Standard Metrics has been committed to building interoperable software to facilitate better collaboration between stakeholders in the private markets since day one. We released an API in 2022, an Excel plug-in in 2023, and more recently have integrated with Derivatas, Omni Analytics, and Snowflake. Continuing on this trend, we’re proud to release our new Model Context Protocol (MCP). Your venture-capital data is already in Standard Metrics; now it’s in your AI chat window, too.

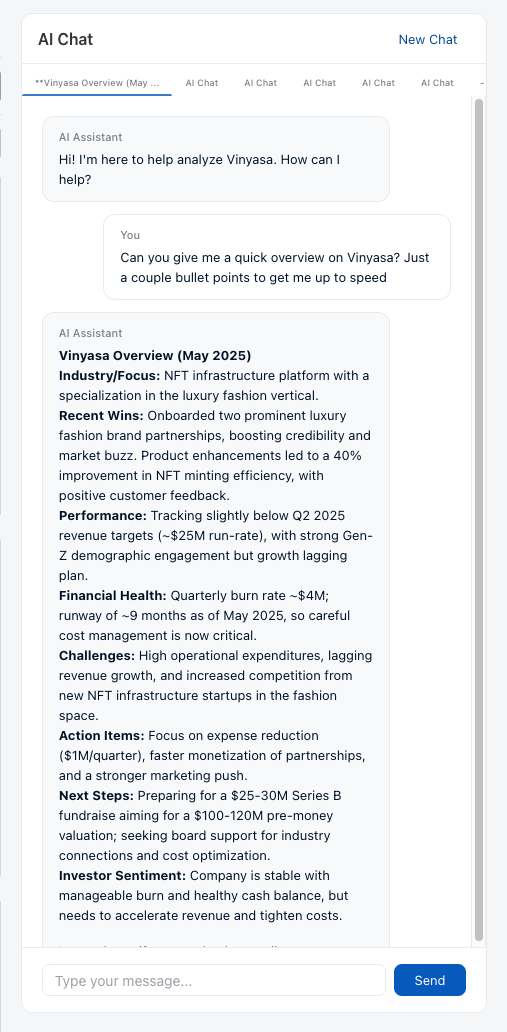

Our new MCP server lets compatible clients like Claude Desktop pull Standard Metrics data into secure and permission-aware context so you can ask questions in natural language and get instant, chart-ready answers in the tools you’re already using.

Why we built an MCP server

Many of our customers have an elaborate tech stack of tools ranging from LLMs to AI-powered note-taking apps, where they may want to leverage Standard Metrics’ quantitative and qualitative portfolio company data. Many of these tools (like Claude Desktop or ChatGPT Deep Research) already let you connect with MCP servers where the tools can securely tap into third-party data like Standard Metrics’. We knew an MCP bridge to the Standard Metrics API would:

- Eliminate copy-paste friction: No more juggling CSVs or browser tabs to explore Standard Metrics’ data in different platforms

- Respect firm-level permissions: Keep sensitive metrics locked to authorized users while maintaining robust permissions in the Standard Metrics platform

- Deliver truly conversational analysis: Ask natural-language questions in the chat interfaces you’re already working out of, and get chart-ready answers in seconds

On top of in-app integrations like our embedded portfolio intelligence and AI portfolio company analyst, we also wanted meet users where they already do their prompting.

