Heavybit, founded in 2013, is a leading investor in enterprise infrastructure with more than 80 companies in the portfolio that have raised over $5 billion in funding. Notable investments include Tailscale, Sanity, Snyk and LaunchDarkly.

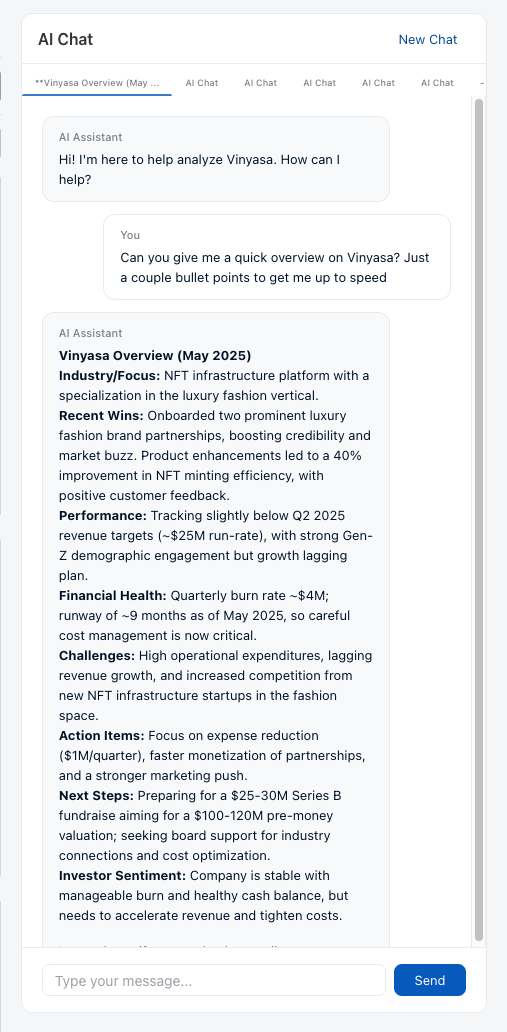

When evaluating portfolio monitoring providers, Heavybit wanted to hit the ground running. The firm needed a solution that seamlessly interoperated with its existing data stack, streamlined information requests for portfolio companies, and paired AI-driven tooling with robust document storage. Just as importantly, Heavybit required a fast, low-friction onboarding process so the team had complete portfolio visibility to help inform decisions right away.

“Heavybit chose Standard Metrics because of the robust, customizable monitoring tools we can utilize to manage our portfolio and the suite of tools available for portfolio companies that we view as key resources,” said Susie Singh, Chief Financial Officer at Heavybit. “I was also impressed at the speed with which Standard Metrics was able to onboard us, as well as their conviction about quickly building out their advanced investment activity ledger, an improved document repository, rights and preferences data management, and more.”

With Standard Metrics, Heavybit was able to onboard their 50+ portfolio companies to the platform and send their first information request out just three weeks after kickoff.

“The onboarding process with Standard Metrics could not have been smoother,” added Susie. “The team provided all of the tools and resources needed for us to get up and running quickly and it is already evident just how powerful the platform will be for us in our portfolio review and management process. We’ve already integrated the data stored on the platform into our own internal tooling, making Standard Metrics an essential part of our technology stack.”

“We’re thrilled to have been able to onboard Heavybit quickly and to provide continued support for their ongoing portfolio monitoring needs, in and out of the platform,” said John Melas-Kyriazi. “Heavybit will be a strong design partner for us as we continue aggressively building advanced capabilities around investment analytics and portfolio intelligence.”

About Heavybit:

For over a decade, Heavybit has backed and partnered with talented technical founders behind category-defining companies like Tailscale, LaunchDarkly, Sanity and PagerDuty, as well as emerging leaders like Groundcover, LocalStack, Unikraft, and Milestone. With more than 80 companies in the portfolio that have raised over $5 billion in funding, Heavybit seeks to invest in teams building AI-native solutions across infrastructure, security, and enterprise software.

