About Operator Collective

Operator Collective is the early-stage venture firm that pioneered the Collective Venture Model® to integrate world-class operators into every step. They bring together 250+ Operator LPs as a group that is critical to a startup’s success but largely absent from the venture ecosystem – senior leaders who have built and scaled iconic tech companies. These include the founders of Cloudflare and Zoom, CEOs of Waymo and Webflow, Presidents of Atlassian and Toast, COOs of Stripe and Vercel, CFOs of Canva and ServiceNow, and senior executives from Anthropic, Databricks, OpenAI, Meta, Amazon, and more. They invest across B2B software, including vertical AI solutions, security & IT, developers & product, and go-to-market. Our portfolio includes category leaders such as Vercel, Ramp, Ironclad, Guild, Midi, Hightouch, and Hex.

The Problem

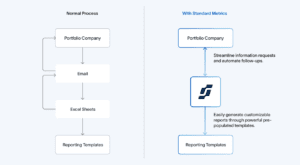

Prior to Standard Metrics, Operator Collective relied on multiple sources of portfolio company performance data. This made it difficult for the investment team to do portfolio reviews, as well as answer one-off questions about their portfolio companies in real time. Moreover, this lack of clean and centralized data also limited comprehensive LP reporting.

“It was painful to get this information because you had to sort through emails and investor updates and board decks, and, in many cases, the specific information that we wanted wasn’t there,” said Anna Jacobson, Operations & Data Partner at Operator Collective. “So then after going through all those materials, we still needed to do additional outreach to somebody at the portfolio company to try to get what we needed — which required significant manual effort from us and was likely annoying for them!”

This lack of centralized data meant that the firm’s yearly audit process was also hampered by significant back and forth with portfolio companies. Once a year, an external audit firm would ask Operator Collective for information on about 15 to 20% of the firm’s portfolio. Jacobson would then have to reach out to portfolio companies via email again to ask them to provide the information needed to meet the auditors’ requests.

“It was very much a manual process that sometimes had incomplete metrics requiring even more follow-up. It was time consuming and tedious on both sides.”

The Solution

Operator Collective has built many of its own tools and processes across the firm – from investor relations platforms to portfolio support systems – and has been extremely data-driven since Day 1. The team has always had a high bar for bringing in external solutions. But when Jacobson noticed that over a quarter of Operator Collective’s portfolio companies were already on Standard Metrics reporting to other investors, the firm decided to adopt the platform for portfolio reviews and LP reporting. “As the market has changed, institutional investors, in particular, are holding all of their fund managers to higher reporting standards, demanding more proof and more evidence of performance,” said Jacobson. “Standard Metrics fit naturally into the tools and processes we’d already built around tracking portfolio performance.”

The Standard Metrics platform also solved a specific pain point: Jacobson realized she could set up a custom view for external auditors that gave them direct access to exactly the company data and metrics they needed for testing, without the back-and-forth. “We were able to give our auditor access to the companies that they had selected for testing and the specific metrics that they were looking for,” said Jacobson. “So it was a limited view, but it gave them exactly what they needed.”

The Results

With Standard Metrics, portfolio response rates to Operator Collective’s information requests have reached almost 100%, portfolio companies have enjoyed a “simple, easy” reporting process, and portfolio and LP reporting have been streamlined, explained Jacobson.

“Anecdotal feedback that we’ve gotten from portfolio companies is that reporting via Standard Metrics is simple and they like doing it,” said Jacobson. “Several of them have told me that they’ve recommended it to their other investors.”

Audits have also become less time consuming for Operator Collective and their portfolio companies.

“The amount of busy work on our side decreased a lot: the audit process is more efficient,” said Jacobson. “In the past, I have gotten feedback from portfolio companies that it’s very disruptive for them to have to field these one-off requests from their investors. For us to be able to say, ‘We’re going to ask you for this data four times a year, we’re going to tell you exactly when we need it, we’re going to give you enough time to pull these numbers together, and then we will not bother you again outside of that (even for audits, as we already have the data),’ I think that’s a big, big plus for them.”

Standard Metrics provided Operator Collective’s auditors with a more comprehensive view of selected portfolio company data, highlighting who at the firm had inputted or adjusted each individual company datapoint, as well as when data was inputted or updated.

“The auditors were able to go in themselves and validate company data then come back to us with only one or two questions, as opposed to 100,” said Jacobson. “One of the questions was, ‘Hey, Anna, we saw that you were the last person who touched this particular metric — can you explain the change?’ I was able to explain to them that the company had rounded off a number but we wanted the exact number, so we went back in and updated it manually. It demonstrated that the auditors were really using Standard Metrics thoroughly.”

For the next audit season, Jacobson will continue to turn to Standard Metrics: “I plan to do the same thing for 2025.”

Automate your portfolio reporting

Find out how you can:

- Collect a higher volume of accurate data

- Analyze a robust, auditable data set

- Deliver insights that drive fund performance