Almost every software-as-a-service business dreams of killing spreadsheet-based workflows. Name a successful SaaS company, and you can easily imagine a spreadsheet (or several) being retired as a result of buying their product.

In the process of building Standard Metrics, we came to realize that a middle path is the right one for software companies like ours: we automate as much as we can within our vertical application, but we also enable our customers to leverage live platform data in spreadsheets and other horizontal tools like data warehouses to cover edge case workflows.

A lofty goal: moving private markets data and workflows to the cloud

When we launched Standard Metrics in 2020, our goal was to automate and improve financial reporting for venture capital firms and startups. Our initial strategy was to ensure that all portfolio data collection and analysis occurred within our application. The idea was to create a robust environment where every data point was collected, managed, analyzed, and visualized without ever needing to export it to other tools.

We believed that a SaaS application should be a self-contained ecosystem, capable of handling every data need from within its own walls. Spreadsheets, with their limitations and tendency for data silos, seemed like an anachronism in this vision. What need could a user possibly have for using a spreadsheet if we built them the exact tools they needed for their job? By keeping users within our platform, we hoped to eliminate inconsistencies, errors, and inefficiencies associated with moving data back and forth.

Assumptions challenged

As we scaled our business and engaged more deeply with our customers, we began to see both the successes and the limitations of our initial approach. It became increasingly clear that while our platform could handle a significant amount of data processing and analysis, there were compelling reasons why spreadsheets continued to play a crucial role in our customers’ lives after they had collected and digitized their data on our platform.

Spreadsheets are powerful tools for bespoke analysis. They allow users to integrate data from various sources, build complex models, and conduct detailed and customized analyses that go beyond the scope of any single application. For example, many of our customers would build specific models for each portfolio company they invested in, but needed to manually update the model on a monthly or quarterly basis with financial information they collected on Standard Metrics.

We also began to see increasing customer adoption of data warehouses. Data warehouses serve as centralized repositories that aggregate vast amounts of information, enabling sophisticated queries and reporting. Our users often need to combine data from Standard Metrics with other datasets for internal tools or analysis that combines portfolio company data with information from prospective investments.

A shift in our strategy

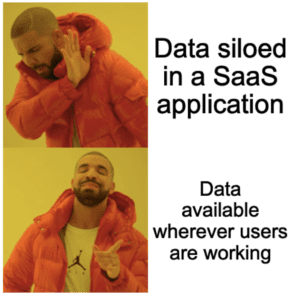

The problem with our approach was clear. Our product was great for most user workflows, but we could never match the horizontal flexibility of Excel or a data warehouse. Why should we fight these tools when we could work better together? This led us to shift our strategy a couple of years ago, and we began to focus on enhancing the ways in which our platform could work with these tools.

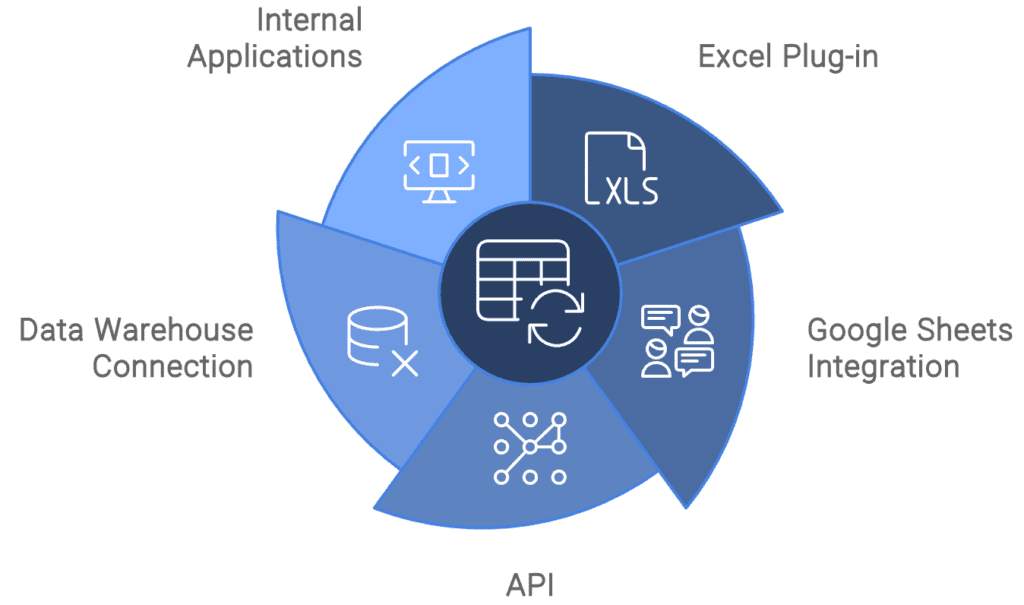

We set out to build solutions that would allow our users to leverage Standard Metrics data wherever they worked best. This led to the development of our Excel plug-in (we also now have a Google Sheets integration live in Beta) and our API. Users can seamlessly integrate Standard Metrics data into their existing workflows, whether they are working in Excel, connecting to a data warehouse, or utilizing other applications (such as internally-developed software). If there’s a use-case we can’t yet support in-app, customers can perform exactly the analysis they need to with fresh data, pulled live from our purpose-built time series database. By offering these integrations, we are not only respecting the existing tools our users rely on but also enhancing their capabilities.

Data accessibility is king

Our customers have taken these horizontal integrations and run with them. Some examples of interesting use cases we’ve seen:

- Building an LLM chatbot on top of Standard Metrics data pulled into a data lakehouse

- Identifying outlier portfolio performance using bespoke internal Excel models

- Producing custom internal quarterly financial reports

- Syncing portfolio data with a home-built crypto/blockchain reporting tool

While the dream of a spreadsheet-free world is still appealing, we’ve learned that the ideal solution lies in creating a flexible, integrated data ecosystem. Ultimately, data needs to be accessible where it will be most impactful for customers. But the ideal isn’t a hard-coded value, and a spreadsheet isn’t a database. Our integrated approach at Standard Metrics ensures that our customers can achieve accurate, timely, and insightful analysis, driving better decision-making and enhancing their investment strategies.

Thanks to Ethan Finkel on our product team for helping to write this piece.

Automate your portfolio reporting

Find out how you can:

- Collect a higher volume of accurate data

- Analyze a robust, auditable data set

- Deliver insights that drive fund performance