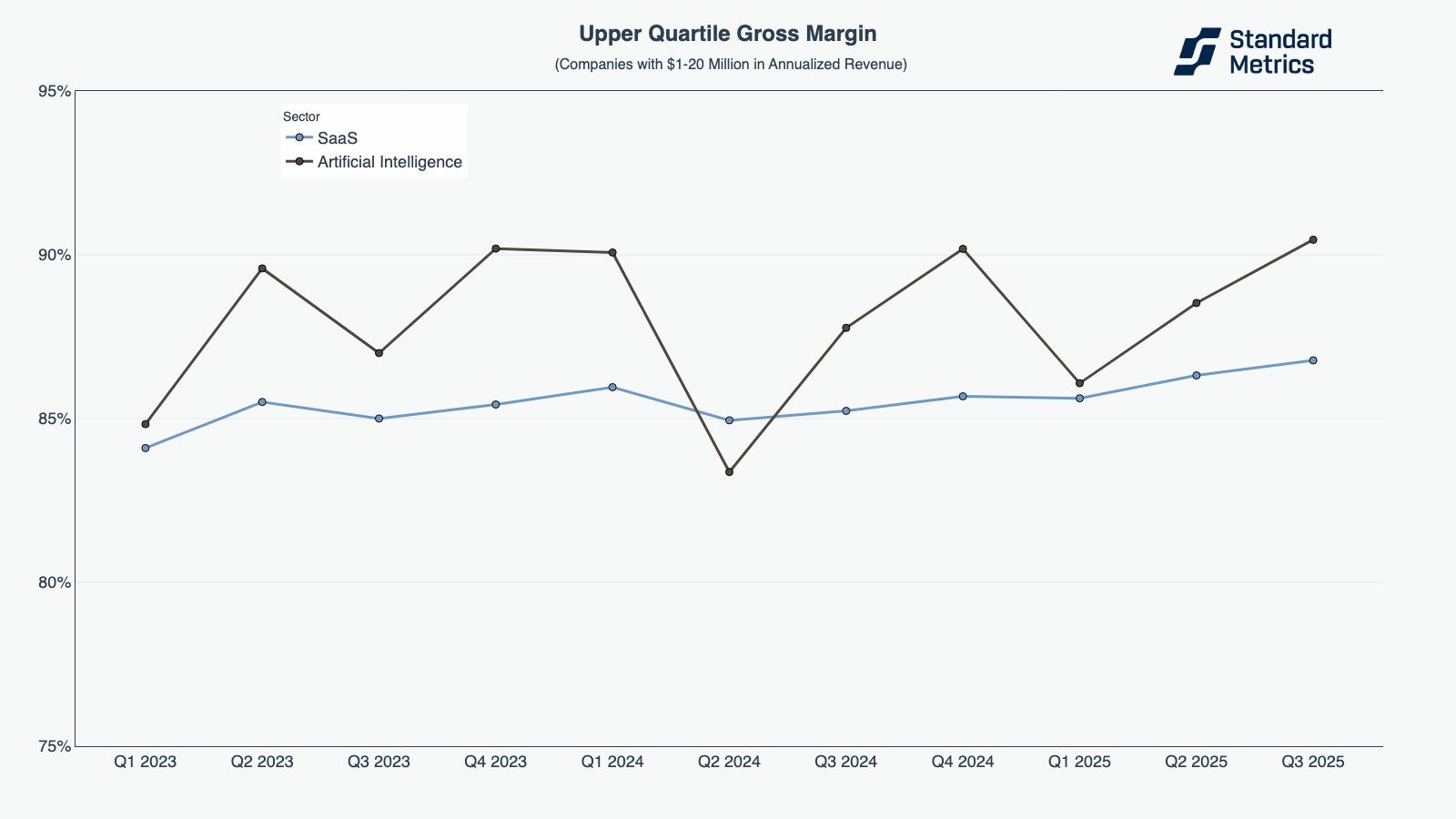

As we did in our Q2 2025 Startup Benchmarking Report, we compared AI to SaaS (instead of all sectors) for our gross margin analysis. Like last quarter, AI companies outperformed SaaS in Q3 2025 in the $1-20M category.

N=173

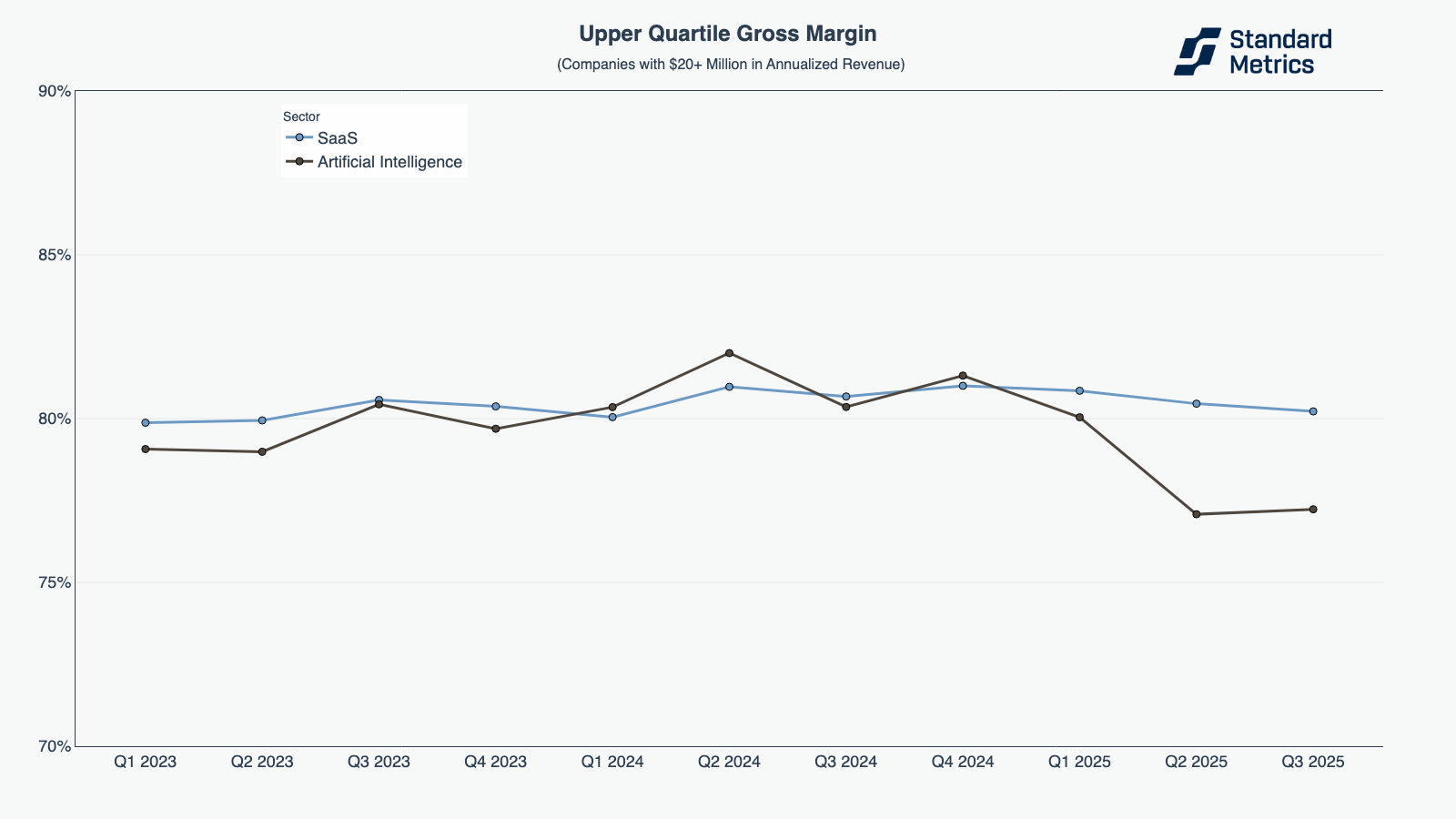

However, later stage AI continued to operate at a lower gross margin (at 77% in Q3 2025 vs. a SaaS gross margin of 80%). Later-stage companies in both sectors reported lower gross margins than their early stage counterparts. However, we hypothesize that the difference here may be largely driven by reporting standards becoming more rigorous as companies mature.

