When we founded Standard Metrics in 2020, we set out to transform financial reporting for private investment firms and their portfolio companies. Over the past four years, we’ve brought on more than 100 investors as customers, including industry luminaries like General Catalyst, Salesforce Ventures, and Bessemer Venture Partners. Along the way, we’ve helped them to collaborate with more than 9,000 of their portfolio companies in a multitude of sectors, stages, and geographies.

The rapid growth of our user network is a testament to the trust and support of our community, along with a deep need that exists for tooling to fix broken investor relations. It’s a thrill to be building a product that supports so many firms and companies we admire.

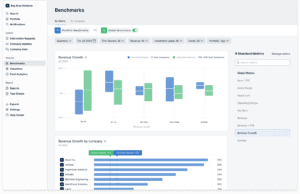

We’ve reached a significant milestone in our journey, and we’re ready to unveil a new product that aligns with our mission to accelerate innovation in the private markets. One of our core goals has always been to develop unique products that leverage the data on our platform for the benefit of the community. With our network now at a meaningful scale, I’m delighted to announce the launch of our first data product: Global Benchmarking.

Global Benchmarking is a powerful new tool designed to give our users a deeper understanding of private company financial performance placed into current market context. We leverage aggregated and anonymized financial data from our platform to deliver timely and relevant market insights to our users. With benchmarks covering key metrics such as revenue growth rates, burn per FTE, and more, our users can gain valuable insights into their performance. For example, what’s the top quartile revenue growth rate right now for SaaS companies between $1-5M in annualized revenue? We can answer that question.

We have a strong perspective that companies need to control and benefit from how their data is used. Companies on Standard Metrics are notified about benchmarking during sign-up, and they can opt out of their data being used at any time in their settings page. Our experience so far is that the overwhelming majority of companies are excited to participate and receive quarterly scorecards to help them assess performance and inform future planning.

For our company-side users, Global Benchmarking insights are available for free. For investment firms, users can access a variety of benchmarking workflows as a paid add-on to their core subscription.

We launched Global Benchmarking quietly several months ago, and we are already seeing incredible early customer feedback. “Global Benchmarking brings powerful signal and context to what were previously individual analyses. By combining the right metrics with the right peer groups, Standard Metrics has reset the bar on creating a single source of truth, for both investors and portfolio companies,” said Joe Lonsdale, Managing Partner at 8VC.

Startups are finding Global Benchmarking indispensable for their financial planning and ongoing updates to their forecasts. “At Pave, we deeply believe in using benchmarks to make tough decisions with confidence. This is why we’re thrilled to have access to Standard Metrics’ benchmarks to ensure we’re optimizing for the right degrees of innovation vs. financial balance. Having trustworthy data is is vital” said Matt Schulman, founder and CEO of Pave.

We’re doubling down on Global Benchmarking, and we’re excited to roll out additional features and refinements in the coming months. You can expect deeper and more integrated workflows, a higher degree of configurability, and narrower and more powerful benchmarking categories as our data set grows and we unlock additional insights for our users.

If you’re an investment firm interested in exploring how Global Benchmarking can enhance your investment strategies, we would love to hear from you. For companies keen to take advantage of these new benchmarks, make sure to encourage your VC to connect with us. You’ll get the product for free once they buy it.

Thank you for being a part of our journey at Standard Metrics. You can find more details about Global Benchmarking here or by contacting our team below.

Automate your portfolio reporting

Find out how you can:

- Collect a higher volume of accurate data

- Analyze a robust, auditable data set

- Deliver insights that drive fund performance