Gain deeper insights and contextualize your data.

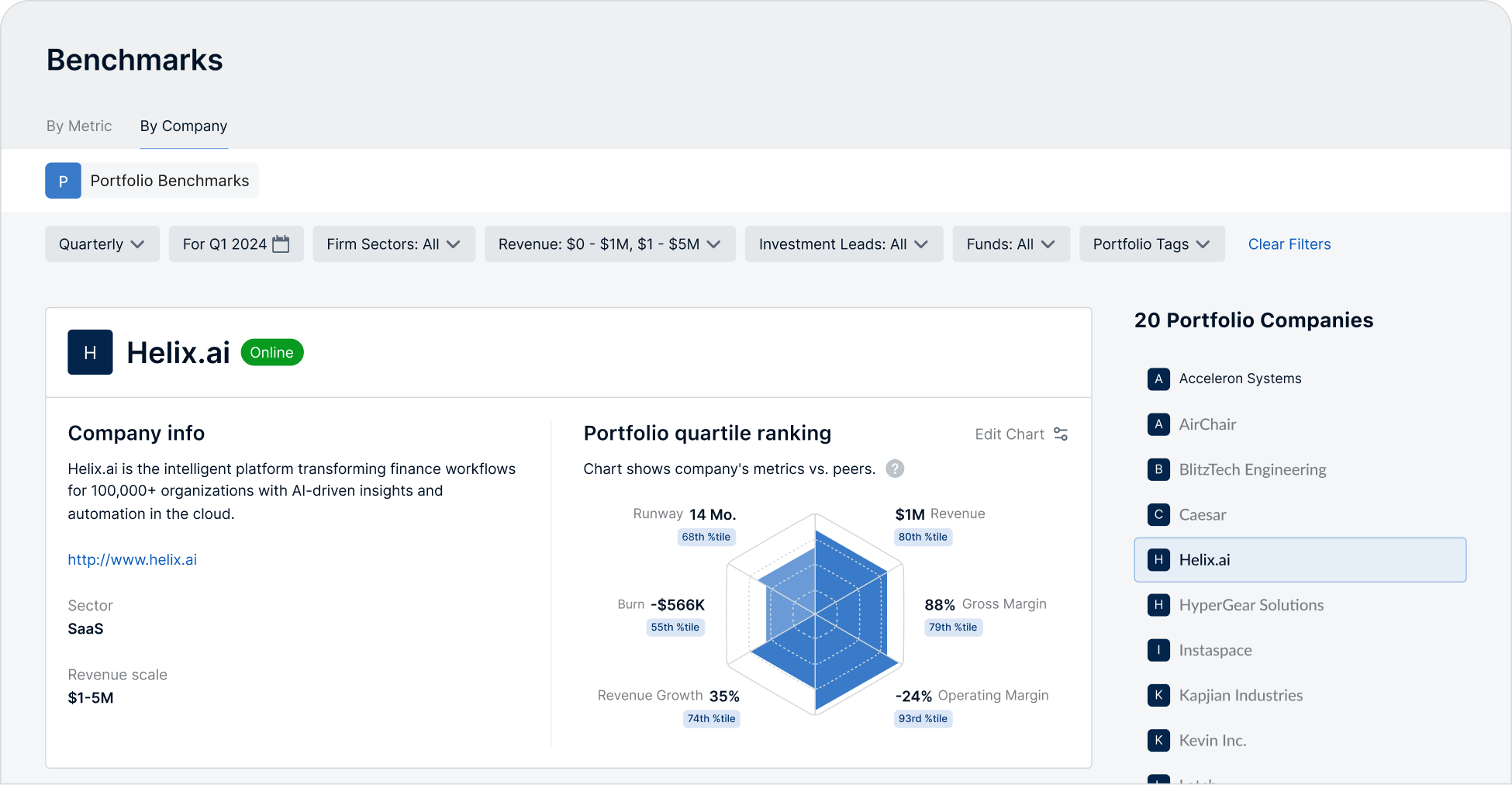

In just a few clicks, you can benchmark your entire portfolio against an aggregated and anonymized data set of over 10,000 venture-backed startups.