N=86

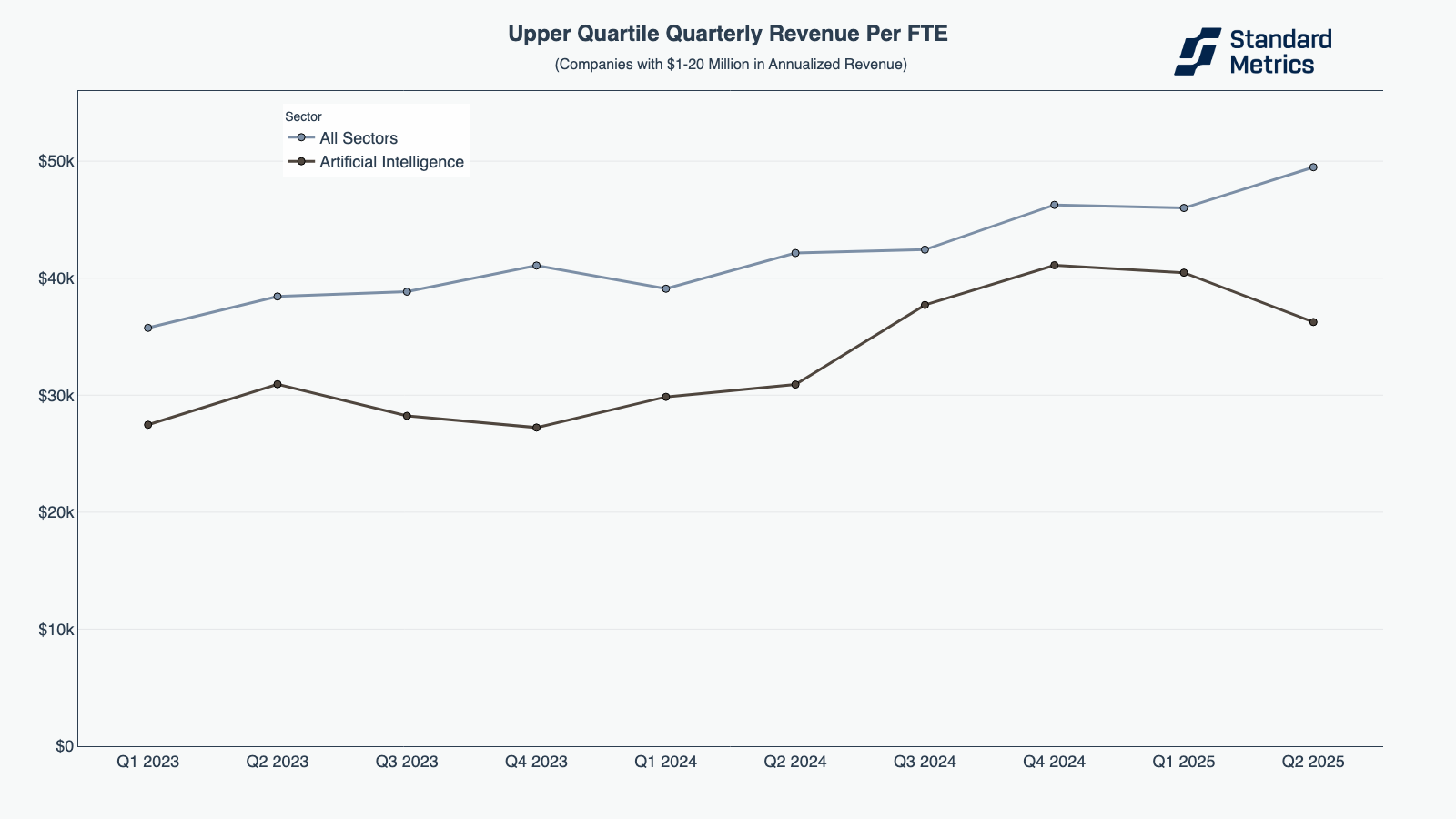

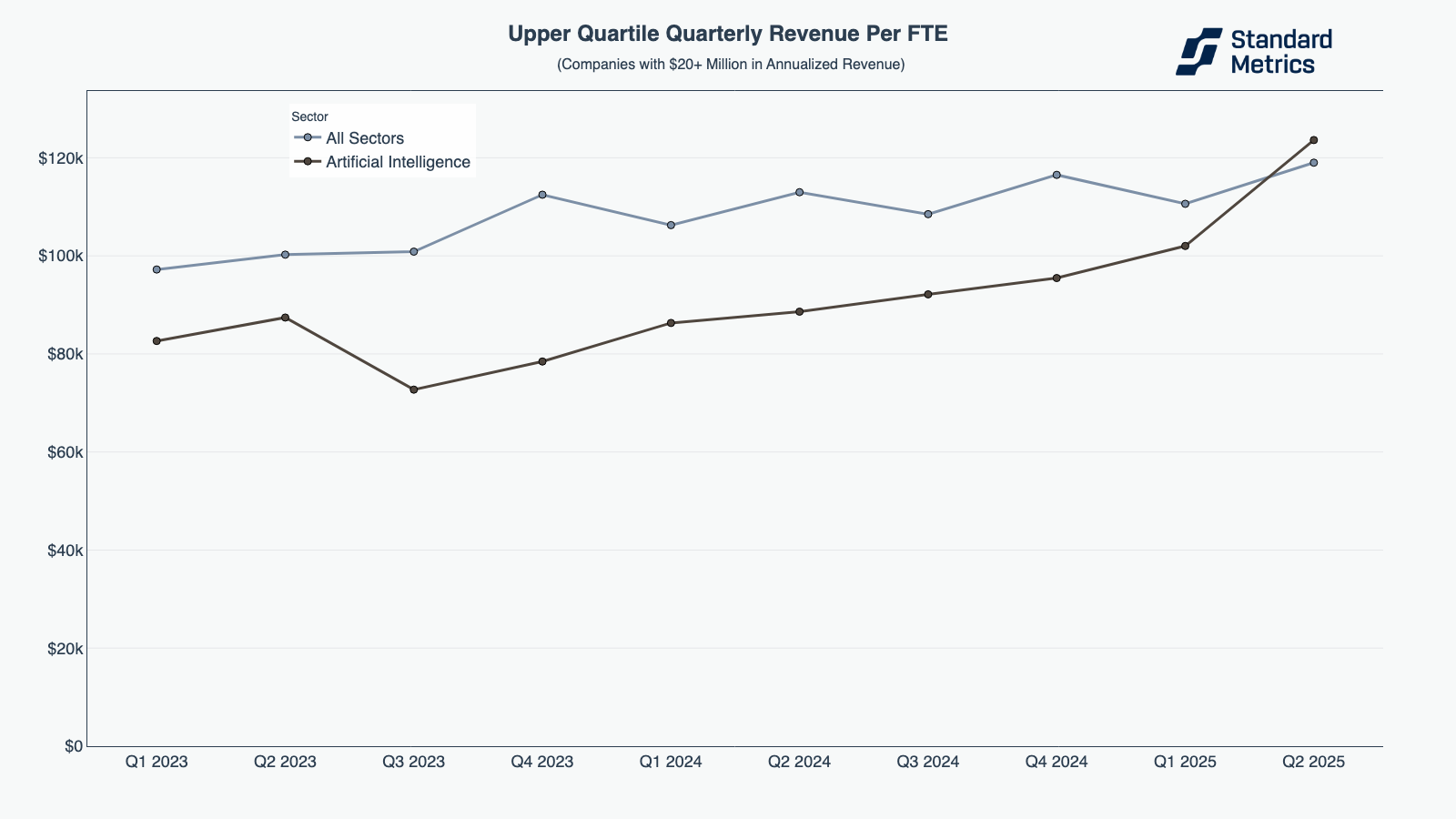

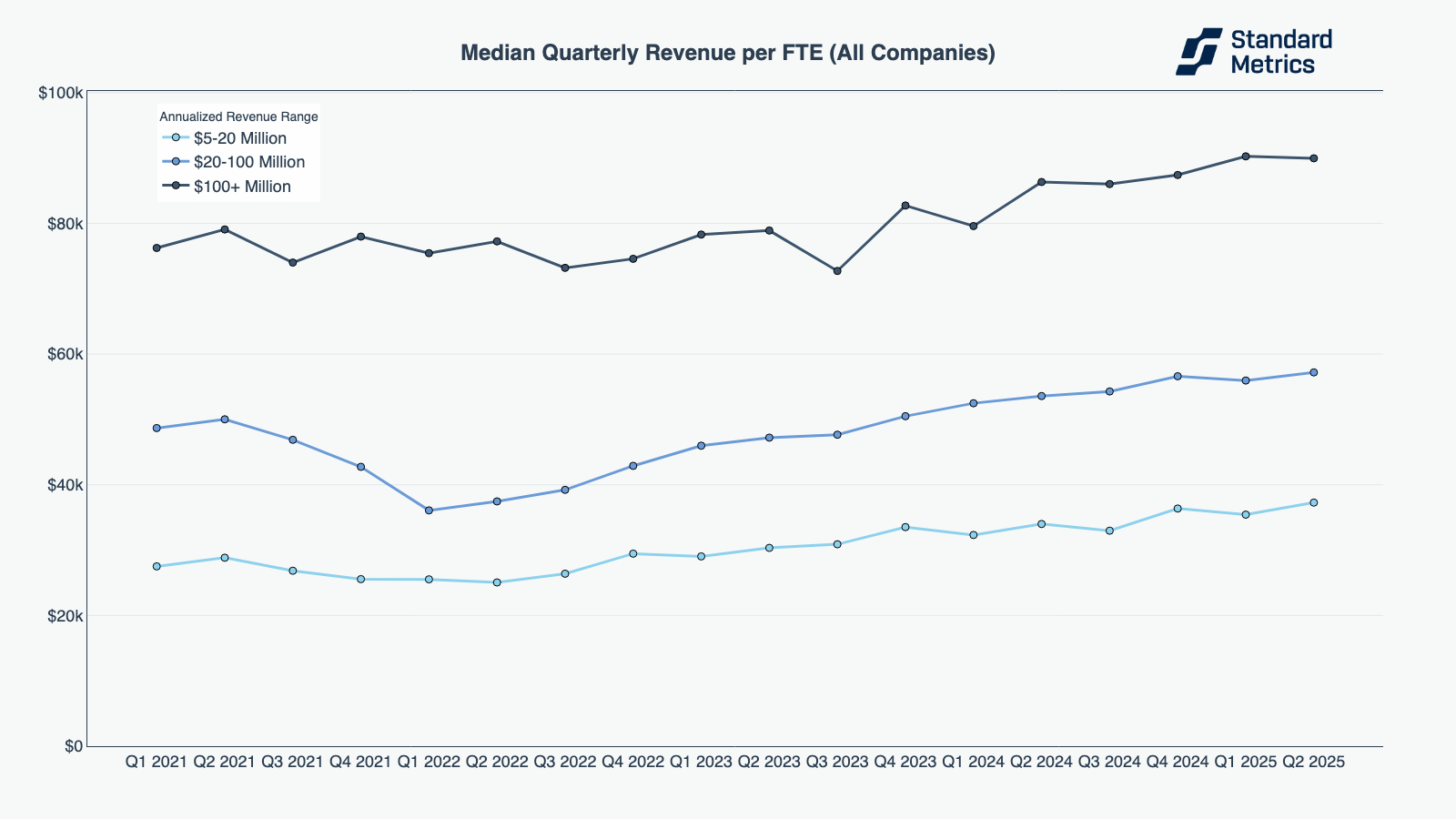

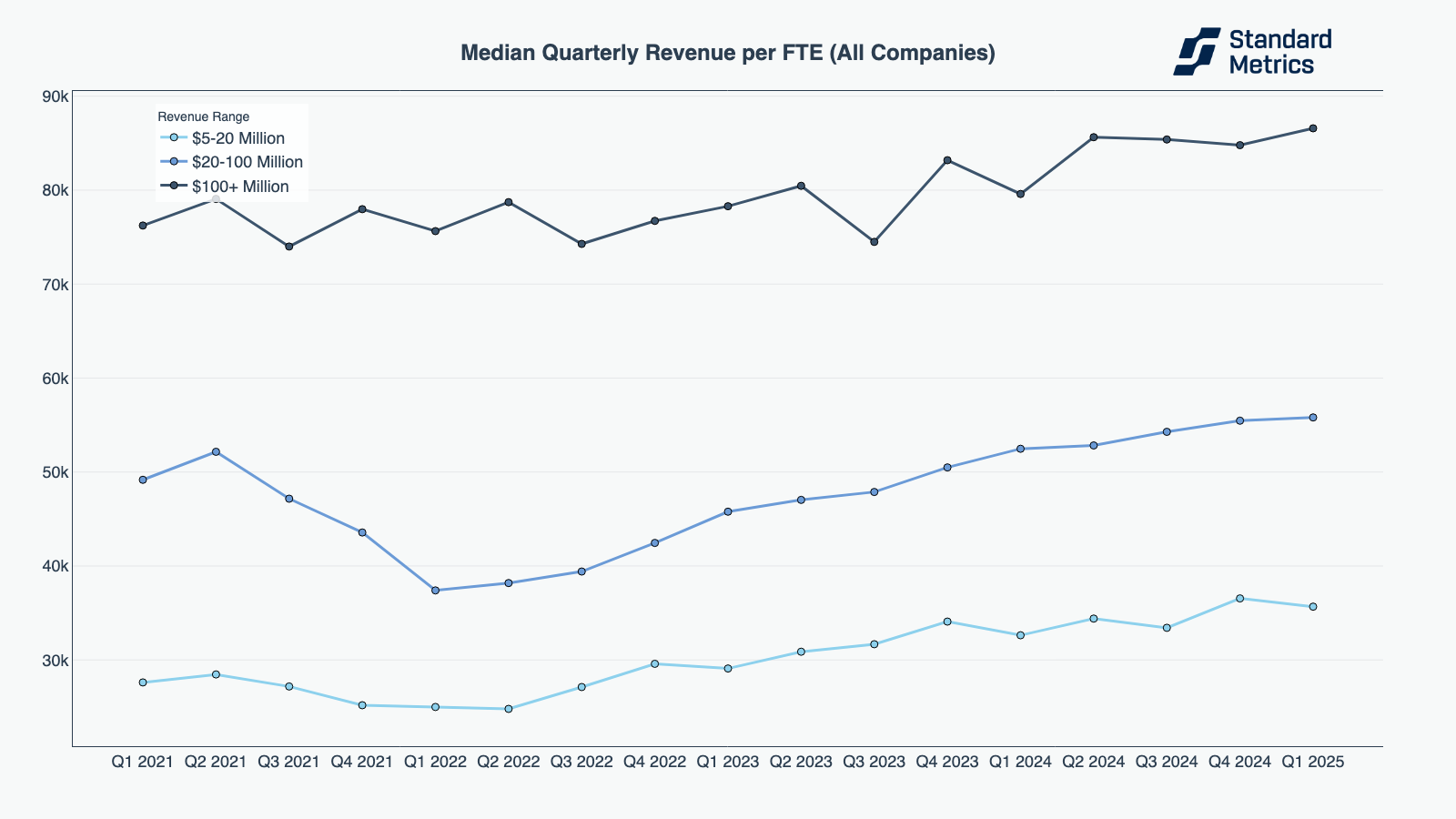

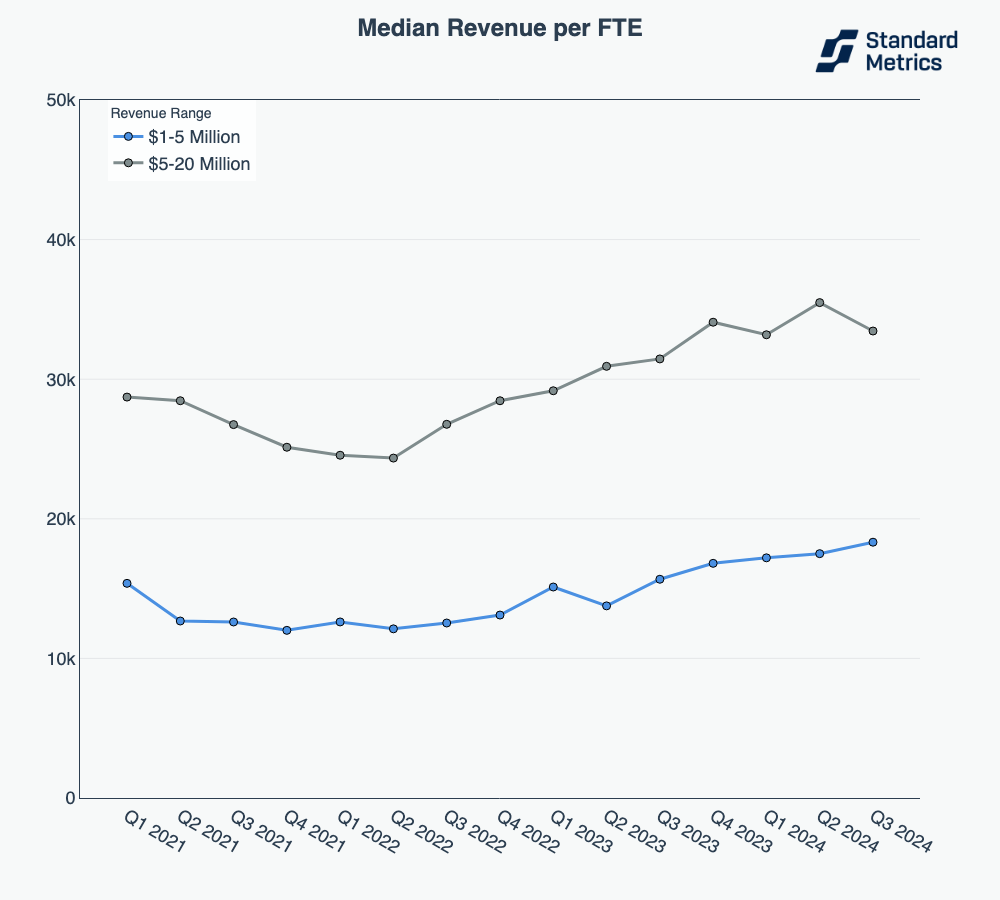

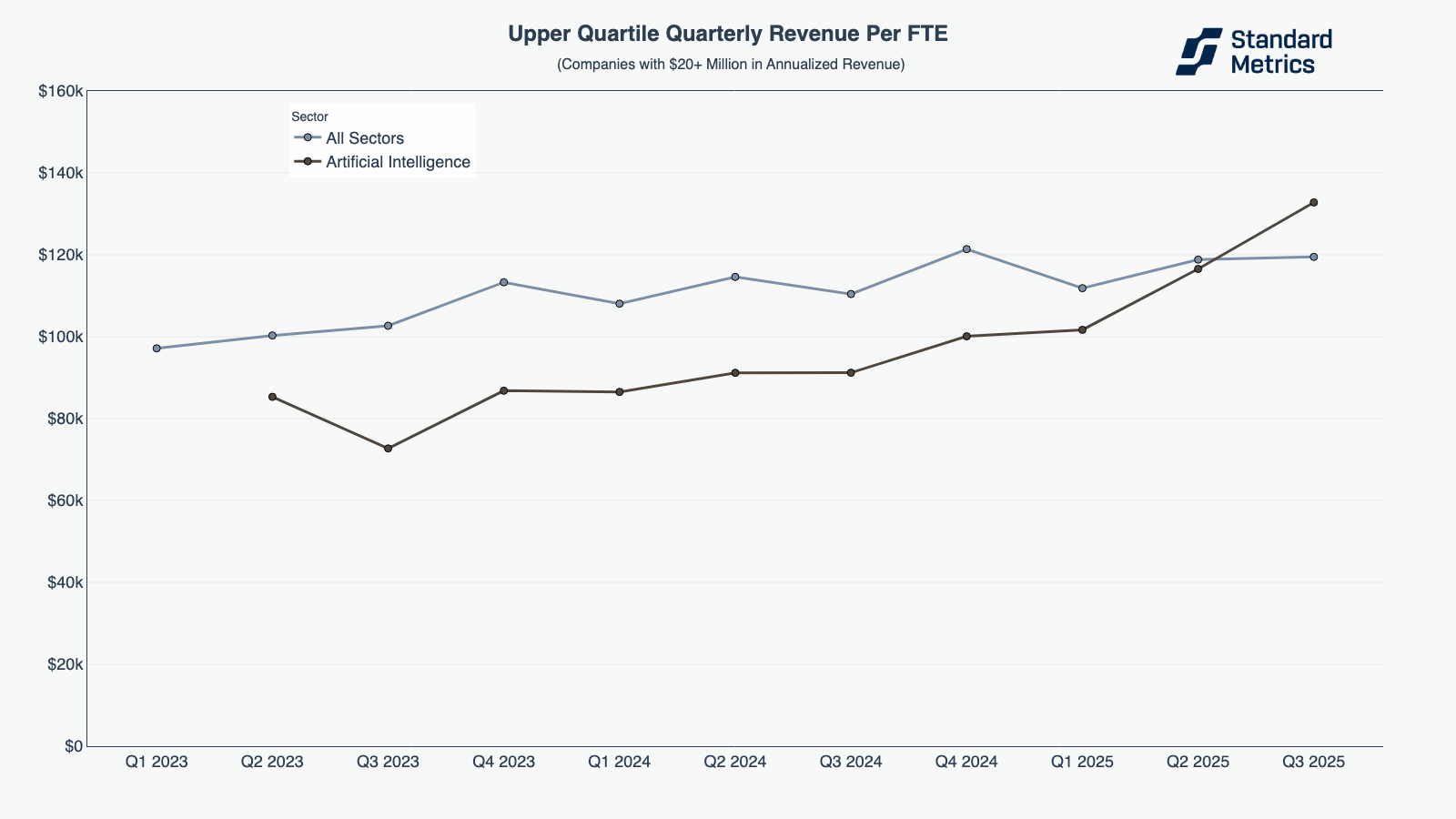

