VC is growing up

The landscape of venture capital investing is changing irreversibly. As non-traditional competitors enter the market offering funding at dizzying velocity and scale, deal-making has become increasingly competitive and commoditized. These challenges are further compounded by the amount of institutional capital flooding into the market from LPs chasing the outsized returns that have made the VC industry what it is today.

Competition from these new players and growing pressure from LPs means that VC firms must source and diligence more deals faster than they ever have before. Despite their best efforts, many VCs will be at a structural disadvantage in this new landscape as their existing best practices were not designed to scale at such a rapid pace.

Traditional VC deal sourcing and due diligence suffer from labored processes and time-pressured deal teams. The resulting investments are made with less information, at less favorable terms, and for less control of companies. Tried and true strategies for compounding returns, such as follow-on investing, suffer from unsophisticated analytics tools that fail to provide full portfolio transparency.

While high-reward investment opportunities still exist, VCs must “level-up” and evolve to successfully deploy capital at the new speed with which the industry is moving. Leading these efforts and working to provide a solid backbone of data, software, and people processes across the firm will be the CFO.

CFOs: a guiding force for VCs

VC firms simply cannot function without their CFOs, who manage one of the most challenging and demanding roles at their organizations. On top of administering the financials of the firm, executing deals, and tracking performance of rapidly scaling companies, venture CFOs must also rationally value the portfolio in a frothy market where valuations are at record levels across every stage — all at the breakneck pace of today’s industry.

Venture CFOs have the unenviable role of “speed limiter,” grounding their deal team’s desire to make new investments in the reality of what capital remains to be called in a given fund. By properly pacing the fund’s dealmaking activity, the CFO avoids potentially over stretching the fund’s ability to pay fees and make new investments.

Through the execution of their wide-ranging responsibilities, venture CFOs are acutely aware of the challenges that are created and exacerbated for their firms by current processes and technology tools. This insight makes them the ideal leaders for driving the changes and improvements needed to keep their firms competitive in today’s market.

Data transparency, a new challenge and a new opportunity for VC CFOs

As firms deploy capital at record pace, data is driving decision-making. While data has always been integral for VCs, their investment processes are often rooted more in art than science. As part of their evolution to stay competitive, VCs must re-examine their current practices and understand where and how a bigger focus on data can have a positive impact.

The most critical component to a successful evolution is ensuring data transparency across the organization.

Data transparency means that a VC is running like a well-oiled machine where all stakeholders have access to the data they need and are working in unison. It gives a VC the opportunity to operate more like a prudent fiduciary and reduce their reliance on ad hoc decision-making.

As a nexus of the investment and operations teams, CFOs understand the unique data needs of the various teams within a VC firm. This means that they are perfectly positioned to be the strategic leaders who deliver data transparency across their organizations.

On the deal-making side of the business, data transparency facilitates data-driven portfolio management: more informed decision-making on new investments, more strategic sizing of follow-on investments in best performers of the fund, increased scrutiny for follow-on allocations, and better advice for portfolio companies.

Operationally, data transparency means more effective quarterly reporting to investors, better reserve planning, and a more strategic approach to capital raise timing.

