According to a survey last year by Juniper Square, “portfolio monitoring” has become the #1 area for forward-looking technology investment in the venture capital industry. 53% of VC firms are looking to improve their portfolio data management.

Why are VCs rapidly adopting software to digitize their data for the first time? Historically, the venture capital industry has had access to notoriously poor data products and tooling. But over the past five years, as the industry has expanded while becoming more global, distributed, and competitive, there’s been a surge of interest around portfolio data management tools. (We prefer the terms “portfolio collaboration” and “portfolio management” to “portfolio monitoring” and wrote a blog post about why.)

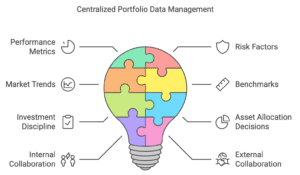

At its core, a central source of truth for portfolio data enables investors to evaluate performance metrics, risk factors, and market trends more effectively. With proprietary data well-organized, firms can build robust benchmarks and help to drive investment discipline, improve asset allocation decisions, and collaborate more effectively internally and externally. Centralized and easily-accessible data is no longer a luxury, but a necessity for effective portfolio management and LP reporting.

Enhancing Decision-Making

For most VC firms, portfolio performance and investment data are still scattered across multiple systems, spreadsheets, and even physical documents. This fragmentation can lead to inefficiencies (weeks spent on analysis, rather than hours), errors (incorrect data shared with limited partners, auditors), and missed opportunities (neglecting underperforming and over-performing companies). Traditional, manual approaches to collecting data create nightmarish reporting experiences for portfolio companies.

In an industry where timing and accuracy are critical, having a centralized data repository can significantly improve the firm’s ability to respond to market changes and investment opportunities. It can mean the difference between doubling down on an outperforming portfolio company and having another fund pre-empt their next round unexpectedly. It can also help firms to step in and help a promising but struggling portfolio company that’s low on runway before it’s too late. The power of centralized data is magnified when firms have access to benchmarking tools that can immediately flag outperformance or areas of concern in their portfolio.

Centralized data also unlocks better collaboration among team members. When everyone has access to the same information with thoughtfully constructed permissions, it becomes easier to align strategies, share insights, and make collective decisions. When an investor leaves a firm, institutional knowledge in the form of structured data and reporting workflows remains behind. This approach can lead to a more cohesive investment strategy and fewer miscommunications. Everyone is on the same page.

Driving Operational Efficiency and Scalability

Managing a portfolio involves a wide variety of different tasks and workflows, from due diligence and compliance, to performance tracking and reporting. Each of these requires accurate and timely data. Centralized data management streamlines these processes by reducing the time spent on data collection and validation. This allows team members to focus on higher-value activities, such as identifying new investment opportunities and working closely with existing portfolio companies.

With the right tools, centralized data collection and analysis can automate a significant amount of routine work (for example, see our case study with January Capital). Automation reduces the risk of human error and ensures that critical tasks are completed consistently and accurately. This can be particularly beneficial for firms managing large and complex portfolios, where manual processes can be both time-consuming and error-prone.

As VC firms grow, invest in additional portfolio companies, and raise new funds, all of these challenges become more complex. Centralized data management provides a scalable solution to support this growth. By having robust data infrastructure in place, firms can easily integrate new companies, strategies, and reporting requirements without disrupting existing operations.

Process Matters

Centralized data is a critical asset for VC firms. It enhances decision-making, drives operational efficiency, and supports growth. Having a centralized data source is an important initial step, but implementing best-in-class processes for portfolio data collection is also critical. We’ll be sharing more learnings about this theme as we continue building for the space and work closely to identify new opportunities with our customers.

At Standard Metrics, we’re committed to providing private investment firms with the tools they need to manage their portfolios effectively. By centralizing data and making it easily accessible, we empower firms to make better decisions, operate more efficiently, and achieve their goals. For more information on how Standard Metrics can help your firm centralize its data and optimize portfolio management, please reach out to our team below.

Automate your portfolio reporting

Find out how you can:

- Collect a higher volume of accurate data

- Analyze a robust, auditable data set

- Deliver insights that drive fund performance