In our Q2 2025 Startup Benchmarking Report, we saw AI companies in the upper quartile of quarterly revenue per FTE efficiency lag in the metric compared to all sector peers (who’ve generally trended upwards in efficiency since 2022 lows). But after two quarters of significant efficiency gains, late-stage AI has reached $133k quarterly revenue per FTE and surpassed the all sector benchmark.

N=66

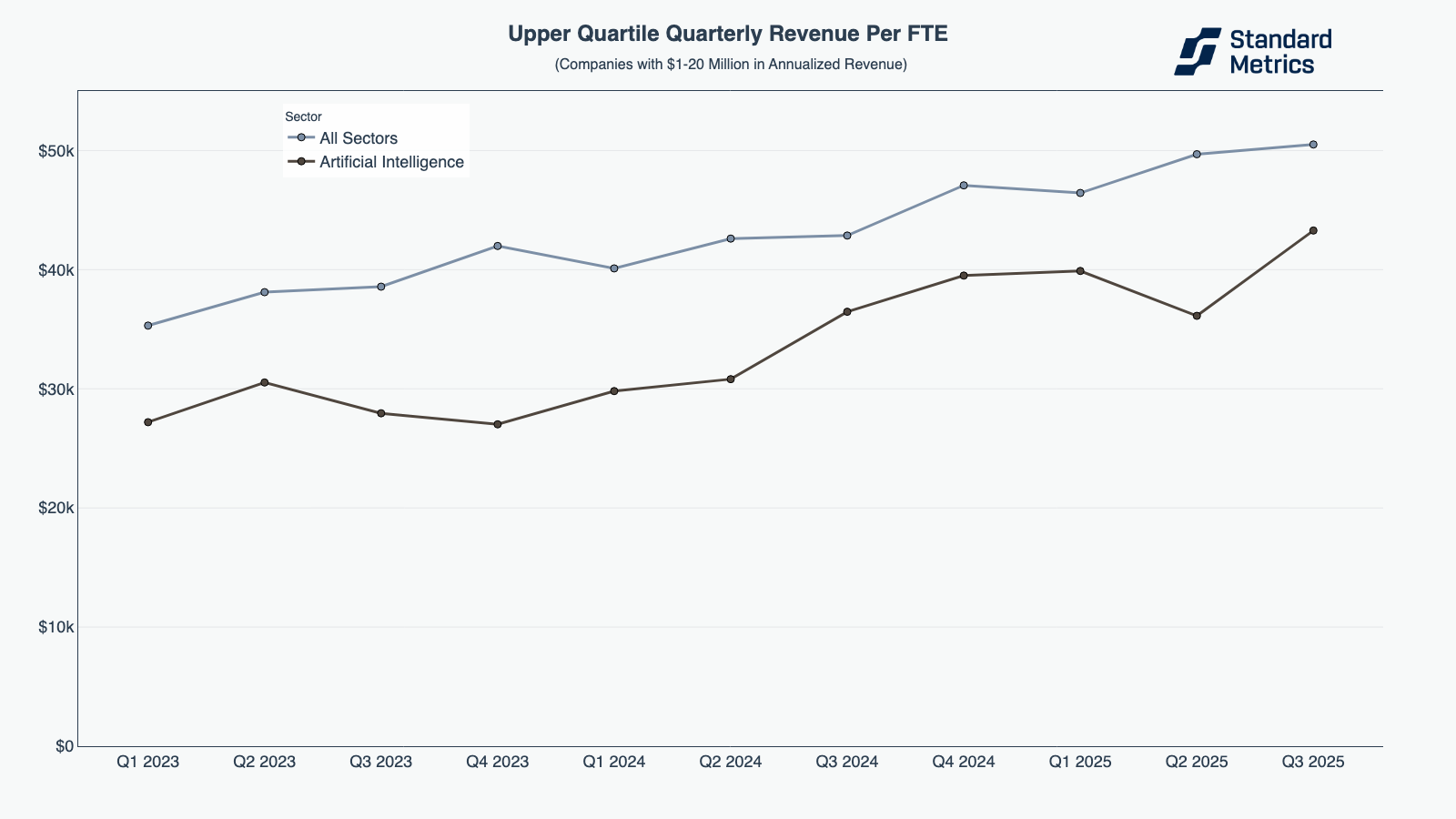

Early-stage AI, however, still trails behind the all sector average in Q3 2025.

N=124

How are the best AI, fintech, and SaaS companies performing over time?

