Standard Metrics is excited to launch an AI portfolio company analyst that incorporates both the quantitative and qualitative data customers have stored on platform to help answer questions on their companies via natural language queries.

Standard Metrics has long powered portfolio reporting for leading VC and PE firms, including Bessemer Venture Partners, Accel, General Catalyst, and 8VC. Our platform helps investors automate portfolio reporting, centralize financial and qualitative data, and collaborate more effectively with their stakeholders. Over time, we’ve expanded the platform with features like a robust API for interoperability and embedded BI tools for in-app analysis, helping firms turn static data into actionable insights.

We believe this tool will continue to improve the portfolio reporting experience, helping firms cut down on analysis time required to deep dive into a portfolio company in preparation for LP and internal meetings (e.g. follow-on investment decisions), empowering non-technical teammates with easy-to-use natural language Q&A functionality (vs. queries, spreadsheets, and long documents), and enabling in-platform understanding of a portfolio company’s performance (vs. importing or exporting data for analysis on external LLMs).

What we built

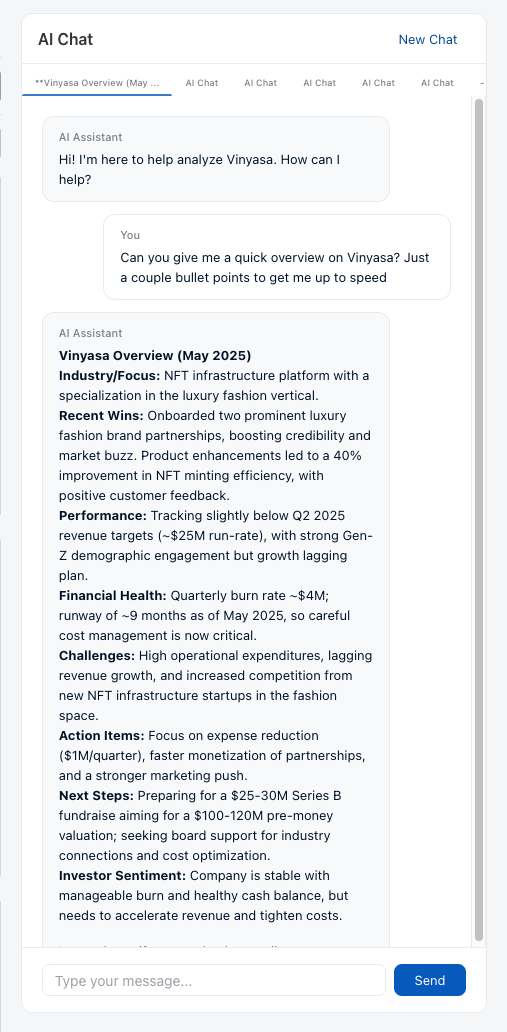

Standard Metrics’ AI portfolio company analyst is just like ChatGPT or Claude, except it knows all about your portfolio companies. Instead of shifting through five different financial statements from a company, ask it: “What is the cash balance for this company over the past 5 quarters?” Instead of reading hundreds of pages of company notes, ask it: “Can you give me a quick overview on this company? Just a couple bullet points to get me up to speed?”

Additionally, we’ve already seen some customers use our AI portfolio company analyst to help with follow-on investment decisions, asking questions like “Do you think we should participate in their next round?” or “What would be a fair price here?”

Our AI portfolio company analyst is:

- Trend-optimized: Our AI portfolio company analyst incorporates historical company performance data from everything from tear sheets to financial metrics, so insights are built from long-term performance vs. one-off documents.

- Privacy-minded: Chats are specific to each user, so two users at the same firm will not be able to see each other’s chats.

- Customizable: Everyone at your firm can use Standard Metrics’ AI portfolio company analyst, but users will only be able to use it for the companies they have access to.

- User-focused: The AI portfolio company analyst automatically saves your conversation history, accessible anytime via the top bar. Each new chat begins a fresh conversation thread.

- Part of our core offering: Standard Metrics’ AI portfolio company analyst is available for no additional charge to any firm user already on our platform.

What’s next

We are very excited to continue to iterate and expand on our AI portfolio company analyst. We’re partnering with our customers over the next few months to learn more about how they are using it and what features they’d like to see next.

If you’re a customer, we’d love to hear from you about how you’re using the tool and how we could improve it. If you haven’t yet joined Standard Metrics but would like to learn more, we’d also love to connect.

Automate your portfolio reporting

Find out how you can:

- Collect a higher volume of accurate data

- Analyze a robust, auditable data set

- Deliver insights that drive fund performance