What you can do with the MCP server

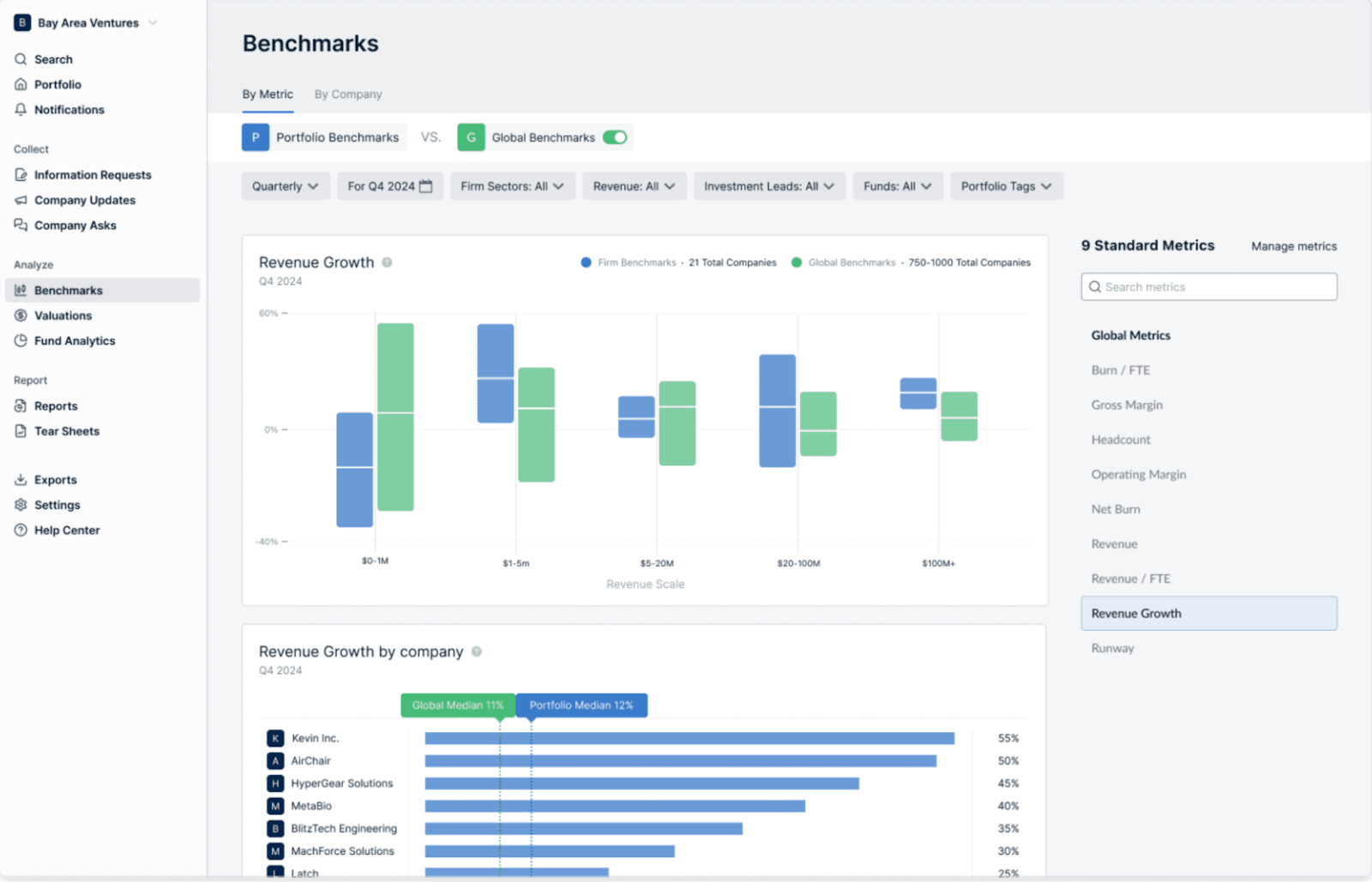

Broadly, the MCP integration allows you to use Standard Metrics data in the tools of your choice, layering the data you have stored on the Standard Metrics platform with the functionality of tools outside of our platform.

Ask Claude or ChatGPT questions about your Standard Metrics data (“List the top five SaaS companies in my portfolio by revenue growth”) and get the answers you need in natural language responses. Layer these tools’ real-time online capabilities into your analysis (“Who are the biggest competitors to these companies right now”) or take advantage of their response styles functionality (”Write a summary of these five companies in my voice for a quick email to another member of my firm”).

Functionality also goes beyond your favorite LLM to other platforms leveraging MCPs like note-taking apps and relationship and deal flow tools. Ask Notion, for example, to pull Standard Metrics data into all relevant documents automatically, eliminating manual workflows and enhancing data retrieval.

Behind the scenes, these tools are using the MCP server to call the Standard Metrics API endpoints, and then synthesize the response into plain-English insights, tables, or exportable visuals.

Configuring with Claude Desktop

While the MCP will allow you to connect to a variety of tools of your choice, many of our customers are particularly excited about the ability to connect with Claude Desktop. A quick how-to:

- OAuth2 handshake: Generate your Client ID and Secret:

- On the left hand menu, click on Settings

- Click on Developer Settings

- Click “Add Application” in the top right

- Fill in the application name and description

- Click “Create Application”

- Copy your Client ID and Client Secret and store them securely (you won’t be able to see the secret again!)

- Configuration setup: Add your Client ID and Secret to your

claude_desktop_config.jsonrunning the MCP with our provided Docker image or pip-installable.- See our GitHub for a detailed configuration example.

- Start using it: Once you restart Claude Desktop, you can ask things like “Show me the latest financial data for AirChair”

- Repeat for other LLMs of your choice: ChatGPT, for example, offers similar functionality.

What’s next

This release is just step one. We plan to continue to improve on our customers’ AI experiences with Standard Metrics data via additional data streams to external LLMs and improving the experience of our in-app AI portfolio analyst.

Have ideas or feedback? We’d love to hear how you’re using the MCP to supercharge your workflows. Drop us a note or open an issue on GitHub: after all, the project is fully open-source.

Automate your portfolio reporting

Find out how you can:

- Collect a higher volume of accurate data

- Analyze a robust, auditable data set

- Deliver insights that drive fund performance