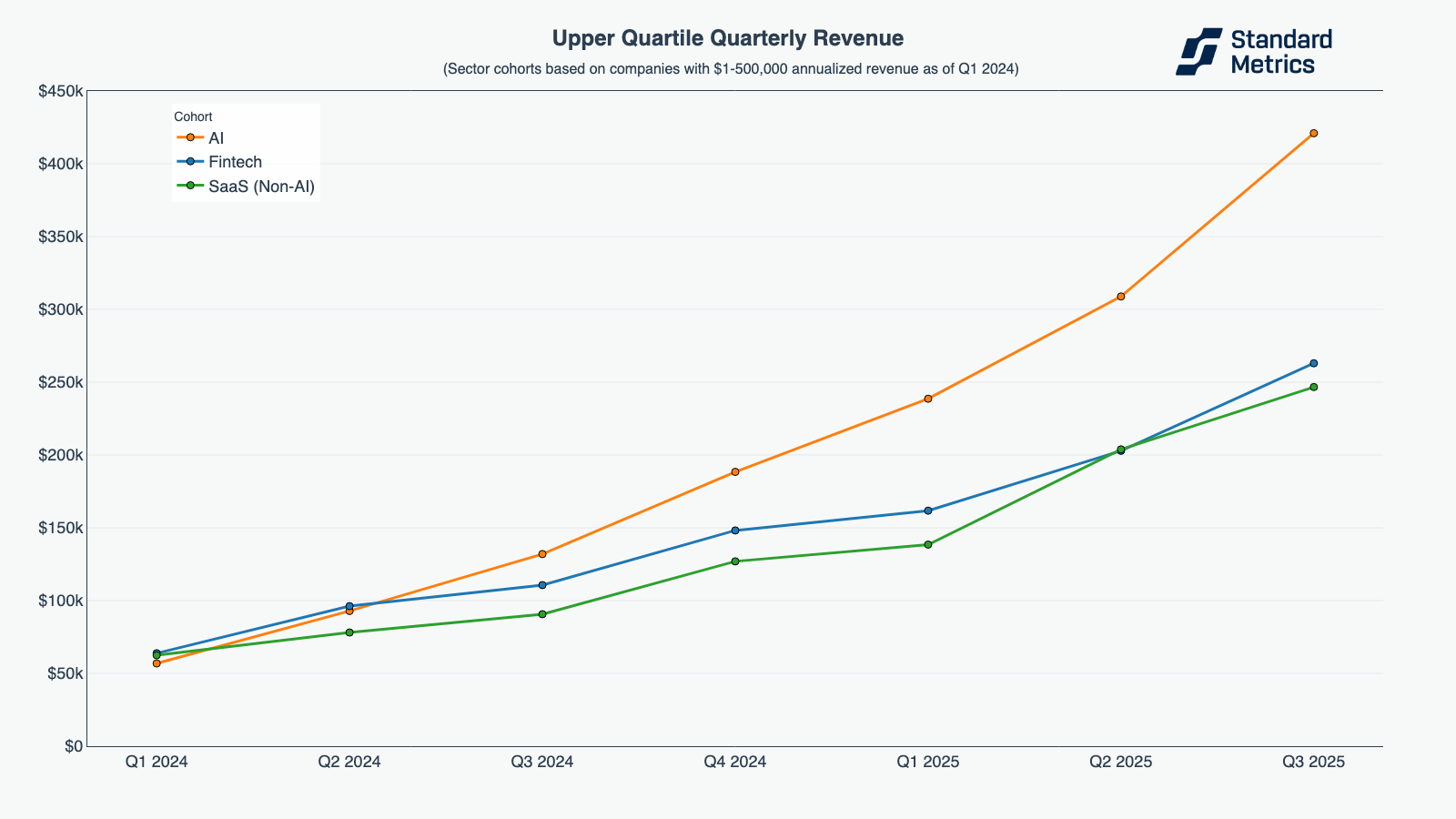

In this new cohort analysis, we examined companies across three sectors — AI, SaaS (excluding those with AI overlap), and fintech — that reported between $1 and $500,000 in annualized revenue as of Q1 2024. We established fixed cohorts based on these criteria and tracked their performance over time, aggregating results within each group, each quarter. While some companies naturally dropped out due to acquisitions or shutdowns, no new companies were added after the initial cohort was defined.

Tracking the upper quartile of each cohort in terms of quarterly revenue, we see the fintech and SaaS cohorts perform quite similarly each quarter. However, the AI cohort accelerated, and the upper quartile AI company grew to $421k in quarterly revenue by Q3 2025, compared to Fintech’s $263k and SaaS’s $247k.

This analysis directionally matches the observation we made in our Q2 2025 Startup Benchmarking Report looking at relative growth rates between the three sectors and noting that the best AI startups are able to reach $100M in revenue more quickly than fintech or SaaS companies.

N=117

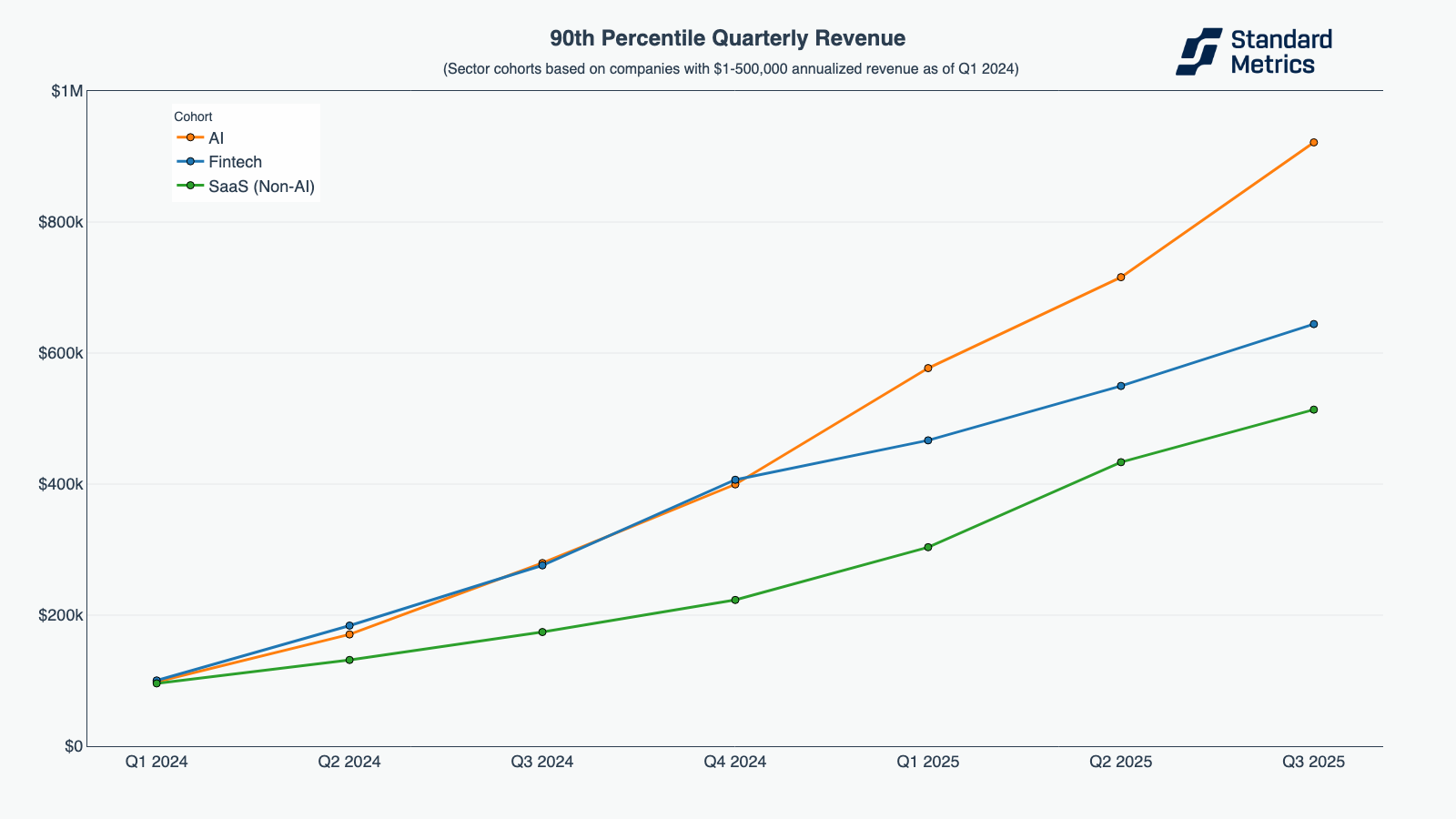

We also see this trend at the 90th percentile. As of Q3 2025, the 90th percentile AI company reached $922k in quarterly revenue compared to Fintech’s $644k and SaaS’s $514k.

