The practice of investor relations is still fundamentally broken in the private markets. Data isn’t being leveraged to its full potential, important signals and collaboration opportunities are missed, and operational inefficiencies take away precious time from investors and operators.

Venture capital and private equity firms need reliable financial metrics from their portfolio companies to power reporting workflows, make informed decisions, assess risks, and uncover opportunities. But acquiring and leveraging this data in a consistent and efficient manner is challenging without purpose-built software. Making this problem worse, portfolio company CEOs and finance leaders on the other side of this process find themselves overwhelmed by manual and unhelpful reporting workflows with their investors, leading to delays, errors, and gaps in information flow.

The industry status quo is Excel sheets and templates being emailed back and forth between stakeholders. I spent six years as a VC before starting Standard Metrics, and I saw these manual workflows and downstream challenges first-hand.

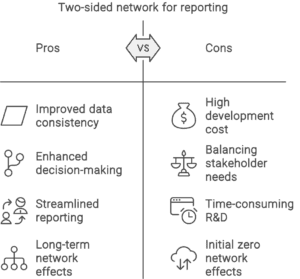

Our solution to this problem at Standard Metrics centers around the concept of a two-sided network. By building reporting software for both investment firms and their portfolio companies, we aim to create a system that works well for everyone. Ultimately, our goal is to make the reporting process as automated and useful as possible for both sides.

Board meetings and portfolio reviews are two examples of workflows that are dramatically improved by collaborative reporting. Having everyone on the same page with trusted metrics paves the way for more efficient conversations, tailored portfolio company support, and insights into future investment decision making.

Network effects are powerful, and our platform becomes more significantly useful to our users as others join. For investors, it’s magical when they onboard and their portfolio companies are already using Standard Metrics. They can easily connect with each other on our platform, speeding up implementation timelines and improving how quickly investors can begin to collect data.

For companies, when more of their investors use Standard Metrics it streamlines their reporting processes. Their data and documents are already on our platform, and each incremental investor report is typically easier and faster than the last. We’ll also share more in the future about new participatory data products we’re building that provide market insights to our users. This is uniquely enabled by building a direct relationship with both sides of the reporting workflow.

But building software is hard, and building software for multiple stakeholders is even harder, especially as a small company. When we founded Standard Metrics, we knew that building a network would be a long-term investment that would require significant R&D, patience, and grit. Network effects start from zero with a new network. It’s challenging to balance the needs of multiple stakeholders, leading to difficult resource allocation decisions in product, design, and engineering.

Fast-forward a few years though, with a lot of hard work and some luck, you get this:

Now with over 9,000 portfolio companies on Standard Metrics, we feel like we’re just getting started. We’re hard at work launching new products and features that will help both investors and companies to move faster together.

Chris Dixon at A16Z famously coined the term: “Come for the tool, stay for the network.” By building a strong, interconnected network on top of automated workflow tools, we’re working to lay the groundwork for a more collaborative innovation economy.

Automate your portfolio reporting

Find out how you can:

- Collect a higher volume of accurate data

- Analyze a robust, auditable data set

- Deliver insights that drive fund performance