Something is Better than Nothing

In the public markets, investor communication is driven by guidelines that are in place for regulatory reasons. Companies fall in line and adopt the cadence of quarterly earnings and annual meetings. They give their investors the information they’re entitled to, in a compliant manner, at the right time. While this leaves lots to be desired, there is at least a standard to adopt so chaos doesn’t ensue.

Despite having a much closer relationship with their investors, startups are left to their own devices when it comes to Investor Relations. While this might seem like white space, it quickly devolves into a vacuum that leaves both founders and investors disjointed. What begins as a promise of collaboration, too often fails to materialize.

Startups see Investor Relations as some combination of a time-sink, a low priority item, and a chore. These are understandable reactions to a flawed manual system of communication. The current paradigm fails all stakeholders yet persists because common sense says something is better than nothing.

And we end up here.

There’s a better way, and after spending years on both sides of the table, we deeply understand each side’s pain points and expectations. We’re working hands-on with early supporters at Quaestor to solve core workflow and communication challenges. We believe that integrations with key data sources will provide for a richer and more automated collaboration experience and a deeper, improved relationship between startups and investors.

What is Investor Relations for Startups?

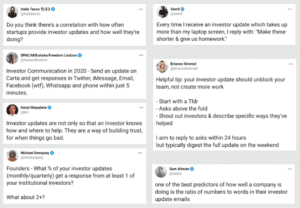

The industry doesn’t have a standard for what bad, good, or great investor communication looks like. Investors don’t have a modern solution to understand the health and status of their portfolio companies at a granular or holistic level. Companies don’t have the proper tools and resources to effectively communicate with their investors.

The only real consensus around how startups should communicate with their investors is that there is no consensus.

“Entrepreneurs often spend an enormous amount of time raising and optimizing who is involved in a financing round. However too few founders tap into their investor and advisor pool sufficiently after all that hard work.”

While most would agree that investor communications are important, how to go about actually doing the communicating continues to be a perplexing question.

“Most investors eventually ask founders to send monthly email updates. These updates can seem like a tedious task, akin to your parents asking you to call them every week when you go to off to college. Since founders are busy and writing takes time, it’s tempting to skip updates and hope no one makes a fuss. Besides, monthly check-ins only benefit investors, right? Wrong. Almost every founder that I’ve talked to finds the act of writing updates valuable, often to their surprise.”

Far too much advice in the startup world is prescribed as if it’s the only solution to the problem. Rather than telling startups how they should communicate with their investors, we want to empower both companies and investors with software that makes the entire process easier. Before we can start asking questions of data, it needs to be organized and displayed accurately in a trusted and centralized location. What begins as dashboard quickly morphs into the control panel that powers the investor communication channel.

Ending “Let me know how I can be helpful?”

Despite investing in cutting-edge technologies and products across industries, most VCs continue to use dated software or cumbersome solutions built for private equity hoping that it can be adapted to fit their needs. We’ve experienced these inefficiencies first hand and believe there’s room to build a product with VCs in mind.

While simply having a centralized and consistent store of your entire portfolio’s data is a much-needed first step, we’re even more excited about what unique insights can be unlocked as a byproduct of being able to ask and answer new questions armed with this data. We’re still in the early innings, but we’ve started to see initial signs of adoption of this thinking in the ecosystem.

Investors spend hours trying to collect, organize, and synthesize disparate data points forcing them to mostly operate in a reactive mode. We view success as empowering investors to be proactive. We’ll enable this switch by giving them real-time visibility into the health of both their overall portfolio and individual companies. This way, they can deploy resources when needed rather than wondering where they can be helpful.

Founders should want to arm their investors with information that makes their relationship stronger and more effective, yet historically this has been yet another manual and time-consuming process to worry about. How a company communicates with their investors is critically important. It shouldn’t be outsourced or deprioritized, it should be improved. With the click of a button, founders will be able to share data that they deem important to the relevant stakeholders.

Software can remove so much of the friction associated with both understanding the health of your company and communicating those data points with your existing investors. More importantly, increased transparency allows for better communication allowing you to leverage your investors. After all, isn’t that what they’re there for?

The Future

We’re initially focused on startup founders and investors, yet we know that the ecosystem is broader than that. We’ll eventually connect the other nodes that make up the innovation economy’s vast network. Over the past decade, we’ve seen how easy it is for employees to be left in the dark for too long. Translating feedback from investors to share with employees shouldn’t be seen as a chore. While some information is sensitive, founders should be able to click a button and immediately update all relevant internal and external stakeholders. Giving founders software that empowers them to plan effectively and collaborate seamlessly with their investors is the first step of many when it comes to fixing Investor Relations for startups.

If this vision piques your interest, I’d love to connect and continue the conversation. You can find me here. Our whitepaper, A Startup’s Guide to Investor Relations, also speaks to some of these questions.

Automate your portfolio reporting

Find out how you can:

- Collect a higher volume of accurate data

- Analyze a robust, auditable data set

- Deliver insights that drive fund performance