N=117

A struggle at the beginning across industries

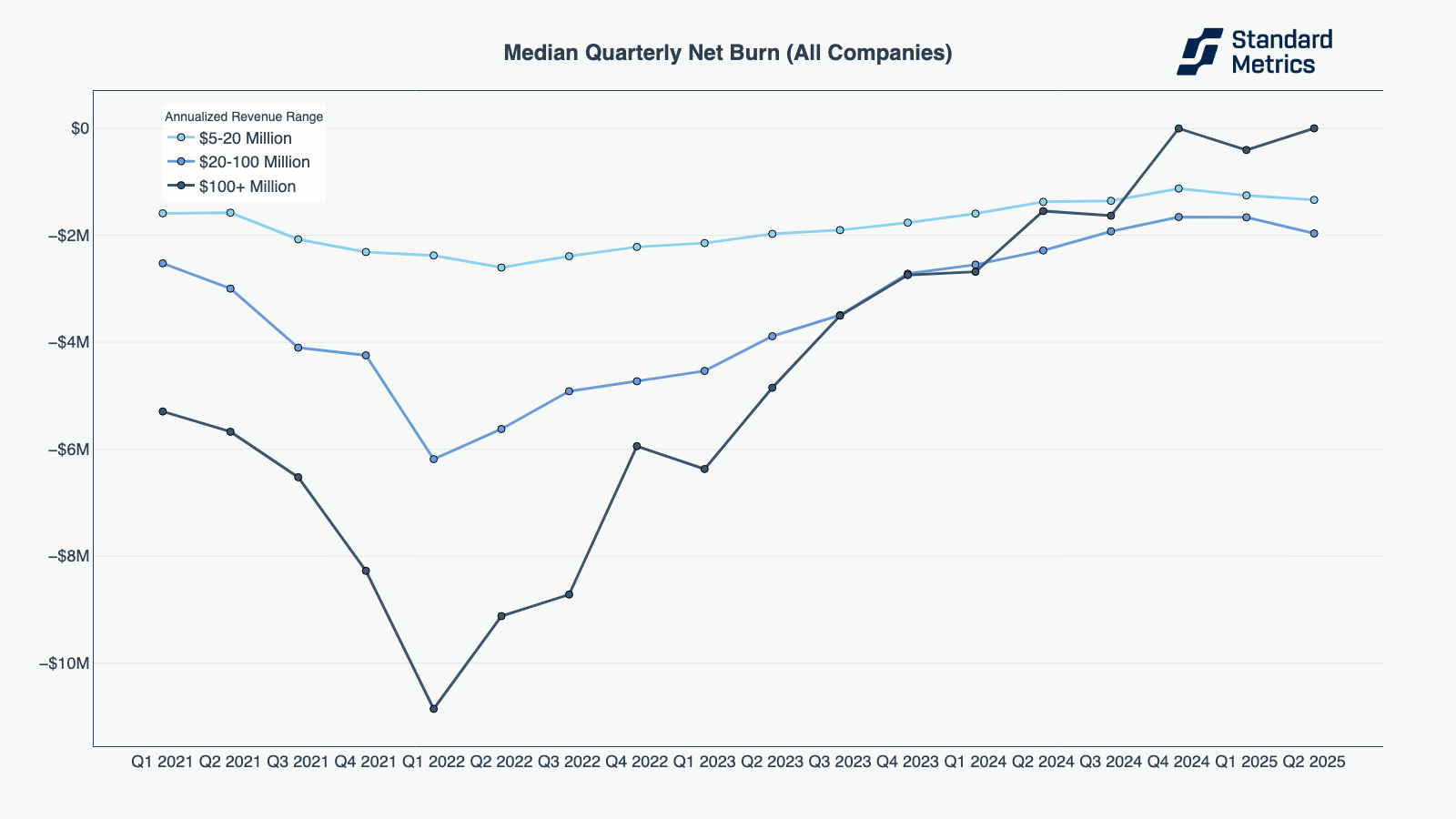

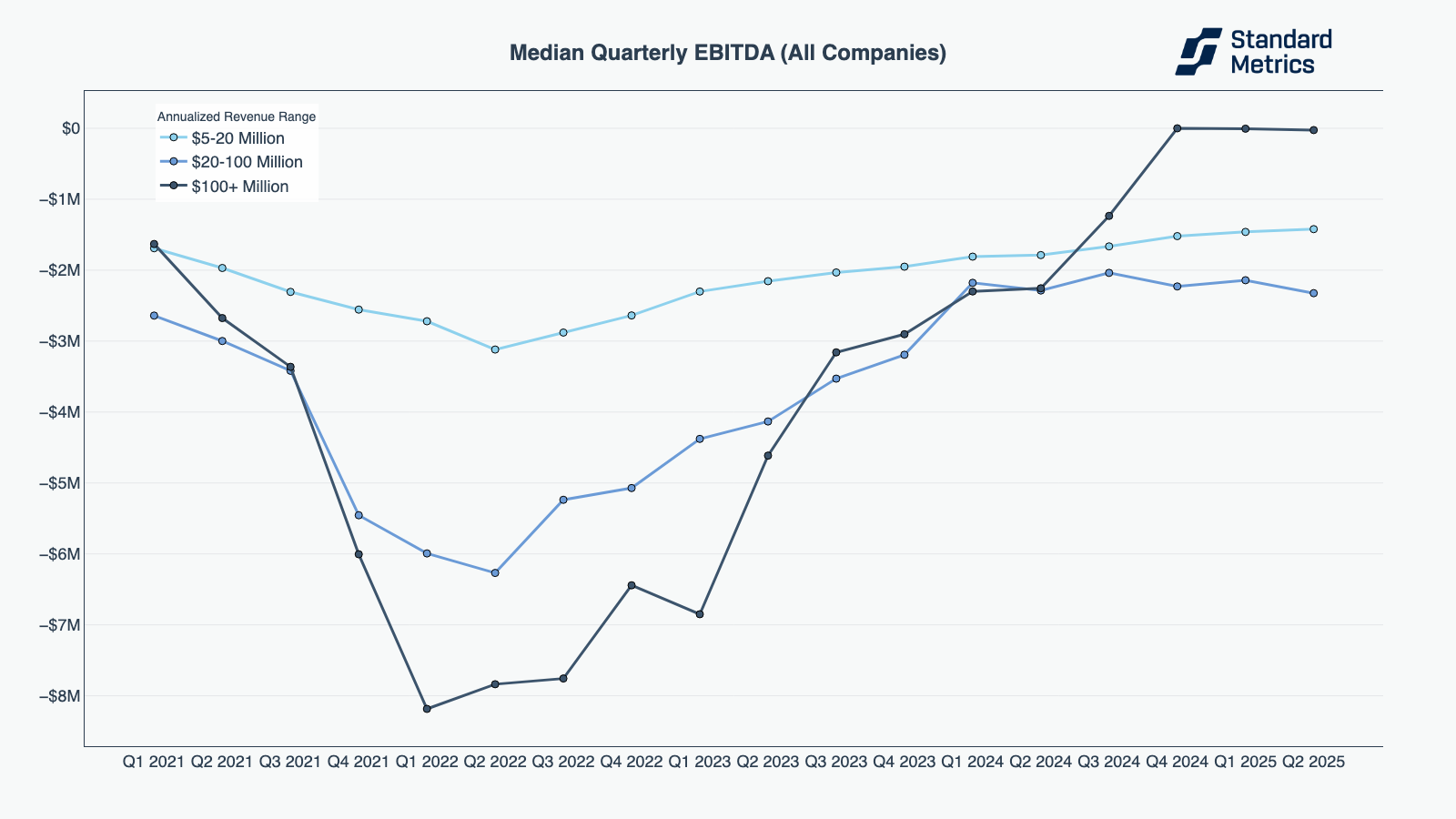

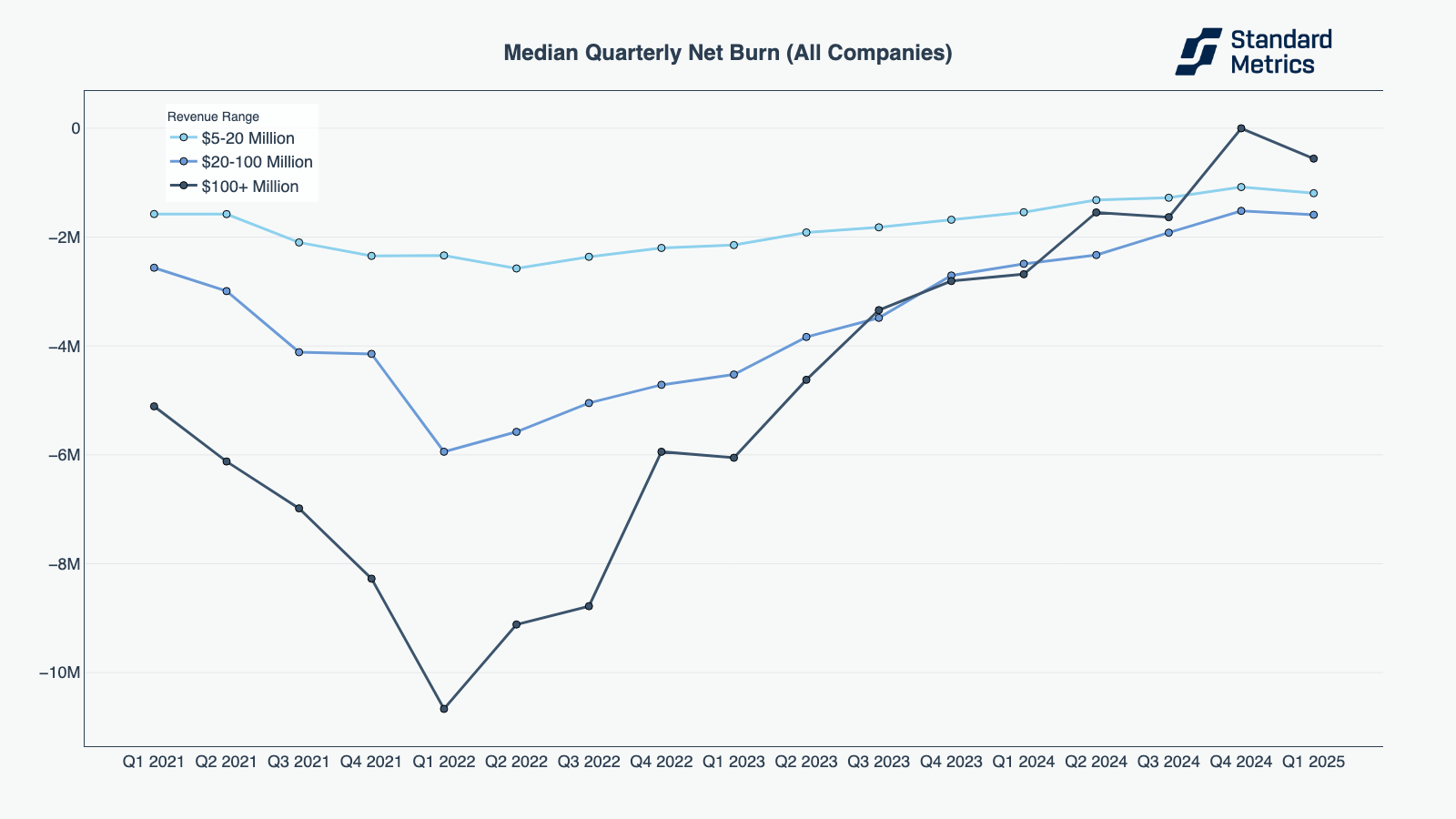

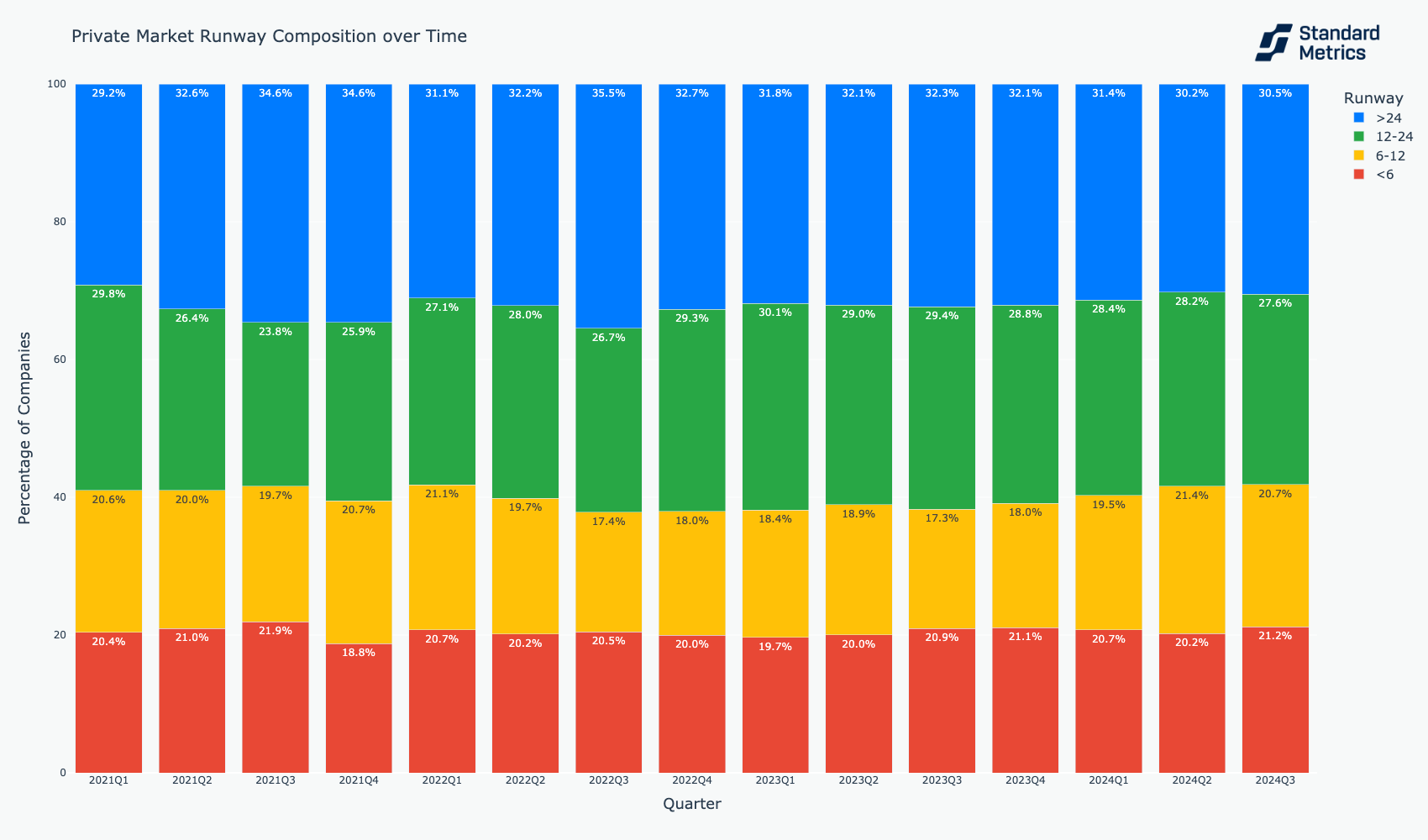

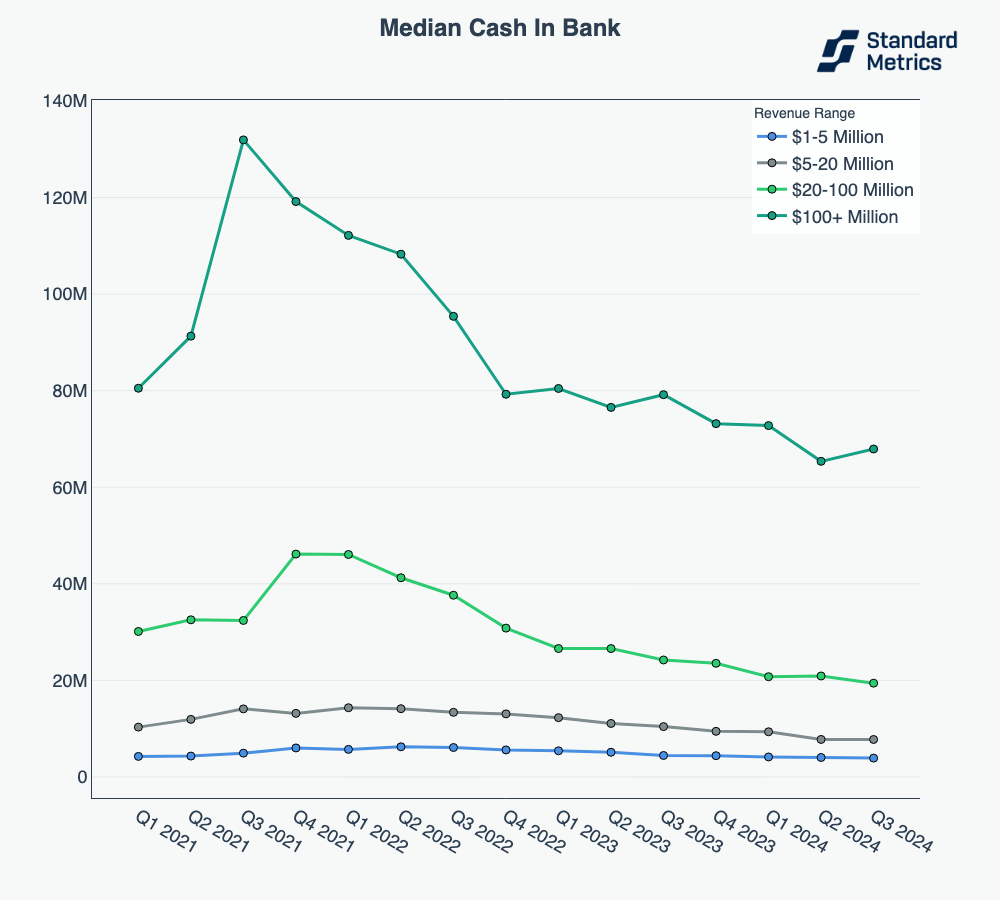

