Analyze your portfolio with confidence and act on insights in real time

Store all portfolio and investment data in a single source of truth to enable deeper analysis, better decision-making, and seamless collaboration.

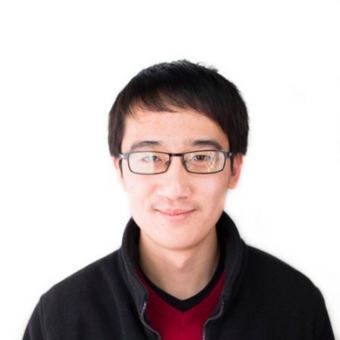

Collect: Automate portfolio data collection to save time and get more reliable data, faster

Elevate your collection cycle: Our workflows automate all of your information requests for portfolio company data and documents with powerful templates and deep customization.

Have data you trust: Monitor a complete audit trail for all the metrics you receive and benefit from direct portfolio company system integrations that access source data.

Empower your team: Bolster your staff with our managed data services offering so your analysts can focus on the tasks that matter most and leave document data extraction to us.

Learn more: Click here for more details on our data collection process.

Analyze: Store your data in a single source of truth and access it in the way that works best for your organization

Centralize your data: Access all of your core portfolio data, investment data, and mission-critical documents in one place to make data-driven decisions on new or follow-on investments.

Gain better visibility: Perform custom KPI calculations in-app, compare budgets versus actuals, and track your investments, valuations, and fund-level metrics alongside portfolio company information.

AI-powered analysis, anywhere you work: Use Standard Metrics data either directly in LLMs via our hosted MCP or directly inside the platform with our AI Analyst to answer portfolio-wide questions, run ad-hoc analysis, benchmark performance, and draft summaries. No reports to build, no code to maintain, and no credentials to manage, instead just secure, pre-authenticated access to your data through natural language.

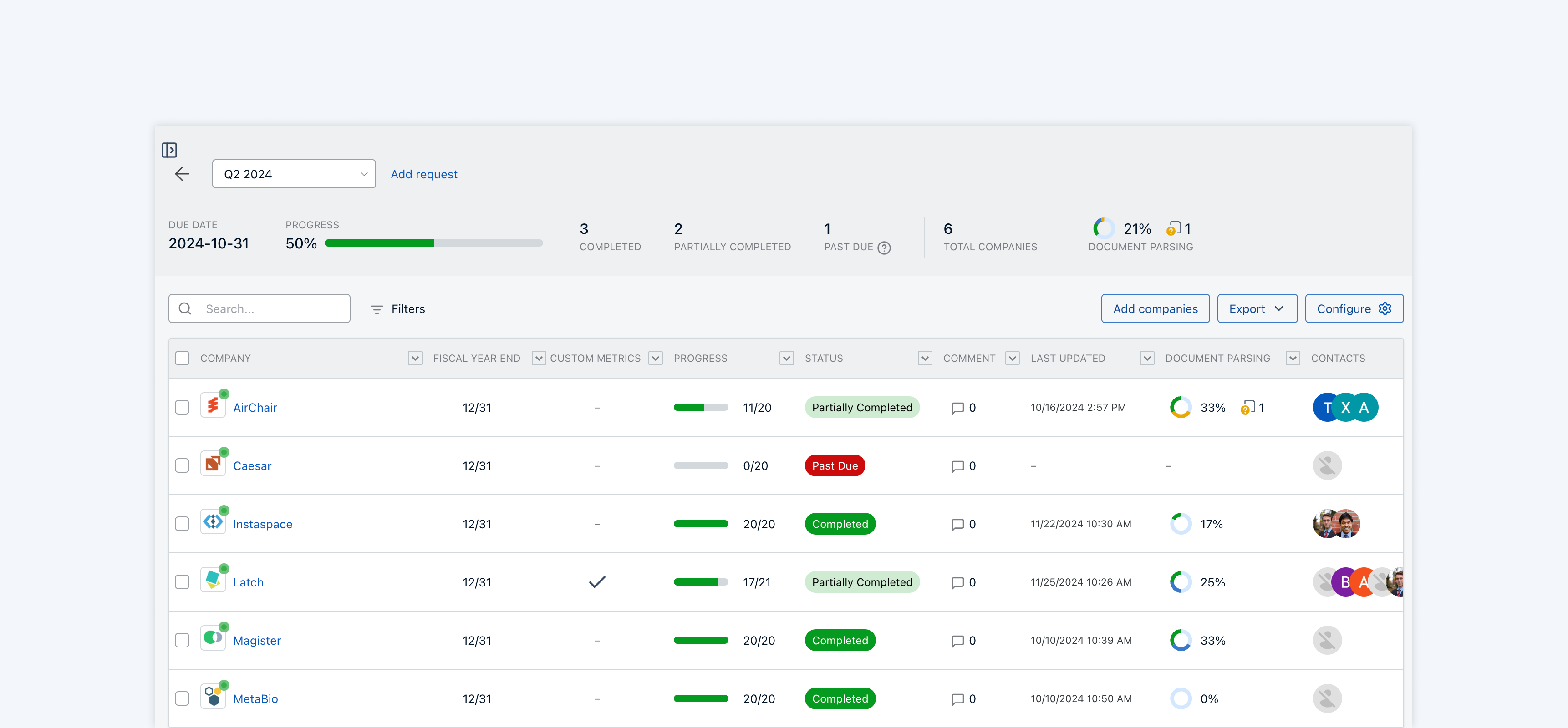

Report: Leverage our powerful tools or bring your own

Share insights that matter: Align your team and LPs on key data trends through auto-populated tear sheets and custom reporting templates.

Save time when creating reports: Flexible, in-app, AI-powered embedded BI tools drive faster portfolio reviews with real-time, easy-to-build dashboards, custom charts, and automated metrics.