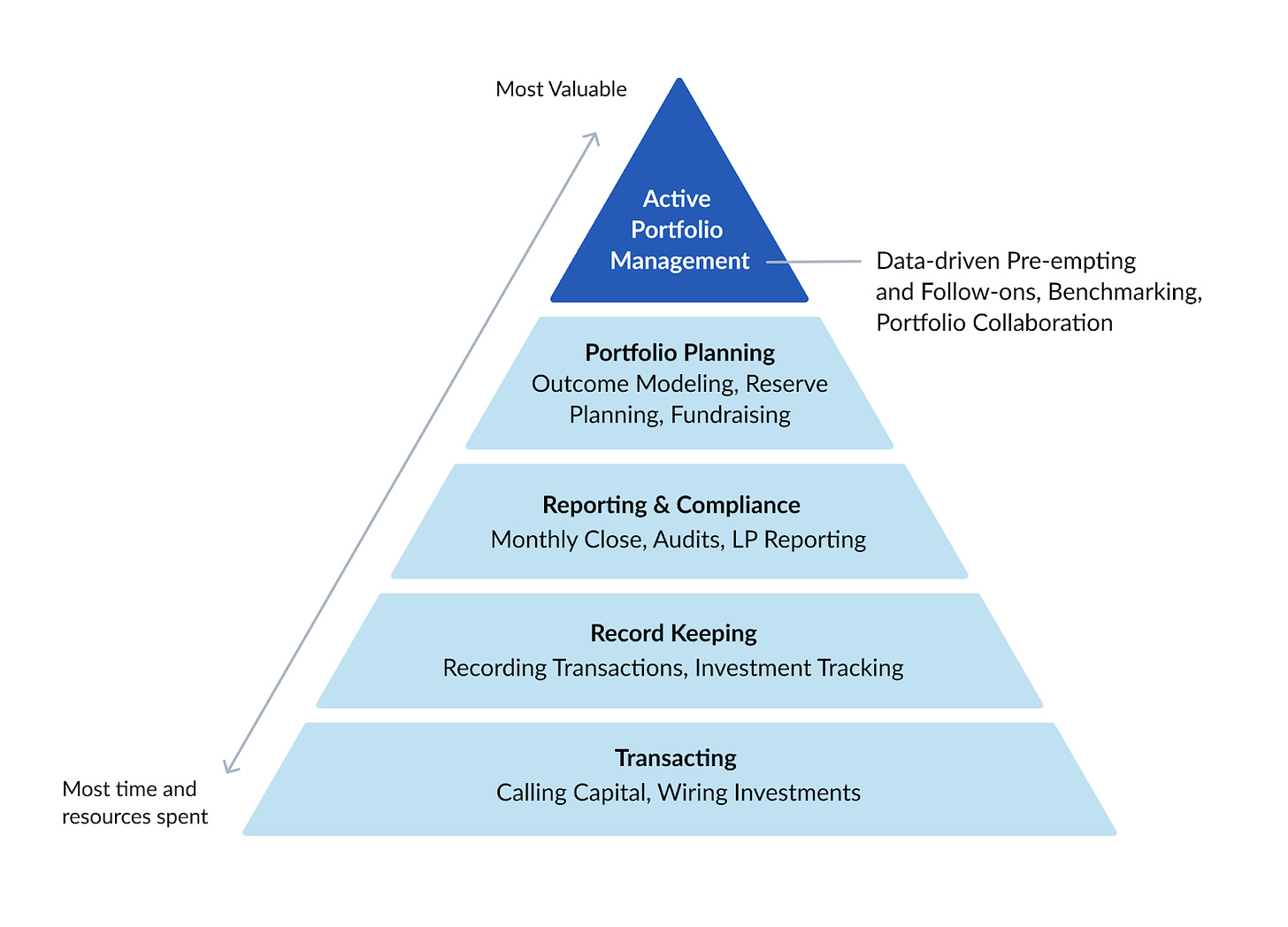

When thinking about how data transparency can impact your organization, consider this Hierarchy of Needs pyramid for portfolio data. Now consider how different it would look if the data needed at each level was readily accessible to anyone across the organization who needs it. When the deal team, seeing outperformance in their outcome modeling for a promising investment, has access to pacing and reserve planning data, they know exactly how much they can offer that company in follow-on funding. The CFO can green light the transaction knowing the deal team’s decision was made with full visibility into the firm’s financial position, record the transaction, and wire the capital. That is the promise of data transparency.

Incremental changes that drive compounding impact

As non-traditional investors continue to put pressure on the industry with their high velocity deal-making, data transparency helps VC firms level-up to stay competitive. To evolve, CFOs drive incremental changes that have compounding impact across the organization. Data transparency is an important first step for VCs in this process and the CFO, as the connector between the front and back office of the firm, is the ideal leader for this evolution.

In Part II of this blog post, we will explore tactically how venture CFOs can leverage data transparency to re-imagine and revolutionize their financial operations.

Automate your portfolio reporting

Find out how you can:

- Collect a higher volume of accurate data

- Analyze a robust, auditable data set

- Deliver insights that drive fund performance