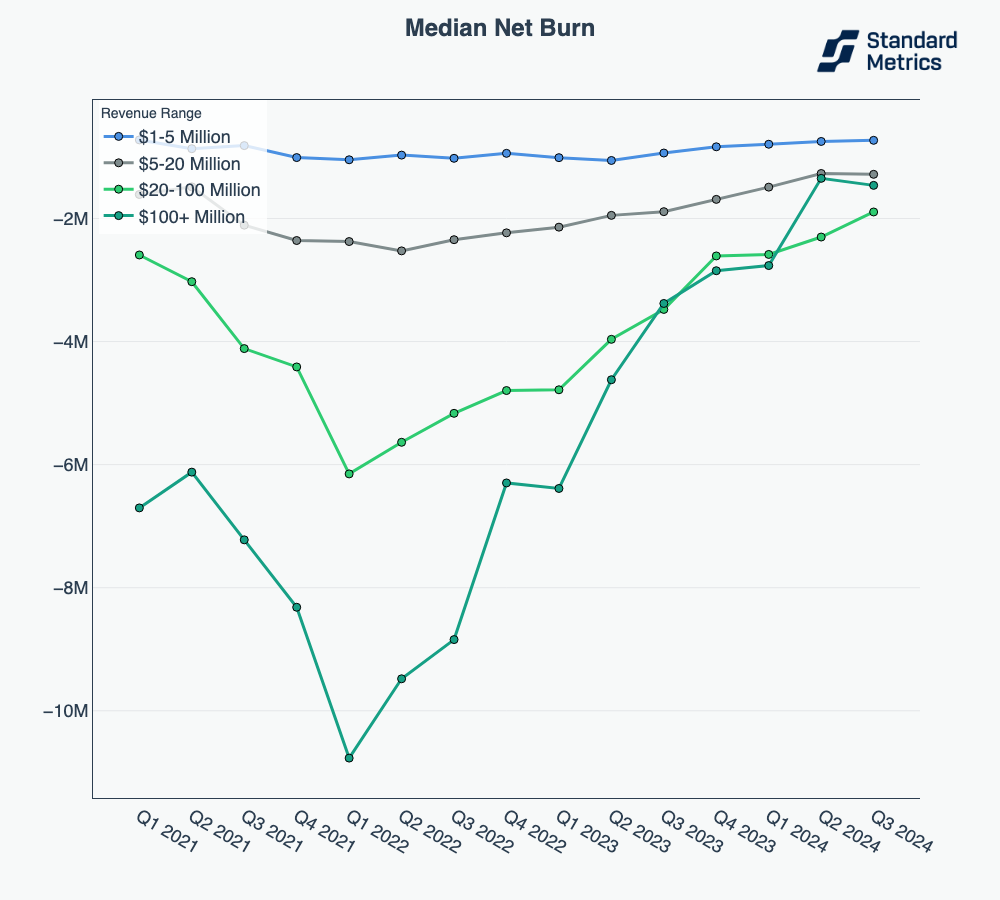

While we found the AI and fintech industries particularly interesting this quarter, Standard Metrics’ data spans the entire private market, allowing us to explore trends in aggregate across industries.