Heavybit invests at the earliest stages, leading pre-seed and seed rounds with checks of $500,000 to $5 million and backing start-ups around the world with a portfolio that spans 47 cities across 15 countries. Beyond capital, founders gain access to a global network of 1,000+ expert advisors, an experienced platform team, and a partnership with deep domain expertise that together provide tailored, hands-on support to accelerate their go-to-market and scale effectively.

About Standard Metrics:

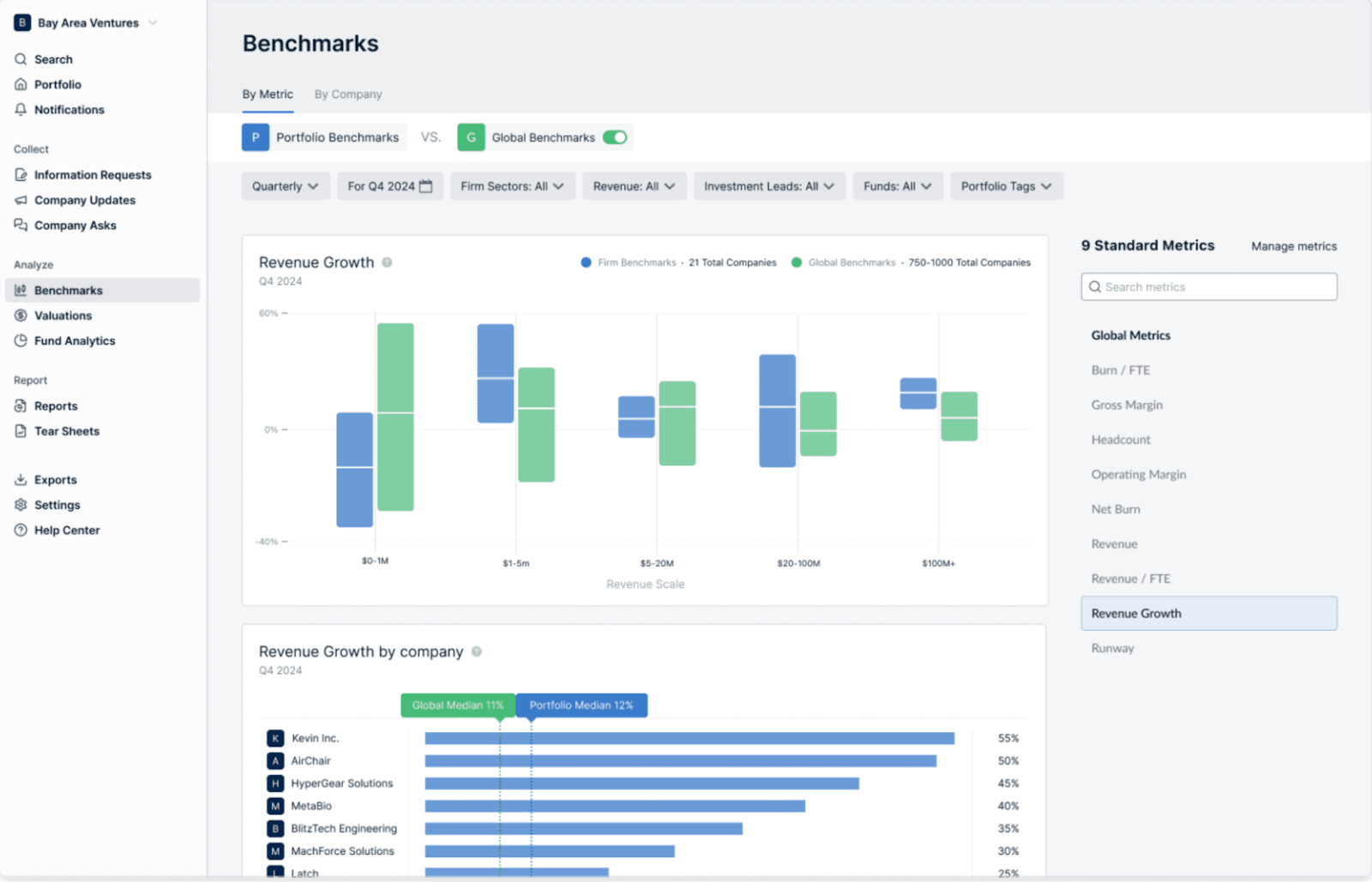

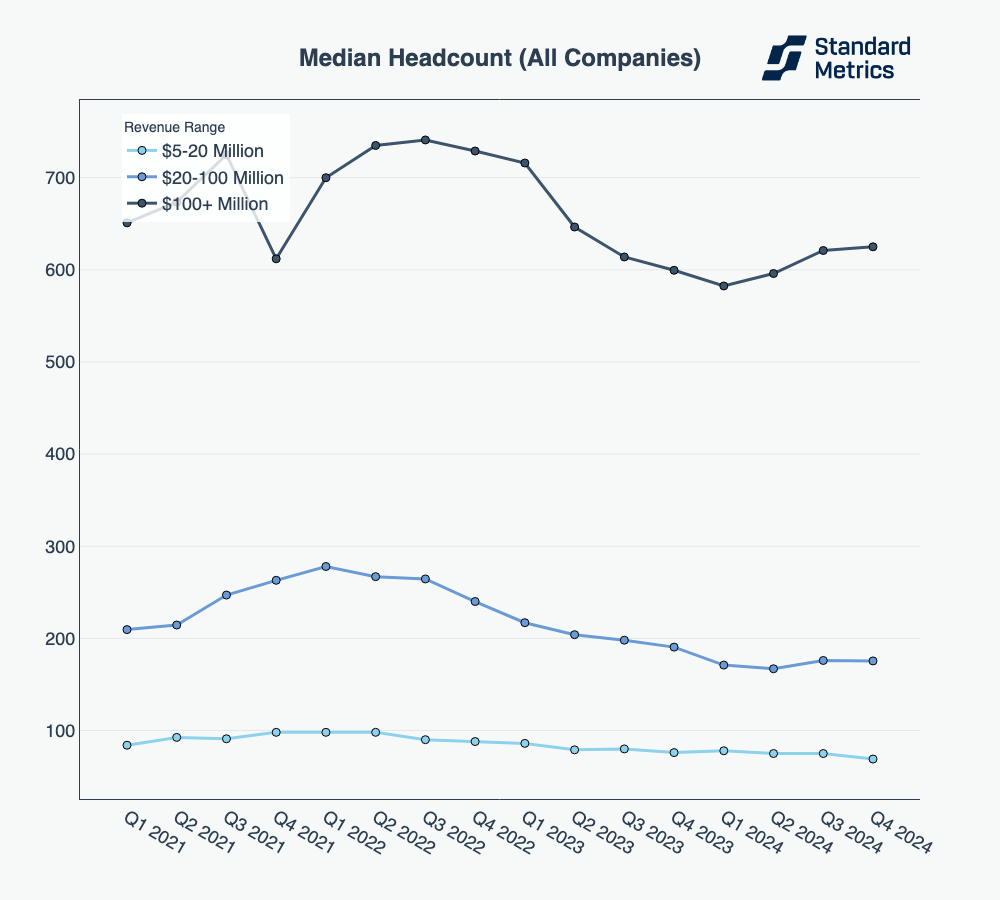

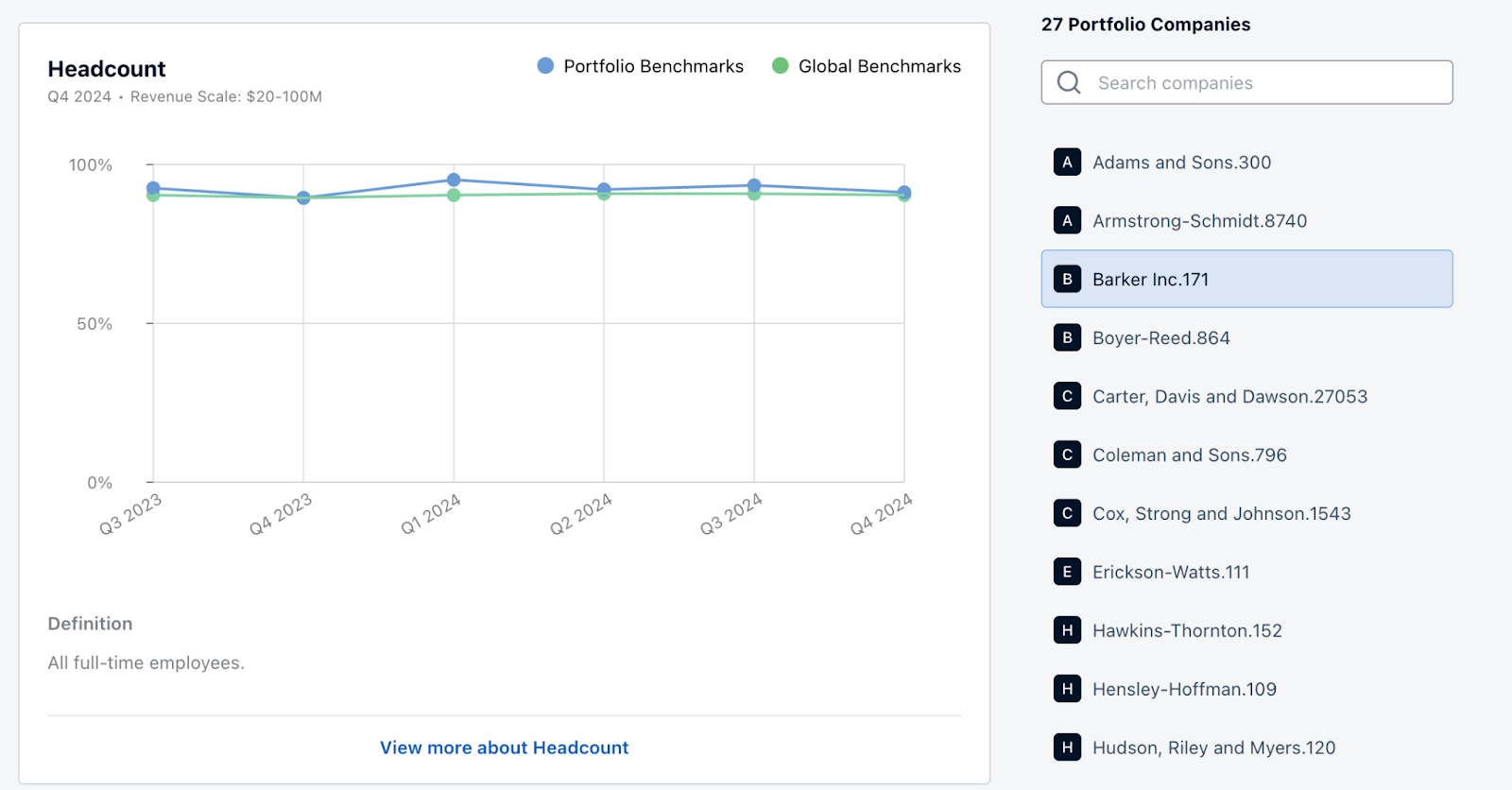

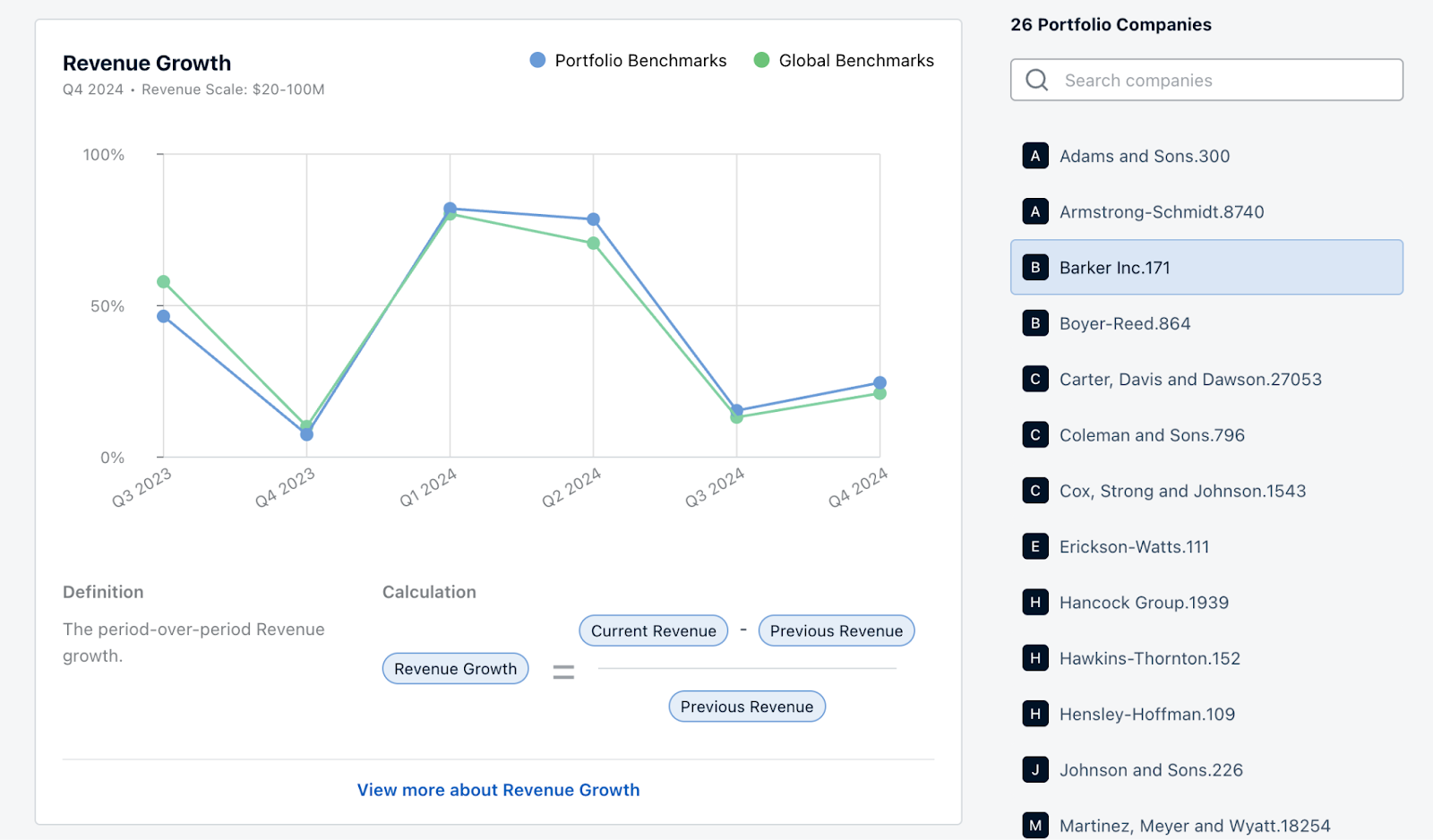

Standard Metrics combines institutional-grade infrastructure with cutting-edge AI to transform portfolio management for 10,000+ companies and 100+ venture capital and private equity firms.

Top investors like Bessemer Venture Partners, General Catalyst, and Accel trust Standard Metrics for data collection, analysis, reporting, and benchmarking. A single source of truth for company performance data, Standard Metrics arms investors with a robust set of auditable metrics, while reducing the reporting burden on portfolio companies. Automated data ingestion combined with AI-driven analysis and reporting tools help VC/PE firms streamline portfolio reviews, valuations, LP reporting, diligence, and more. Leveraging this new supercharged workflow, finance teams and investors alike can confidently make informed, data-driven decisions without delay.

Automate your portfolio reporting

Find out how you can:

- Collect a higher volume of accurate data

- Analyze a robust, auditable data set

- Deliver insights that drive fund performance