Integrate with existing reporting tools: Our API, MCP, Excel add-in, and easy exports allow you to integrate with our app seamlessly, so you can pipe in or out the data you need.

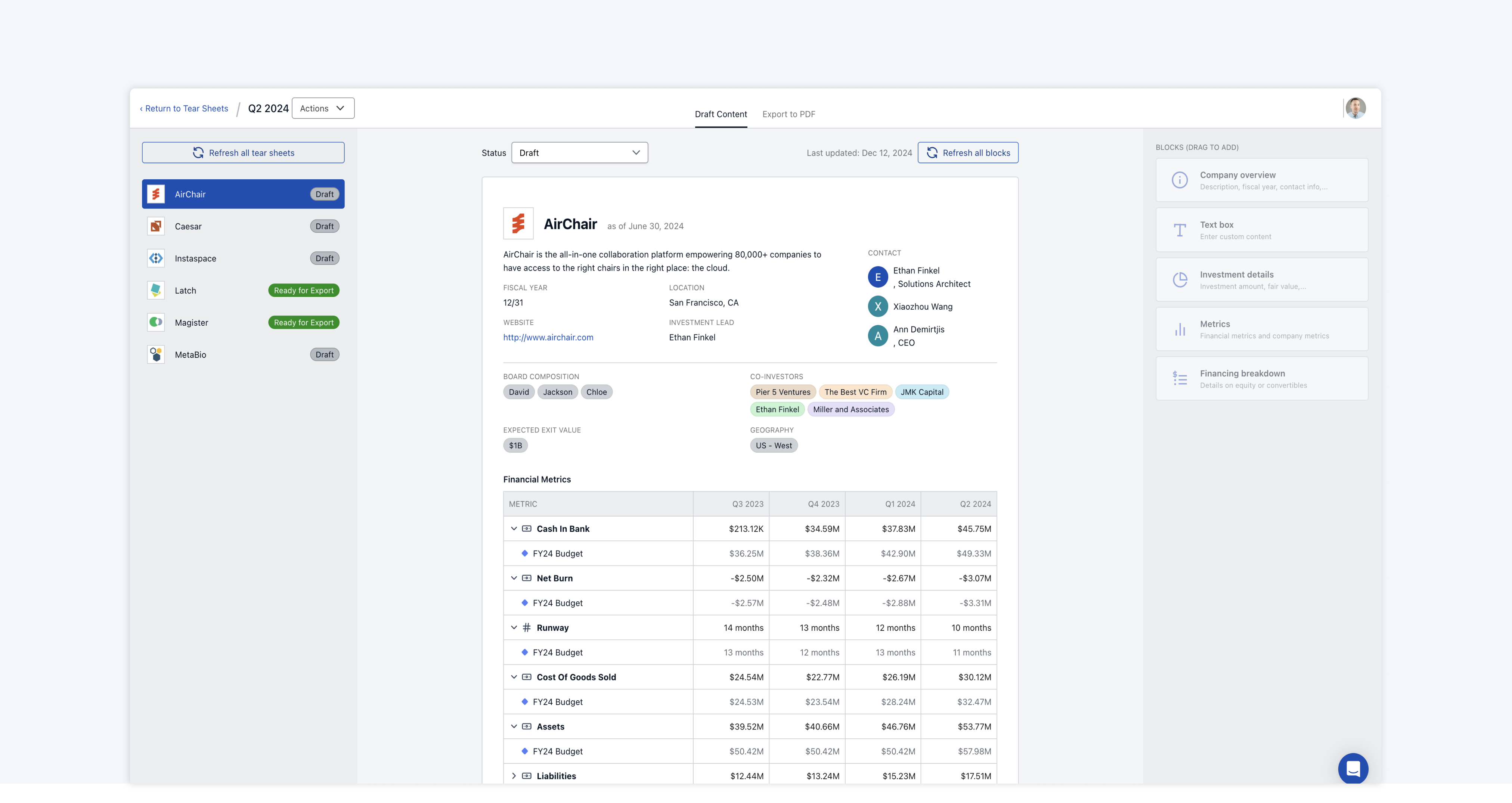

Benchmark: Get the market context you need to truly understand portfolio company performance

Unlock actionable insights, fast: In just a few clicks, benchmark your entire portfolio against an aggregated and anonymized data set of over 10,000 venture-backed startups.

Sharpen your portfolio reviews: Slice market data by revenue scale and sector, gaining the current context you need to truly understand the performance of your portfolio.

Be a better board member to your portfolio companies. Bring deep analytical insight to every board meeting you attend.

Dive deeper: Click here for more information on our Global Benchmarking product.

Enhance: Use cutting-edge AI to streamline portfolio reporting and analysis

Empower non-technical users: Our embedded portfolio intelligence offering helps you build the visuals you need via drag-and-drop as well as natural language queries so AI can do the work for you.

Bolster your staff: Our AI-powered, human-perfected document data extraction process helps your finance team focus on the tasks that matter most.

Find out how many companies you have online today

- Accelerate implementation

- Reduce their reporting burden

- Receive more high quality data, faster

Here’s what our customers say about us

A complete experience for complex institutions

Real-Time FX Rates

Track your investments in native currencies and normalize to your universal currency without worry.

Document Management

Access all of your mission-critical documents from a central repository.

Data Security

Have peace of mind knowing that your data is following the highest industry standards, SOC 2 Type II.

Central Source of Truth

Ensure that you’re always working on the latest, most complete dataset.

API

Connect Standard Metrics to all of your systems in the way you need.

AI-Powered Portfolio Intelligence

Leverage a powerful BI tool to create bespoke visualizations, alerts, deliveries, and dashboards.