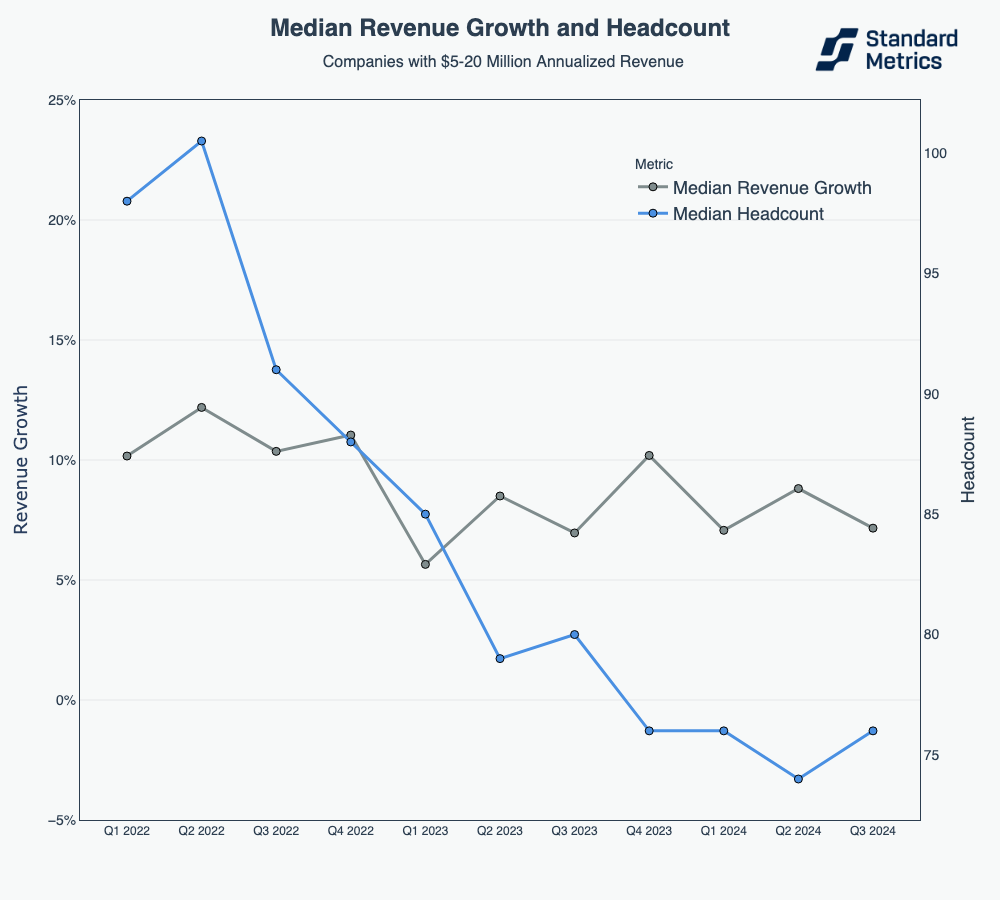

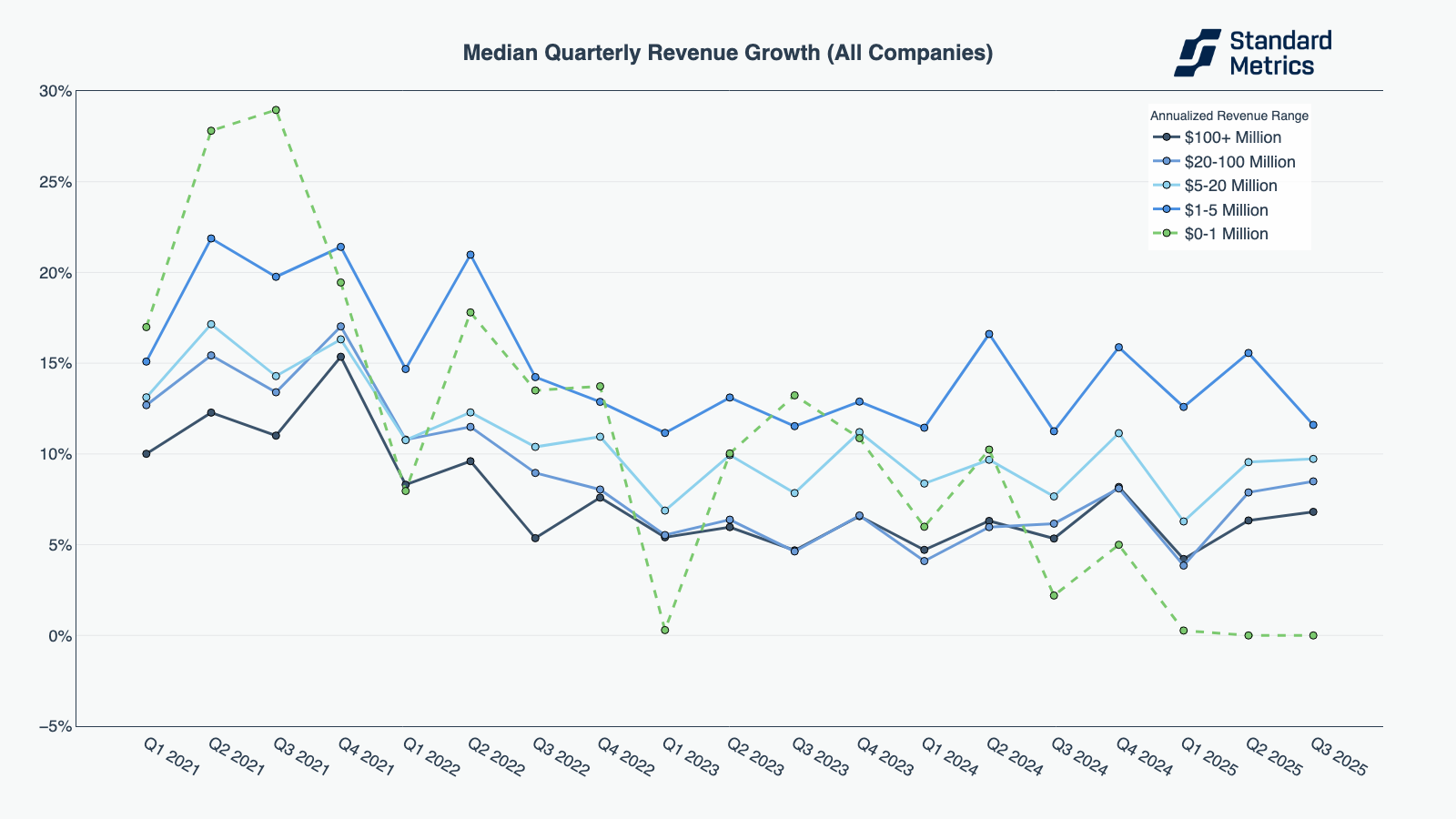

One we found interesting: for companies at the $0-1M revenue ranges across all sectors, we saw flat revenue (no growth) for the second quarter in a row. For a cohort that saw the highest median quarterly revenue growth across all revenue buckets in Q2 and Q3 2021, this marks a dark spot in what already is a long-term downward trend (a trend experienced by a significant n-count of over 1,000 startups of this size on platform).

N=438

Conclusion

In Q3 2025, fintech continued its steady climb, with companies across all revenue bands improving in both quarterly revenue growth and gross margins, as well as outperforming the broader market.

AI, meanwhile, remained one of the strongest categories in the private markets ecosystem, but its story is beginning to bifurcate: early-stage companies still generated outsized growth, while later-stage companies saw momentum cool for the first time in several quarters. Even with this deceleration, AI continued to outpace SaaS and fintech over longer time horizons, particularly among top performers.

At the same time, early-stage companies across all sectors faced a tough environment this quarter, with the median startup in the $0-1M revenue range posting flat revenue with no growth.

As we head into next quarter, we’ll be curious whether fintech’s momentum holds, how AI’s late-stage companies evolve, and whether the early-stage segment begins to rebound.

Methodology

This report summarizes data from over 10,000 anonymized startups who report data to their investors on Standard Metrics. Companies are included in an annualized revenue bucket based on their annualized revenue value calculated in each respective quarterly period. Companies self-identify their sector at time of onboarding onto our platform and can update their sector at any time afterwards. Companies are in control of their data on Standard Metrics and can opt out of their data being included in anonymous benchmarking anytime. The underlying composition of company data on Standard Metrics can shift over time as new companies join or leave (e.g. IPO, M&A, shut down) our platform.

For graphs that represent multiple revenue buckets of companies [e.g. “Median Quarterly Revenue Growth (All Companies)” chart above], our N count is the minimum number of companies across the smallest cohort in the most recent period (e.g. “Q3 2025”). For graphs analyzing a single revenue bucket on one metric, N is the number of companies in the most recent period in the chart. Data points must have at least 30 companies to be shown.

Automate your portfolio reporting

Find out how you can:

- Collect a higher volume of accurate data

- Analyze a robust, auditable data set

- Deliver insights that drive fund performance