Get the market context you need to truly understand private company performance.

Learn more

In just a few clicks, you can benchmark your entire portfolio against an aggregated and anonymized data set of over 10,000 venture-backed startups.

Our data can be sliced by revenue scale and sector and provides the context you need to truly understand the performance of your portfolio.

We deliver a quarterly scorecard to your companies, allowing for a shared understanding of performance that keeps advisory conversations focused and streamlined.

Bring deep analytical insight and full market context to every board meeting you attend.

Unlock market context with Global Benchmarking.

Request a demo

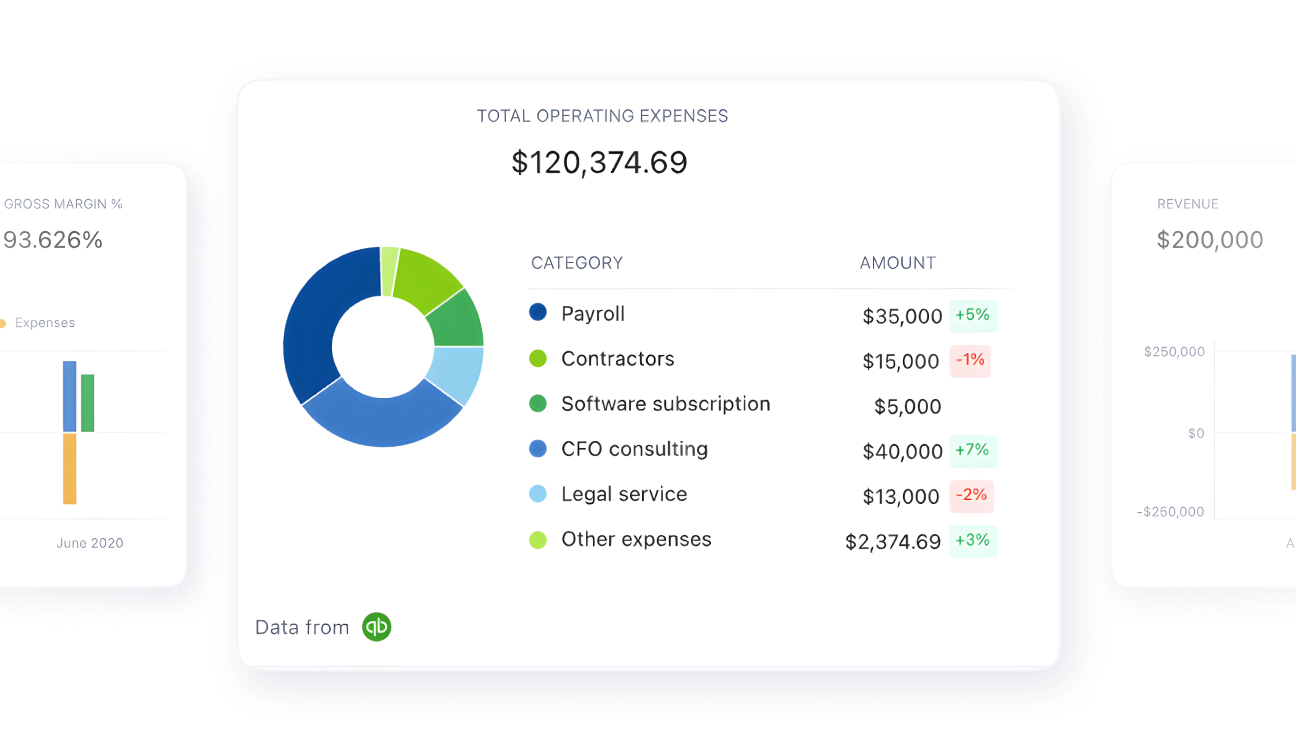

Get deep insight into how your company is performing so you can know exactly where to apply resources to improve your business health.

Leverage our market insights to drive more strategic investor discussions by anchoring in market context.

Standard Metrics is currently invite-only via our customer network. Ask your investors to get onto Standard Metrics!