We’re excited to announce our strategic partnership and integration with Derivatas, a leading provider of venture capital valuation software and services. This partnership aligns with our goal of providing a comprehensive system of record and analysis platform for venture capital firms.

Why We Built This Integration

Maintaining accurate, up-to-date portfolio company valuations is a ubiquitous hurdle in the private markets. Collecting the critical underlying financial metrics (revenue, EBITDA, burn, etc.) from portfolio companies is time-consuming, collating those KPIs with investment-level data is manual, and having to maintain up-to-date information across disparate providers is unproductive.

With Standard Metrics and Derivatas partnering together, firms can automate their valuation workflows, more effortlessly maintain a source of truth, and trust that their valuation data is error-free.

How it Works

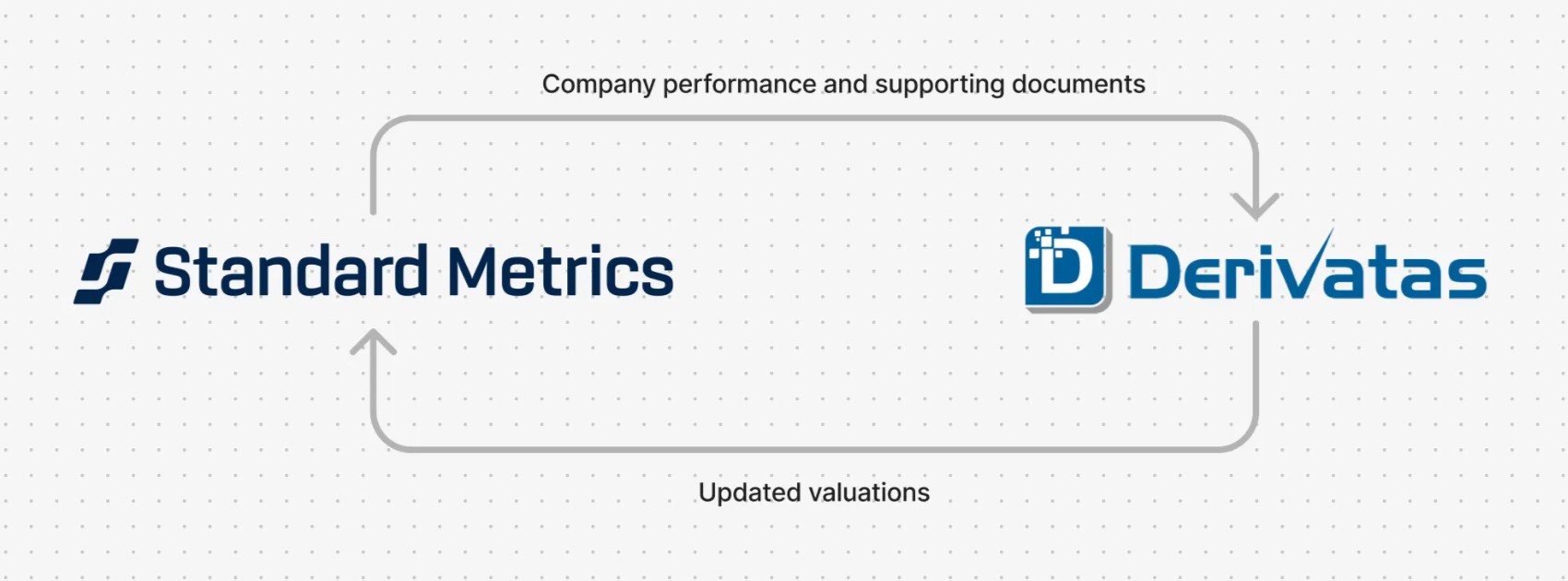

With the click of a button, portfolio company metrics, fund information, and relevant documents from Standard Metrics will sync with Derivatas’ valuation module, ensuring accurate valuations with minimal manual effort.

This integration delivers several key advantages for our shared venture capital customers:

- Time Savings: eliminate manual data entry and reduce the time spent on quarterly valuation processes

- Worry-free reporting: automated data synchronization minimizes the risk of data entry errors

- Enhanced Analysis: enable more timely and accurate portfolio performance analysis for GPs/LPs

Looking Ahead

This partnership represents our commitment to providing venture capital firms with the most comprehensive and efficient tools for portfolio management. By combining Standard Metrics’ powerful portfolio monitoring capabilities with Derivatas’ expertise in valuations, we’re turning the traditionally onerous quarterly valuation process into a stress-free, streamlined experience for mutual customers.

Contact success@standardmetrics.io or inquiries@derivatas.com to learn how this integration can streamline operations for your firm today.

Automate your portfolio reporting

Find out how you can:

- Collect a higher volume of accurate data

- Analyze a robust, auditable data set

- Deliver insights that drive fund performance